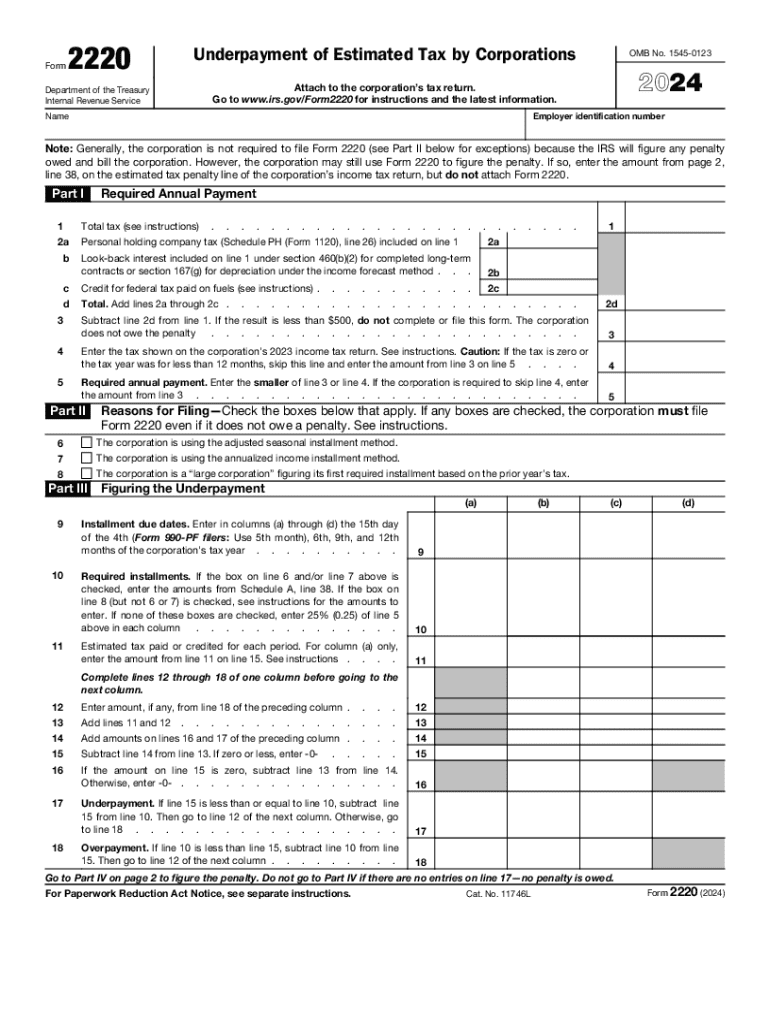

Form 2220 Underpayment of Estimated Tax by Corporations 2024-2026

Understanding IRS Form 2210

IRS Form 2210 is used by individuals to calculate any penalty for underpayment of estimated tax. This form is essential for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated tax payments. The underpayment penalty is typically assessed when the total tax owed exceeds a certain threshold and the taxpayer fails to meet the required payment schedule.

How to Complete IRS Form 2210

Completing IRS Form 2210 involves several steps. First, gather your income information and tax payments made during the year. Next, determine if you owe a penalty by checking your total tax liability against your payments. The form includes various sections that guide you through the calculations needed to ascertain the penalty amount. Pay close attention to the instructions provided for each line to ensure accuracy.

Filing Deadlines for IRS Form 2210

IRS Form 2210 must be filed by the tax return deadline, which is usually April 15 for most taxpayers. If you are unable to file your return by this date, you may request an extension. However, the estimated tax payments must still be made on time to avoid penalties. It is crucial to stay informed about any changes to deadlines that may occur due to special circumstances, such as natural disasters or changes in tax law.

Penalties for Non-Compliance with IRS Form 2210

Failing to file IRS Form 2210 when required can lead to significant penalties. The IRS imposes an underpayment penalty based on the amount owed and the duration of the underpayment. Additionally, interest accrues on any unpaid tax, increasing the total amount due. Understanding these penalties can help taxpayers avoid costly mistakes and ensure compliance with tax obligations.

IRS Guidelines for Using Form 2210

The IRS provides detailed guidelines for using Form 2210. These instructions clarify who must file the form, how to calculate the penalty, and the specific situations that may exempt a taxpayer from penalties. It is advisable to read these guidelines thoroughly to ensure proper understanding and compliance. The IRS also offers resources and tools to assist taxpayers in completing the form accurately.

Eligibility Criteria for IRS Form 2210

Eligibility for using IRS Form 2210 generally applies to individuals who owe a penalty for underpayment of estimated tax. This includes self-employed individuals, retirees, and those with significant income not subject to withholding. Taxpayers must meet specific income thresholds and payment requirements to qualify for the calculations provided on the form. Understanding these criteria helps ensure that the form is used correctly.

Create this form in 5 minutes or less

Find and fill out the correct form 2220 underpayment of estimated tax by corporations 771766905

Create this form in 5 minutes!

How to create an eSignature for the form 2220 underpayment of estimated tax by corporations 771766905

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 2210 and why is it important?

IRS Form 2210 is used to determine if you owe a penalty for underpayment of estimated tax. Understanding this form is crucial for taxpayers who may not have paid enough taxes throughout the year. By using airSlate SignNow, you can easily eSign and submit your IRS Form 2210, ensuring compliance and avoiding penalties.

-

How can airSlate SignNow help with IRS Form 2210?

airSlate SignNow simplifies the process of completing and submitting IRS Form 2210. With our platform, you can fill out the form electronically, eSign it, and send it directly to the IRS. This streamlines your tax filing process and helps you stay organized.

-

Is there a cost associated with using airSlate SignNow for IRS Form 2210?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and provide access to features that make managing IRS Form 2210 and other documents easy. You can choose a plan that fits your budget while ensuring you have the tools you need.

-

What features does airSlate SignNow offer for IRS Form 2210?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for IRS Form 2210. These features enhance your workflow, making it easier to manage tax documents efficiently. Additionally, you can track the status of your submissions in real-time.

-

Can I integrate airSlate SignNow with other software for IRS Form 2210?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to manage IRS Form 2210 alongside your other financial documents. This integration helps streamline your processes and reduces the risk of errors during tax season.

-

What are the benefits of using airSlate SignNow for IRS Form 2210?

Using airSlate SignNow for IRS Form 2210 offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. Our platform allows you to complete and submit your forms quickly, reducing the stress associated with tax filing. Plus, eSigning ensures that your documents are legally binding and secure.

-

Is airSlate SignNow secure for handling IRS Form 2210?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling IRS Form 2210. We use advanced encryption and security protocols to protect your sensitive information. You can trust that your tax documents are secure while using our platform.

Get more for Form 2220 Underpayment Of Estimated Tax By Corporations

- Request for verification of spouse or dependent status troy form

- Trident tech application update form

- Request for in state classification for tuition assessment form

- 2016 2017 proof of dependents worksheet office of financial aid wcupa form

- Student enrollment verification form california state

- 2020 21 graduate application for admission form

- Declaration of f inances admissions illinois state university form

- The university of tennessee group travel procurement card form

Find out other Form 2220 Underpayment Of Estimated Tax By Corporations

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document