Nonrefundable Individual Tax Credits and Recapture Arizona 2024-2026

Understanding Nonrefundable Individual Tax Credits and Recapture in Arizona

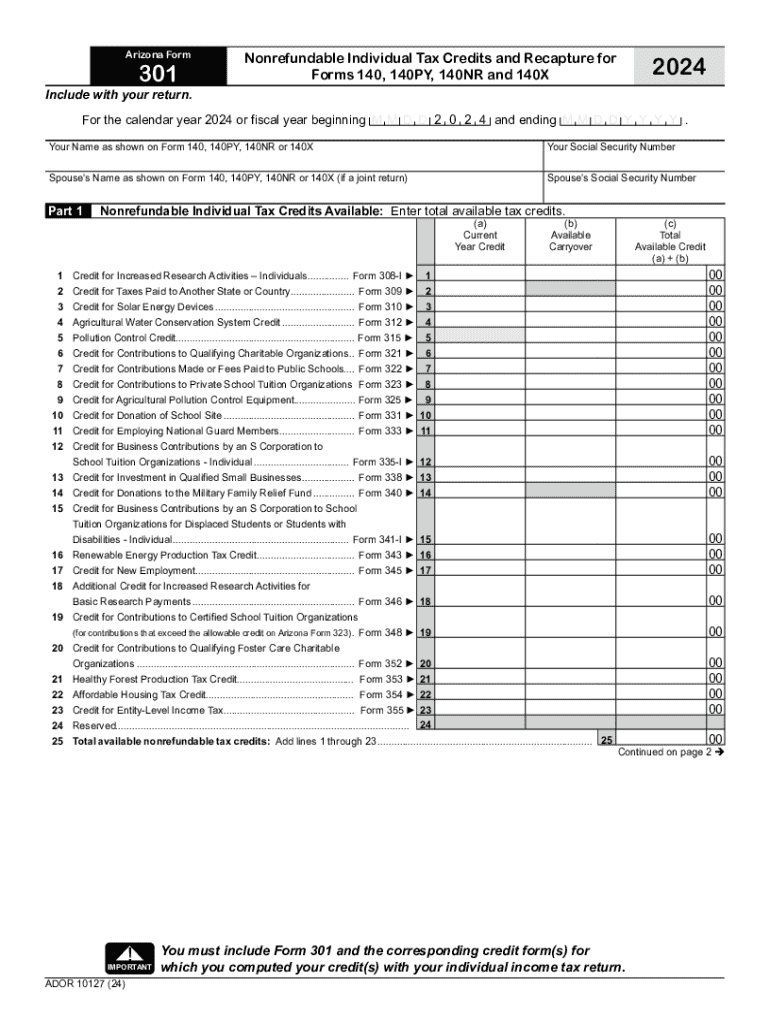

The Nonrefundable Individual Tax Credits and Recapture in Arizona are designed to provide tax relief to eligible taxpayers. These credits can reduce the amount of tax owed but cannot result in a refund if they exceed the tax liability. It is essential to understand the specific credits available, such as those for charitable contributions, renewable energy, and school tuition, as well as the recapture provisions that may apply if certain conditions are not met.

Steps to Complete the Nonrefundable Individual Tax Credits and Recapture

Completing the Nonrefundable Individual Tax Credits and Recapture involves several steps:

- Gather all necessary documentation, including income statements and records of eligible expenses.

- Determine eligibility for specific credits by reviewing the requirements for each type.

- Fill out the AZ Form 301 accurately, ensuring all information is complete and correct.

- Calculate the total credits and apply them against your tax liability.

- Review the form for accuracy before submission.

Eligibility Criteria for Nonrefundable Individual Tax Credits

To qualify for the Nonrefundable Individual Tax Credits in Arizona, taxpayers must meet specific eligibility criteria. Generally, these include:

- Filing status: Must be an individual taxpayer or married filing jointly.

- Income limits: Some credits have income thresholds that must not be exceeded.

- Residency: Must be a resident of Arizona for the tax year in question.

- Specific conditions related to the type of credit being claimed, such as contributions to qualifying organizations or investments in renewable energy.

Key Elements of the Nonrefundable Individual Tax Credits

The key elements of the Nonrefundable Individual Tax Credits include the types of credits available, the maximum amounts that can be claimed, and the specific documentation required to substantiate claims. Important credits may include:

- Charitable contribution credits

- School tuition credits

- Renewable energy credits

Each credit has its own set of rules and limitations, which should be carefully reviewed to ensure compliance and maximize potential benefits.

Form Submission Methods for Arizona Form 301

Taxpayers can submit the AZ Form 301 through various methods:

- Online: Many taxpayers prefer to file electronically using tax preparation software that supports Arizona forms.

- Mail: Completed forms can be mailed to the Arizona Department of Revenue at the specified address on the form.

- In-Person: Taxpayers can also submit forms directly at designated Arizona Department of Revenue offices.

Filing Deadlines for Arizona Form 301

It is crucial to be aware of the filing deadlines for the AZ Form 301 to avoid penalties. The typical deadline for filing individual tax returns in Arizona aligns with the federal deadline, which is usually April 15. However, extensions may be available, allowing taxpayers additional time to file, although any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Create this form in 5 minutes or less

Find and fill out the correct nonrefundable individual tax credits and recapture arizona

Create this form in 5 minutes!

How to create an eSignature for the nonrefundable individual tax credits and recapture arizona

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az form 301 and how can airSlate SignNow help?

The az form 301 is a crucial document used in various business processes. airSlate SignNow simplifies the signing and sending of this form, ensuring that your documents are processed quickly and securely. With our platform, you can easily eSign and manage your az form 301, streamlining your workflow.

-

How much does it cost to use airSlate SignNow for az form 301?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose from monthly or annual subscriptions, which provide access to features specifically designed for managing documents like the az form 301. Visit our pricing page for detailed information on plans and discounts.

-

What features does airSlate SignNow offer for az form 301?

airSlate SignNow provides a range of features for handling the az form 301, including customizable templates, secure eSigning, and real-time tracking. These features enhance efficiency and ensure compliance, making it easier for businesses to manage their documentation needs effectively.

-

Can I integrate airSlate SignNow with other applications for az form 301?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage the az form 301 alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our platform can connect with them to streamline your processes.

-

What are the benefits of using airSlate SignNow for az form 301?

Using airSlate SignNow for your az form 301 provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are signed and stored securely, helping you maintain compliance and improve overall productivity.

-

Is airSlate SignNow user-friendly for managing az form 301?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage the az form 301. Our intuitive interface allows users to navigate the platform effortlessly, ensuring that even those with minimal technical skills can eSign and send documents without hassle.

-

How does airSlate SignNow ensure the security of az form 301?

airSlate SignNow prioritizes the security of your documents, including the az form 301. We implement advanced encryption protocols and comply with industry standards to protect your data. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Nonrefundable Individual Tax Credits And Recapture Arizona

Find out other Nonrefundable Individual Tax Credits And Recapture Arizona

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy