Arizona Form 301 Nonrefundable Individual Tax Credits and Arizona Form 301 Nonrefundable Individual Tax Credits and Arizona Tax 2019

Understanding the Arizona Form 301 Nonrefundable Individual Tax Credits

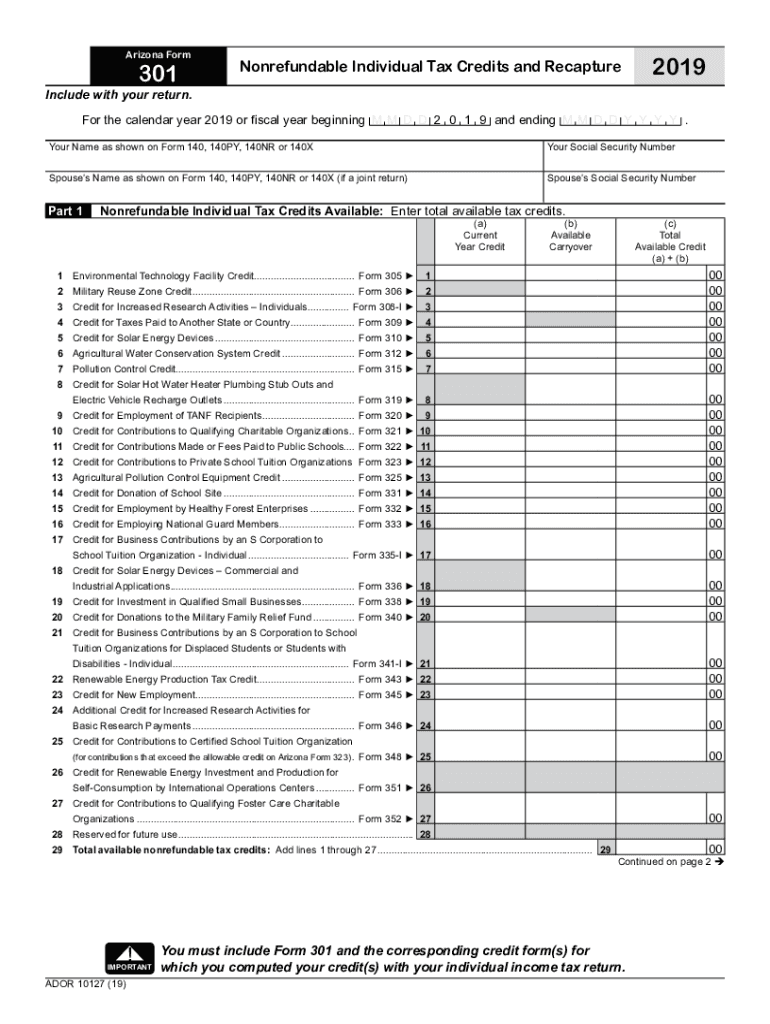

The Arizona Form 301 is designed for taxpayers seeking to claim nonrefundable individual tax credits. These credits can reduce your tax liability but cannot result in a refund. Familiarity with the specifics of this form is essential for ensuring that you maximize your eligible credits while remaining compliant with state tax regulations. The form encompasses various credits, including those for charitable contributions, school tuition, and contributions to qualifying organizations.

Steps to Complete the Arizona Form 301

Completing the Arizona Form 301 involves several key steps:

- Gather all necessary documentation, including proof of contributions and any other relevant financial records.

- Carefully fill out the form, ensuring that all sections are completed accurately. Pay attention to the specific credits you are claiming.

- Double-check your calculations to confirm that the amounts entered align with your supporting documents.

- Sign and date the form to validate your submission.

Utilizing digital tools can simplify this process, allowing for easy corrections and secure storage of your completed form.

Eligibility Criteria for Arizona Form 301

To qualify for the credits on the Arizona Form 301, taxpayers must meet specific eligibility criteria. This may include:

- Being a resident of Arizona for the tax year in question.

- Making qualified contributions to approved organizations.

- Meeting income limitations that may affect the amount of credit available.

Reviewing these criteria before filing can help ensure that you are eligible for the credits you intend to claim.

Required Documents for Filing Arizona Form 301

When preparing to file the Arizona Form 301, it is important to have the following documents ready:

- Receipts or documentation of contributions made to qualifying organizations.

- Previous tax returns, if applicable, to reference any carryover credits.

- Identification information, such as your Social Security number or taxpayer identification number.

Having these documents organized will streamline the filing process and help ensure accuracy.

Form Submission Methods for Arizona Form 301

The Arizona Form 301 can be submitted through various methods, allowing taxpayers flexibility in how they file:

- Online submission through the Arizona Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate address provided by the state.

- In-person submission at designated tax offices, if preferred.

Choosing the method that best suits your needs can enhance the efficiency of your filing experience.

Legal Use of Arizona Form 301

The Arizona Form 301 is legally binding when completed and submitted according to state regulations. To ensure compliance, it is vital to:

- Follow all instructions provided with the form.

- Use a reliable method for e-signing if submitting electronically, ensuring that your signature meets legal standards.

- Keep copies of all submitted documents for your records.

Understanding these legal aspects helps protect your rights as a taxpayer and ensures that your credits are properly applied.

Quick guide on how to complete arizona form 301 nonrefundable individual tax credits and arizona form 301 nonrefundable individual tax credits and arizona tax

Complete Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Tax seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your papers swiftly without any delays. Manage Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Tax effortlessly

- Locate Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you'd like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Tax and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 301 nonrefundable individual tax credits and arizona form 301 nonrefundable individual tax credits and arizona tax

Create this form in 5 minutes!

How to create an eSignature for the arizona form 301 nonrefundable individual tax credits and arizona form 301 nonrefundable individual tax credits and arizona tax

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is the Arizona Form 301 Tax?

The Arizona Form 301 Tax is a document that businesses in Arizona use to report and pay certain taxes. This form is essential for ensuring compliance with state tax regulations, and it helps streamline the tax filing process for businesses. Using solutions like airSlate SignNow can simplify the management of the Arizona Form 301 Tax through secure electronic signatures.

-

How can airSlate SignNow help me with the Arizona Form 301 Tax?

airSlate SignNow provides an easy-to-use platform for signing and managing the Arizona Form 301 Tax. With our e-signature features, you can quickly get signatures from required parties and keep your documents organized. This not only saves time but also minimizes the risk of errors in the submission process.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 301 Tax?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. While there is a fee for using our services, the efficiency and convenience provided can greatly outweigh the costs, especially when dealing with important documents like the Arizona Form 301 Tax.

-

What features does airSlate SignNow offer for managing the Arizona Form 301 Tax?

airSlate SignNow offers advanced features such as document templates, custom workflows, and secure cloud storage, which are particularly beneficial for managing the Arizona Form 301 Tax. These features ensure that your forms are always accessible and can be efficiently completed and tracked through the signing process.

-

Can I integrate airSlate SignNow with other software for Arizona Form 301 Tax management?

Absolutely! airSlate SignNow can seamlessly integrate with various third-party applications, making it easy to manage the Arizona Form 301 Tax alongside your existing software. This integration can help streamline your overall workflow, saving you more time during tax season.

-

Is airSlate SignNow compliant with Arizona tax regulations for the Form 301 Tax?

Yes, airSlate SignNow is fully compliant with Arizona state regulations, ensuring that your submissions of the Arizona Form 301 Tax are legally valid. Our commitment to compliance means you can use our platform with confidence, knowing your documents meet necessary legal standards.

-

How can I ensure the security of my Arizona Form 301 Tax documents with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Arizona Form 301 Tax. Our platform uses advanced encryption protocols, ensuring that your sensitive information remains safe during transmission and storage, so you can focus on your business without worry.

Get more for Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Tax

Find out other Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Form 301 Nonrefundable Individual Tax Credits And Arizona Tax

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal