Arizona Form 301 Nonrefundable Individual Tax Credits and Arizona Form 301 Nonrefundable Individual Tax Credits and Arizona Form 2021

Understanding the Arizona Form 301 Nonrefundable Individual Tax Credits

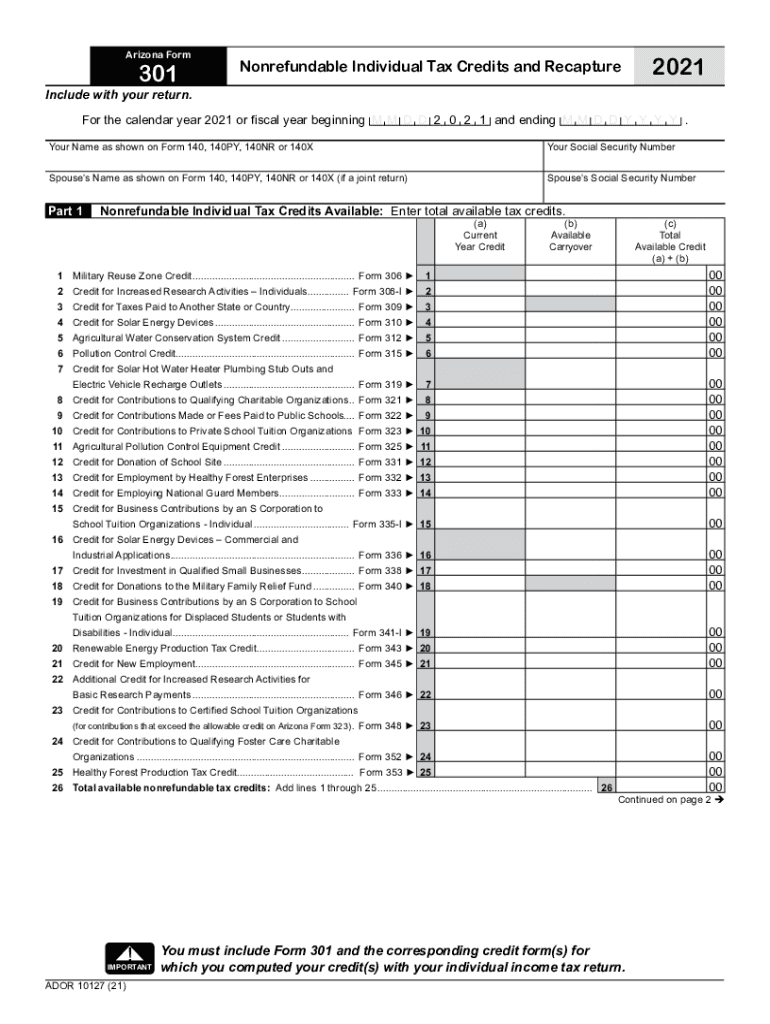

The Arizona Form 301 is designed for taxpayers seeking to claim nonrefundable individual tax credits. These credits can significantly reduce your tax liability, but understanding the specifics is crucial. The form is primarily used to report various credits such as the credit for contributions to qualifying charitable organizations and the credit for the purchase of a qualifying solar energy device. Each credit has its own eligibility criteria and limits, which are essential to review before completing the form.

Steps to Complete the Arizona Form 301

Completing the Arizona Form 301 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including proof of contributions and any relevant tax information. Next, carefully follow the instructions provided with the form. Fill out personal identification details, then proceed to report the credits you are eligible for. Ensure that you double-check all entries for accuracy before submitting the form. Finally, keep a copy of the completed form and any supporting documents for your records.

Eligibility Criteria for Arizona Form 301

To qualify for the credits available on the Arizona Form 301, taxpayers must meet specific eligibility criteria. Generally, these criteria include having a valid Arizona tax identification number and being subject to Arizona income tax. Additionally, certain credits require that contributions be made to approved organizations or for specific purposes, such as educational or charitable contributions. It is important to review the guidelines for each credit to ensure compliance and maximize potential benefits.

Legal Use of the Arizona Form 301

The Arizona Form 301 must be used in accordance with state tax laws to ensure that the credits claimed are valid. This includes adhering to the stipulations set forth by the Arizona Department of Revenue regarding acceptable documentation and the types of credits available. Using a reliable electronic signing solution, like signNow, can enhance the legal standing of your completed form by providing an electronic certificate of authenticity, ensuring that your submission is secure and compliant with regulations.

Filing Deadlines for Arizona Form 301

Filing deadlines for the Arizona Form 301 are crucial for taxpayers to keep in mind. Typically, the form must be submitted by the same deadline as your Arizona income tax return. For most individuals, this means filing by April 15. However, if you have filed for an extension, ensure that you submit the form by the extended deadline. Missing the deadline could result in penalties or the loss of credits, so it is advisable to mark your calendar and prepare your documents in advance.

Form Submission Methods for Arizona Form 301

The Arizona Form 301 can be submitted through various methods, providing flexibility for taxpayers. Options include filing online through the Arizona Department of Revenue's e-filing system, mailing a paper form, or submitting it in person at designated tax offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits your situation. Electronic submission is often faster and can provide immediate confirmation of receipt.

Quick guide on how to complete arizona form 301 nonrefundable individual tax credits and arizona form 301 nonrefundable individual tax credits and arizona

Complete Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form without any hassle

- Find Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form and then click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 301 nonrefundable individual tax credits and arizona form 301 nonrefundable individual tax credits and arizona

Create this form in 5 minutes!

How to create an eSignature for the arizona form 301 nonrefundable individual tax credits and arizona form 301 nonrefundable individual tax credits and arizona

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is Arizona 301 and how does it relate to airSlate SignNow?

Arizona 301 refers to a specific electronic signature law in Arizona that governs the legality of eSigning documents. airSlate SignNow ensures compliance with Arizona 301, making it a reliable solution for businesses operating in the state who need to eSign documents securely.

-

How much does airSlate SignNow cost for Arizona businesses?

airSlate SignNow offers competitive pricing tailored to different business needs. For Arizona businesses looking to comply with Arizona 301, plans start at an affordable monthly rate, which provides features like unlimited eSigning and document templates.

-

What features does airSlate SignNow provide that support Arizona 301 compliance?

airSlate SignNow includes features such as secure document storage, audit trails, and customizable templates that adhere to Arizona 301 standards. These features ensure that your electronic signatures are legally binding and compliant with state regulations.

-

How does airSlate SignNow benefit Arizona businesses specifically?

By using airSlate SignNow, Arizona businesses can streamline their document workflows and increase efficiency. Complying with Arizona 301 allows for faster transactions and improved customer satisfaction due to the ease of eSigning documents.

-

Can airSlate SignNow integrate with other tools for Arizona businesses?

Yes, airSlate SignNow offers integrations with various platforms like Google Drive, Salesforce, and many others. This flexibility allows Arizona businesses to incorporate airSlate SignNow into their existing workflows while adhering to Arizona 301 requirements.

-

Is airSlate SignNow user-friendly for those unfamiliar with electronic signatures?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those who are new to electronic signatures. The platform provides straightforward guidance on how to eSign documents in compliance with Arizona 301, ensuring everyone can navigate it with ease.

-

What types of documents can be signed using airSlate SignNow in Arizona?

airSlate SignNow allows users to eSign a variety of documents, including contracts, agreements, and forms, all of which must comply with Arizona 301. This versatility makes it a great solution for diverse business needs across different industries in Arizona.

Get more for Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form

- Legal last will and testament form for married person with adult and minor children florida

- Mutual wills package with last wills and testaments for married couple with adult and minor children florida form

- Florida widow form

- Legal last will and testament form for widow or widower with minor children florida

- Legal last will form for a widow or widower with no children florida

- Legal last will and testament form for a widow or widower with adult and minor children florida

- Legal last will and testament form for divorced and remarried person with mine yours and ours children florida

- Legal last will and testament form with all property to trust called a pour over will florida

Find out other Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself