MVD 10009 REV 0318 MOTOR VEHICLE DIVISION ANY ALTERATIONS or 2021

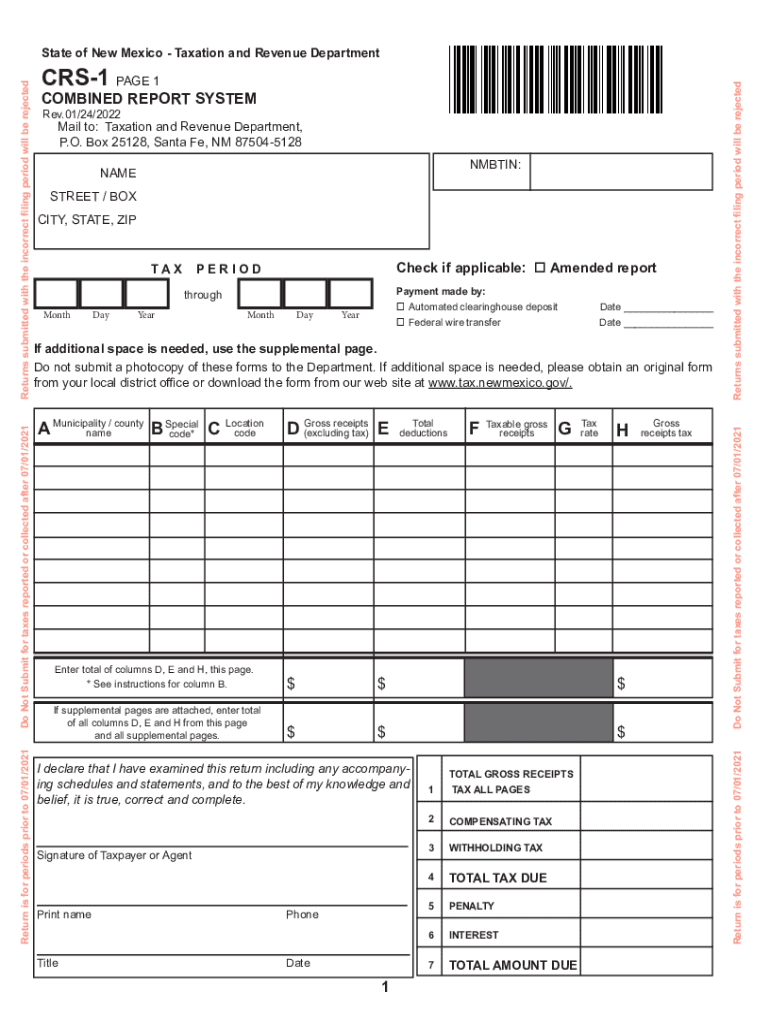

Understanding the New Mexico CRS-1 Form

The New Mexico CRS-1 form, also known as the CRS tax form, is essential for businesses operating in the state. This form is used to report gross receipts tax, which is a tax on the sale of goods and services. Understanding its purpose is crucial for compliance with state tax regulations. The CRS-1 form helps the New Mexico Taxation and Revenue Department track tax liabilities and ensure that businesses fulfill their tax obligations accurately.

Steps to Complete the New Mexico CRS-1 Form

Filling out the CRS-1 form involves several key steps:

- Gather necessary information, including your business name, address, and CRS number.

- Determine the reporting period for which you are filing.

- Calculate your gross receipts for the reporting period, ensuring to include all sales and services provided.

- Complete the form by entering your gross receipts, deductions, and any applicable tax credits.

- Review the form for accuracy before submission.

Required Documents for CRS-1 Submission

When submitting the CRS-1 form, you need to have specific documents ready:

- Your business's CRS number, which identifies your tax account.

- Records of all sales and receipts for the reporting period.

- Any documentation supporting deductions or tax credits claimed.

Form Submission Methods for CRS-1

The CRS-1 form can be submitted through various methods, providing flexibility for businesses:

- Online: You can file the CRS-1 form electronically through the New Mexico Taxation and Revenue Department's online portal.

- By Mail: Completed forms can be printed and mailed to the appropriate state office.

- In-Person: Businesses may also choose to submit the form in person at designated tax offices.

Penalties for Non-Compliance with CRS-1 Filing

Failure to file the CRS-1 form on time can result in penalties. The New Mexico Taxation and Revenue Department imposes fines based on the amount of tax owed and the duration of the delay. Businesses may also face interest charges on unpaid taxes, making timely filing crucial to avoid additional costs.

Eligibility Criteria for Filing the CRS-1 Form

All businesses that engage in selling goods or services in New Mexico are required to file the CRS-1 form. This includes sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). It is essential for businesses to register for a CRS number before filing the form to ensure compliance with state tax laws.

Quick guide on how to complete mvd 10009 rev 0318 motor vehicle division any alterations or

Effortlessly Prepare MVD 10009 REV 0318 MOTOR VEHICLE DIVISION ANY ALTERATIONS OR on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your files quickly and without interruptions. Manage MVD 10009 REV 0318 MOTOR VEHICLE DIVISION ANY ALTERATIONS OR on any device through the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign MVD 10009 REV 0318 MOTOR VEHICLE DIVISION ANY ALTERATIONS OR with Ease

- Find MVD 10009 REV 0318 MOTOR VEHICLE DIVISION ANY ALTERATIONS OR and click on Get Form to begin.

- Use the tools at your disposal to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign MVD 10009 REV 0318 MOTOR VEHICLE DIVISION ANY ALTERATIONS OR and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mvd 10009 rev 0318 motor vehicle division any alterations or

Create this form in 5 minutes!

How to create an eSignature for the mvd 10009 rev 0318 motor vehicle division any alterations or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the new mexico form crs 1 instructions for completing the document?

The new mexico form crs 1 instructions provide step-by-step guidance on how to fill out the form correctly. It's essential to follow these instructions carefully to ensure all necessary information is included. This will help prevent delays in processing your form.

-

How can airSlate SignNow assist me with the new mexico form crs 1 instructions?

AirSlate SignNow streamlines the process of filling and signing the new mexico form crs 1 through digital means. With our platform, you can easily upload the form and follow the new mexico form crs 1 instructions within the application. This allows for a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the new mexico form crs 1 instructions?

AirSlate SignNow offers various pricing plans, including a cost-effective option suitable for businesses of all sizes. This pricing includes access to features that help you efficiently manage your new mexico form crs 1 instructions. You can try our services with a free trial to see how it fits your needs.

-

What features does airSlate SignNow offer for the new mexico form crs 1?

AirSlate SignNow offers features such as eSignature capabilities, document templates, and real-time collaboration, which are beneficial when following the new mexico form crs 1 instructions. Additionally, our user-friendly interface makes it easy to navigate through the required steps.

-

Can I integrate airSlate SignNow with other applications while using the new mexico form crs 1 instructions?

Yes, airSlate SignNow supports various integrations with popular business tools to enhance your workflow when dealing with the new mexico form crs 1 instructions. Whether you need to connect with CRMs or other document management systems, our platform can accommodate these needs.

-

What are the benefits of using airSlate SignNow for the new mexico form crs 1 instructions?

Using airSlate SignNow for the new mexico form crs 1 instructions offers numerous benefits, including increased efficiency, reduced processing time, and enhanced compliance. Our platform simplifies document management, making it easy to track and store your signed forms securely.

-

How can I ensure my documents are secure when using airSlate SignNow for the new mexico form crs 1 instructions?

AirSlate SignNow employs robust security protocols to ensure that your documents, including those related to the new mexico form crs 1 instructions, are protected. Through encryption and secure data storage, we prioritize your information's safety while you manage your documents online.

Get more for MVD 10009 REV 0318 MOTOR VEHICLE DIVISION ANY ALTERATIONS OR

- Fiu dcf form

- Writing a personal spiritual reference letter form

- Cooper middle school 7 grade summer non fiction book form

- Nervous system fill in the blank worksheet answers form

- Class of 2016 graduation party bid and waiver graduation party bid and waiver form

- Moneague college application form 2020

- Ryan smith memorial scholarship rsms miamisburg miamisburgcityschools form

- Vocal assessment form

Find out other MVD 10009 REV 0318 MOTOR VEHICLE DIVISION ANY ALTERATIONS OR

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity