Instructions for Form 1040 NR 2023

Understanding Arizona Form 301

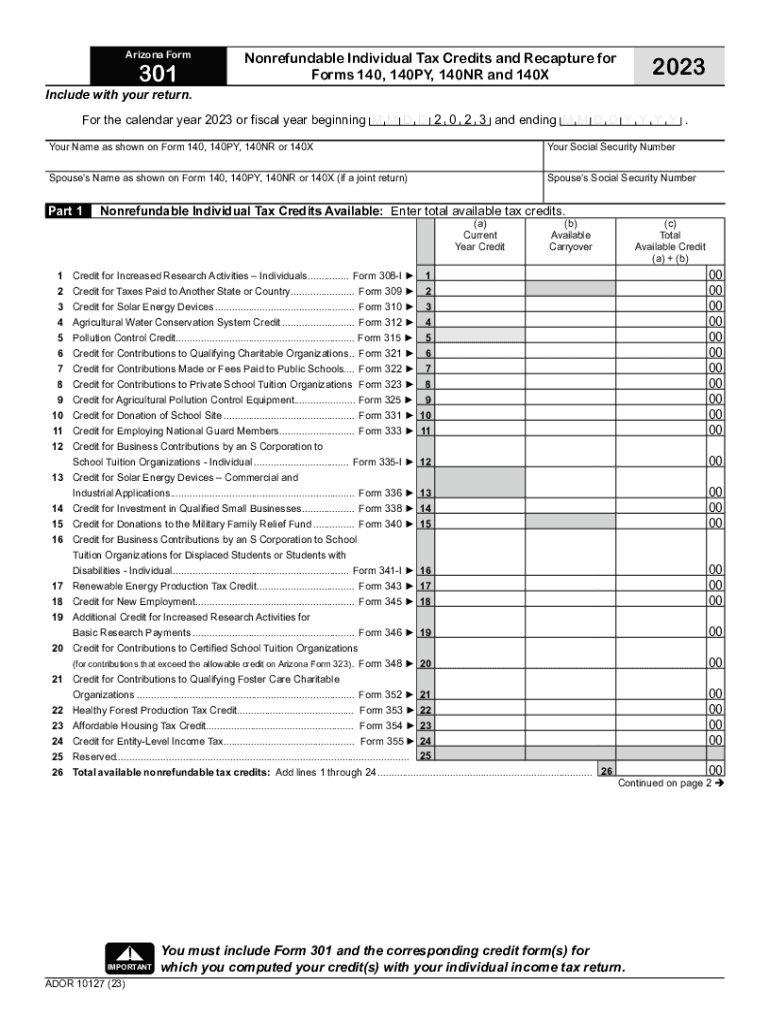

The Arizona Form 301, also known as the Arizona Nonrefundable Tax Credit form, is essential for taxpayers in Arizona who wish to claim specific tax credits. This form is primarily used to report nonrefundable credits against the state income tax. It is crucial for individuals and businesses to accurately complete this form to ensure compliance with Arizona tax regulations.

Key Elements of Arizona Form 301

Arizona Form 301 includes several key components that taxpayers must understand:

- Taxpayer Information: This section requires basic information about the taxpayer, including name, address, and Social Security number.

- Credit Calculations: Taxpayers must detail the specific credits they are claiming, including the amounts and the relevant tax year.

- Signature: The form must be signed and dated by the taxpayer or an authorized representative to validate the submission.

Steps to Complete Arizona Form 301

Completing Arizona Form 301 involves several steps:

- Gather necessary documentation, such as proof of eligibility for the credits being claimed.

- Fill out the taxpayer information section accurately.

- Detail the specific credits you are claiming, ensuring that all calculations are correct.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Filing Deadlines for Arizona Form 301

It is important to be aware of the filing deadlines for Arizona Form 301 to avoid penalties. Typically, the form must be submitted by the due date of the state income tax return. For most taxpayers, this is April 15 of the following year. However, extensions may be available, and it is advisable to check the Arizona Department of Revenue website for the most current information.

Legal Use of Arizona Form 301

Arizona Form 301 is legally binding and must be used in accordance with Arizona tax laws. Taxpayers are responsible for ensuring that they meet all eligibility criteria for the credits claimed. Misuse of the form or incorrect information can lead to penalties, including fines or additional tax liabilities.

Obtaining Arizona Form 301

Taxpayers can obtain Arizona Form 301 from the Arizona Department of Revenue's website or through authorized tax preparation services. It is available in both digital and paper formats, allowing for flexibility in how it is completed and submitted.

Quick guide on how to complete instructions for form 1040 nr

Complete Instructions For Form 1040 NR effortlessly on any device

Digital document management has become widely embraced by companies and individuals alike. It presents an ideal eco-conscious substitute for traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Handle Instructions For Form 1040 NR on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Instructions For Form 1040 NR with ease

- Obtain Instructions For Form 1040 NR and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or black out sensitive data with utilities that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form 1040 NR while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1040 nr

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1040 nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az form 301 and how can airSlate SignNow help with it?

The az form 301 is a crucial document for businesses operating in Arizona. airSlate SignNow facilitates the eSigning and management of this form, ensuring that it is completed accurately and promptly. With our intuitive platform, you can fill out and send the az form 301 for signatures in just a few clicks.

-

How much does it cost to use airSlate SignNow for the az form 301?

airSlate SignNow offers various pricing plans that are economical and tailored to meet your business needs. You can utilize our services for eSigning the az form 301 at a fraction of the cost compared to traditional methods. Check our website for detailed pricing and potential discounts for long-term commitments.

-

What features does airSlate SignNow provide for managing the az form 301?

Our platform offers features like eSigning, document templates, and tracking for the az form 301. You can customize workflows, ensure compliance, and have complete visibility into the signing process. These tools are designed to simplify your document management experience.

-

Can I integrate airSlate SignNow with other tools for handling the az form 301?

Yes, airSlate SignNow can seamlessly integrate with a variety of third-party applications like CRMs, cloud storage solutions, and more. This makes it easier to manage the az form 301 along with other business processes. Our integrations enhance productivity and streamline your document workflows.

-

Is airSlate SignNow secure for signing the az form 301?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure the safety of your documents, including the az form 301. We prioritize your data protection and compliance, so you can eSign with confidence, knowing your information is secure.

-

How long does it take to complete the az form 301 using airSlate SignNow?

Completing the az form 301 using airSlate SignNow is quick and efficient, often taking just a few minutes. Our user-friendly interface allows you to fill out the form, get it signed, and send it back in no time. This speed helps you to keep your business processes moving swiftly.

-

What are the benefits of using airSlate SignNow for the az form 301?

Using airSlate SignNow for the az form 301 saves time and reduces the need for paper-based processes. You benefit from enhanced efficiency, increased accuracy, and access to a comprehensive eSign solution that is easy to use. These advantages help streamline your operations and improve overall productivity.

Get more for Instructions For Form 1040 NR

- Immunization record drexel university form

- Berea college international application form 2018 2019

- Volunteer work comp election form

- Collegeuniversity date form

- Grades k 12 registration form 2018 2019

- Please only use form

- Please type then print sign and submit via fax mail or e mail form

- Matt amp joann butler youth development scholarship program 451464961 form

Find out other Instructions For Form 1040 NR

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy