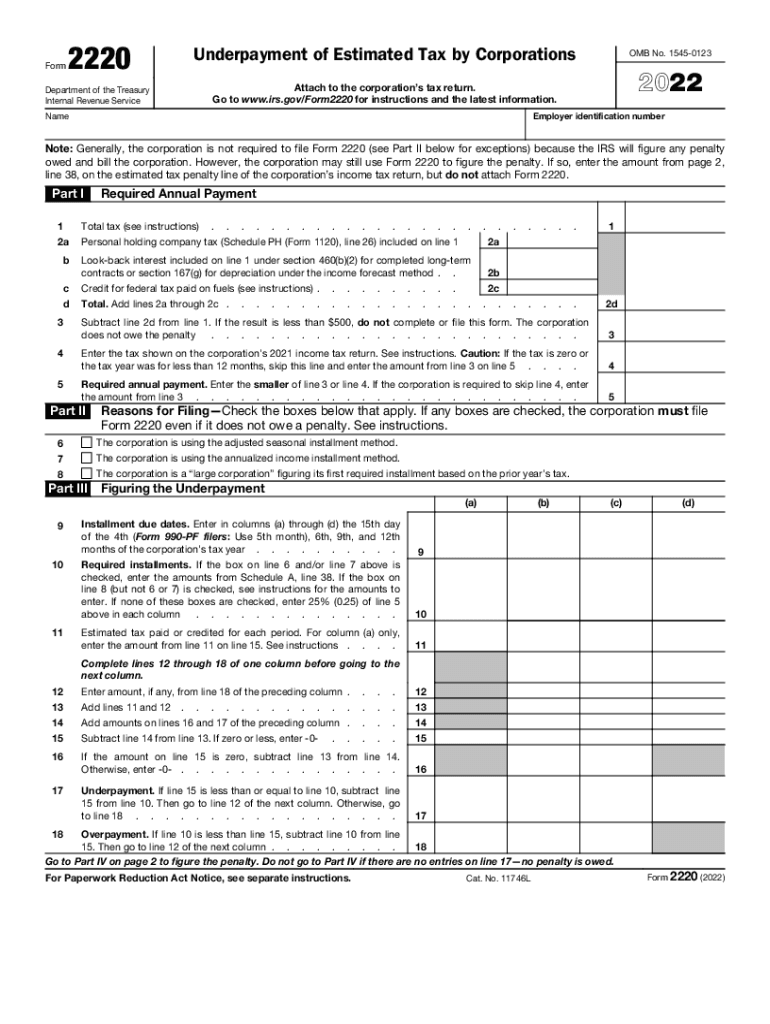

Form 2220 Underpayment of Estimated Tax by Corporations 2022

What is the IRS Form 2210?

The IRS Form 2210 is a tax form used by individuals to calculate their underpayment of estimated tax for the year. This form is essential for those who do not pay enough tax throughout the year, whether through withholding or estimated tax payments. The form helps taxpayers determine if they owe a penalty for underpayment and, if so, how much. It is particularly relevant for self-employed individuals or those with significant income not subject to withholding.

Steps to Complete the IRS Form 2210

Completing the IRS Form 2210 involves several key steps:

- Gather Financial Information: Collect your income statements, tax returns, and any records of estimated tax payments made during the year.

- Determine Your Tax Liability: Calculate your total tax liability for the year based on your income and deductions.

- Calculate Estimated Tax Payments: Sum up all the estimated tax payments made and any withholding amounts.

- Complete the Form: Fill out the form by entering your calculated figures, following the instructions provided on the form.

- Review and Submit: Double-check your calculations for accuracy before submitting the form to the IRS.

IRS Guidelines for Form 2210

The IRS provides specific guidelines for the use of Form 2210. Taxpayers must understand the requirements for filing this form to avoid penalties. Key guidelines include:

- Eligibility criteria for using Form 2210, including income thresholds and types of income.

- Deadlines for submitting the form, typically aligned with the annual tax return deadline.

- Instructions for calculating the penalty for underpayment, which varies based on the amount owed and the duration of underpayment.

Penalties for Non-Compliance

Failure to file the IRS Form 2210 when required can result in penalties. These penalties may include:

- A penalty for underpayment of estimated taxes, which is calculated based on the amount owed and the length of time it remains unpaid.

- Interest charges that accrue on any unpaid tax amounts, compounding daily until the balance is settled.

- Potential additional penalties for late filing or failure to pay taxes owed by the due date.

Form Submission Methods

Taxpayers can submit the IRS Form 2210 through various methods:

- Online: Many taxpayers choose to file electronically using tax preparation software that supports IRS forms.

- By Mail: The completed form can be printed and mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Some may opt to deliver the form in person at their local IRS office, though this is less common.

Quick guide on how to complete 2022 form 2220 underpayment of estimated tax by corporations

Complete Form 2220 Underpayment Of Estimated Tax By Corporations effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Form 2220 Underpayment Of Estimated Tax By Corporations on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and eSign Form 2220 Underpayment Of Estimated Tax By Corporations with ease

- Obtain Form 2220 Underpayment Of Estimated Tax By Corporations and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns regarding missing or lost files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 2220 Underpayment Of Estimated Tax By Corporations and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 2220 underpayment of estimated tax by corporations

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 2220 underpayment of estimated tax by corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 2210?

IRS Form 2210 is used by taxpayers to calculate their penalty for underpayment of estimated tax. If you didn't pay enough tax throughout the year, this form helps determine if you owe any penalties. It's vital for ensuring compliance with IRS regulations.

-

How does airSlate SignNow help with IRS Form 2210?

AirSlate SignNow simplifies the process of completing and signing IRS Form 2210. With our easy-to-use eSigning features, you can quickly fill out the form and send it securely. This helps streamline your tax preparation and filing process.

-

Is airSlate SignNow cost-effective for managing IRS Form 2210?

Yes, airSlate SignNow offers affordable pricing plans that are suitable for individuals and businesses dealing with IRS Form 2210. Our cost-effective solution ensures that you can manage your tax documents without excessive costs. Plus, the time saved translates into financial savings.

-

What features does airSlate SignNow provide for IRS Form 2210?

AirSlate SignNow includes features like customizable templates, secure eSignatures, and document tracking specifically for IRS Form 2210. These features ensure that your tax forms are filled out accurately and submitted on time. Enhanced collaboration options also make it easy to share with your financial team.

-

Can I integrate airSlate SignNow with other applications for managing IRS Form 2210?

Absolutely! AirSlate SignNow offers various integrations with popular applications like Google Drive and Dropbox, which facilitate easy access to your IRS Form 2210 documents. This integration enables you to streamline your workflow and enhance productivity when preparing your taxes.

-

What are the benefits of using airSlate SignNow for IRS Form 2210?

Using airSlate SignNow to handle your IRS Form 2210 provides numerous benefits, including enhanced security, ease of use, and quick access. Our platform ensures compliance while making it simple to eSign and manage tax documents efficiently. This saves you time and reduces stress during tax season.

-

Is it easy to eSign IRS Form 2210 with airSlate SignNow?

Yes, airSlate SignNow makes it incredibly easy to eSign IRS Form 2210. Our user-friendly interface allows you to sign documents electronically in just a few clicks. This method is not only faster than traditional signing but also legally binding.

Get more for Form 2220 Underpayment Of Estimated Tax By Corporations

Find out other Form 2220 Underpayment Of Estimated Tax By Corporations

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement