Arizona Form 301 Nonrefundable Individual Tax Credits AndArizona Form 301 Nonrefundable Individual Tax Credits AndIndividual Inc 2022

Understanding the Arizona Form 301 Nonrefundable Individual Tax Credits

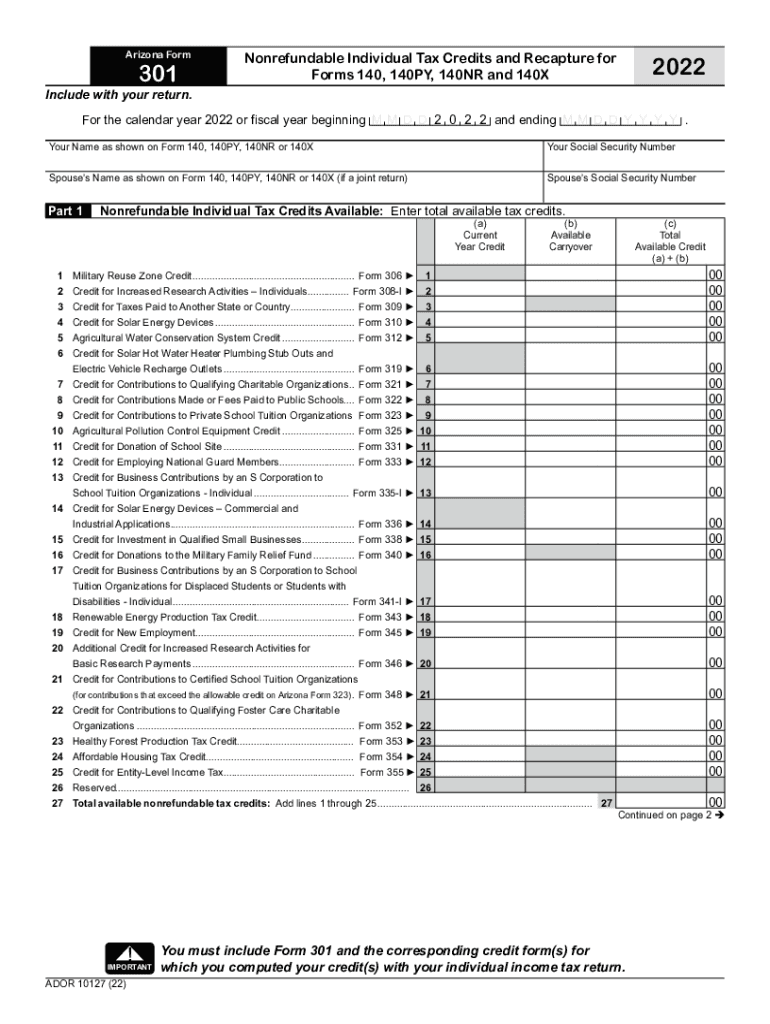

The Arizona Form 301 is a critical document for individuals seeking to claim nonrefundable individual tax credits. These credits help reduce the amount of tax owed to the state, making it essential for eligible taxpayers to understand how to utilize this form effectively. The form is specifically designed for taxpayers who have made qualifying contributions to various programs, including public schools and other charitable organizations. By filling out the Arizona 301 correctly, individuals can ensure they receive the appropriate tax benefits available to them under Arizona law.

Steps to Complete the Arizona Form 301

Completing the Arizona Form 301 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of contributions that qualify for the nonrefundable tax credits. Next, carefully fill out the form, providing accurate personal information and details about the contributions. It is crucial to double-check all entries to avoid errors that could delay processing or result in penalties. After completing the form, review it thoroughly before submitting it to the Arizona Department of Revenue. This attention to detail can help streamline the filing process and maximize potential tax savings.

Eligibility Criteria for the Arizona Form 301

To qualify for the nonrefundable individual tax credits on the Arizona Form 301, taxpayers must meet specific eligibility criteria. Primarily, individuals must have made contributions to qualifying organizations, such as public schools or certain charitable entities. The contributions must adhere to the limits set by the Arizona Department of Revenue to be eligible for credit. Additionally, the taxpayer must be a resident of Arizona and file a state income tax return. Understanding these criteria is essential for taxpayers to effectively claim their credits and ensure compliance with state regulations.

Key Elements of the Arizona Form 301

The Arizona Form 301 includes several key elements that taxpayers must be aware of when filling it out. These elements consist of personal identification information, details of the contributions made, and the calculation of the nonrefundable credits being claimed. The form also requires taxpayers to provide information about their filing status and any other relevant tax information. Familiarizing oneself with these components can help ensure that the form is completed accurately and submitted in a timely manner.

Obtaining the Arizona Form 301

Taxpayers can obtain the Arizona Form 301 through various means to facilitate their filing process. The form is available on the Arizona Department of Revenue's official website, where individuals can download and print it for their use. Additionally, many tax preparation services and software programs include the Arizona 301 as part of their offerings, providing an accessible option for those who prefer digital solutions. Ensuring access to the correct version of the form is vital for accurate tax filing and compliance.

Form Submission Methods for Arizona Form 301

Submitting the Arizona Form 301 can be done through multiple methods, catering to the preferences of different taxpayers. Individuals have the option to file the form electronically using approved e-filing systems, which can expedite processing times. Alternatively, taxpayers may choose to mail their completed forms to the Arizona Department of Revenue. For those who prefer in-person interactions, visiting a local tax office is another viable option. Understanding these submission methods can help taxpayers select the most convenient approach for their needs.

Quick guide on how to complete arizona form 301 nonrefundable individual tax credits andarizona form 301 nonrefundable individual tax credits andindividual

Complete Arizona Form 301 Nonrefundable Individual Tax Credits AndArizona Form 301 Nonrefundable Individual Tax Credits AndIndividual Inc seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Arizona Form 301 Nonrefundable Individual Tax Credits AndArizona Form 301 Nonrefundable Individual Tax Credits AndIndividual Inc on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Arizona Form 301 Nonrefundable Individual Tax Credits AndArizona Form 301 Nonrefundable Individual Tax Credits AndIndividual Inc effortlessly

- Locate Arizona Form 301 Nonrefundable Individual Tax Credits AndArizona Form 301 Nonrefundable Individual Tax Credits AndIndividual Inc and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal equivalence as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or missing documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and eSign Arizona Form 301 Nonrefundable Individual Tax Credits AndArizona Form 301 Nonrefundable Individual Tax Credits AndIndividual Inc and guarantee effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 301 nonrefundable individual tax credits andarizona form 301 nonrefundable individual tax credits andindividual

Create this form in 5 minutes!

People also ask

-

What is the Arizona Form 301 and how do I use it?

The Arizona Form 301 is a key document used for reporting and processing various transactions in Arizona. To use the form effectively, ensure you fill it out completely and accurately, providing all necessary information to avoid delays in processing. You can easily complete and eSign this form using airSlate SignNow, streamlining your document management process.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 301?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your usage and features required, you can choose a plan that suits your budget while ensuring you can efficiently handle the Arizona Form 301 and other documents. Our cost-effective solution helps you save time and resources.

-

What features does airSlate SignNow offer for the Arizona Form 301?

airSlate SignNow provides several features that facilitate the completion of Arizona Form 301, including template creation, customizable fields, and secure eSigning. Additionally, you can track the status of your forms and automate workflows, making the entire process more efficient and organized. These features help enhance productivity and reduce errors.

-

How can airSlate SignNow benefit my business when working with the Arizona Form 301?

Using airSlate SignNow for the Arizona Form 301 can signNowly streamline your document processes. With features such as cloud storage and mobile access, you can manage your forms from anywhere, increasing flexibility. Additionally, eSigning ensures quicker turnaround times for important transactions, boosting overall efficiency.

-

Can I integrate airSlate SignNow with other software for managing Arizona Form 301?

Absolutely! airSlate SignNow offers integrations with various software solutions, including CRMs and accounting platforms. This allows you to seamlessly manage the Arizona Form 301 alongside your other business processes, enhancing collaboration and ensuring all your documents are in one place.

-

What security measures does airSlate SignNow have for the Arizona Form 301?

airSlate SignNow prioritizes the security of your documents, including the Arizona Form 301, through top-notch encryption and compliance with industry standards. Your data is protected, and only authorized individuals have access to sensitive information. This ensures that your documents remain secure throughout the signing process.

-

How do I get started with airSlate SignNow for handling Arizona Form 301?

Getting started with airSlate SignNow is simple! Just sign up for an account, choose your pricing plan, and you can immediately begin creating and managing the Arizona Form 301. Our user-friendly interface makes it easy for you to navigate through the features and efficiently handle your document needs.

Get more for Arizona Form 301 Nonrefundable Individual Tax Credits AndArizona Form 301 Nonrefundable Individual Tax Credits AndIndividual Inc

Find out other Arizona Form 301 Nonrefundable Individual Tax Credits AndArizona Form 301 Nonrefundable Individual Tax Credits AndIndividual Inc

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form