740 V Kentucky Electronic Payment Voucher Revenue Ky 2015

What is the 740 V Kentucky Electronic Payment Voucher Revenue Ky

The 740 V Kentucky Electronic Payment Voucher is a tax form used by residents of Kentucky to submit their state income tax payments electronically. This form facilitates the payment process and ensures that taxpayers can fulfill their obligations in a timely manner. By using the electronic payment voucher, individuals can avoid the complexities associated with paper forms, making it a convenient option for managing state tax payments.

How to use the 740 V Kentucky Electronic Payment Voucher Revenue Ky

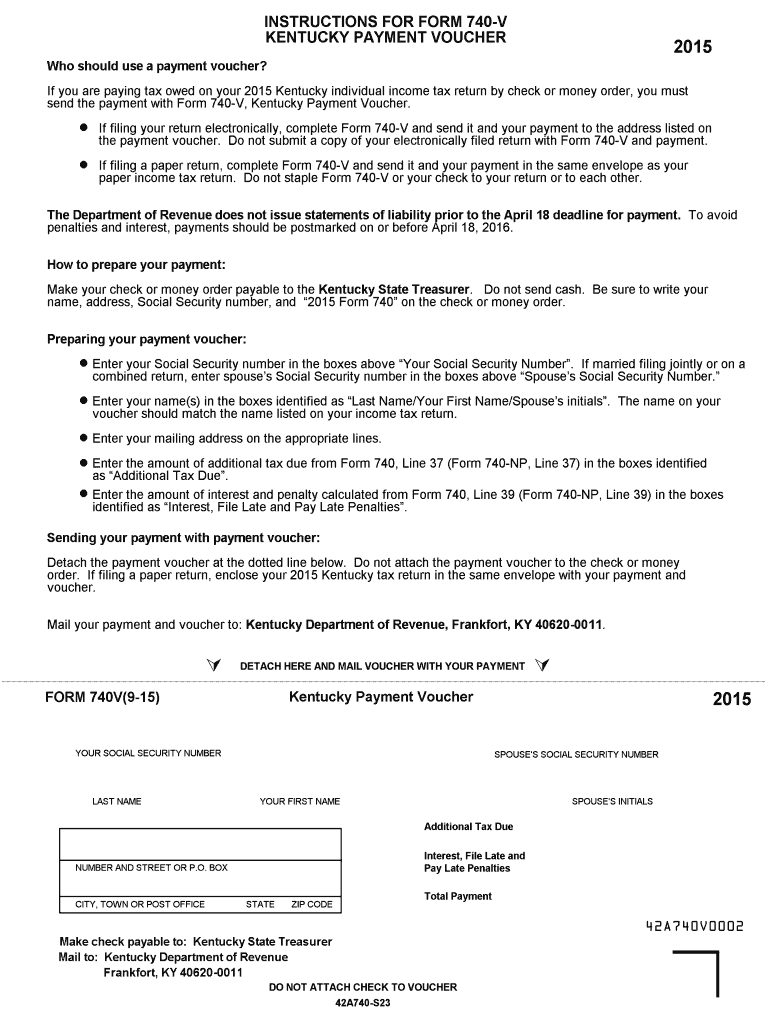

Using the 740 V Kentucky Electronic Payment Voucher involves a few straightforward steps. First, gather all necessary information, including your Social Security number, tax year, and payment amount. Next, access the form online, where you can fill in the required fields. After completing the form, review all entries for accuracy. Finally, submit the form electronically through the designated state tax website or approved platform, ensuring you keep a copy for your records.

Steps to complete the 740 V Kentucky Electronic Payment Voucher Revenue Ky

Completing the 740 V Kentucky Electronic Payment Voucher requires careful attention to detail. Follow these steps:

- Access the form from the official Kentucky Department of Revenue website.

- Enter your personal information, including your name and address.

- Provide your Social Security number and the tax year for which you are making a payment.

- Indicate the payment amount and select the appropriate payment method.

- Review your entries for accuracy and completeness.

- Submit the form electronically and save a copy for your records.

Legal use of the 740 V Kentucky Electronic Payment Voucher Revenue Ky

The legal use of the 740 V Kentucky Electronic Payment Voucher is governed by state tax laws. This form is recognized as a valid method for submitting state tax payments electronically. It complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which allows for electronic signatures and transactions in the United States. Taxpayers should ensure that they follow all guidelines set forth by the Kentucky Department of Revenue to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 740 V Kentucky Electronic Payment Voucher align with the state's tax calendar. Typically, taxpayers must submit their payments by April fifteenth for the previous tax year. However, it is essential to check the Kentucky Department of Revenue's website for any updates or changes to deadlines, especially during tax season or in response to legislative changes.

Form Submission Methods (Online / Mail / In-Person)

The 740 V Kentucky Electronic Payment Voucher can be submitted through various methods. Primarily, taxpayers are encouraged to file online for efficiency and speed. However, if preferred, individuals may also print the form and submit it via mail or in person at designated state tax offices. Each submission method has its own processing times, so it is advisable to consider the urgency of your payment when choosing a method.

Quick guide on how to complete 740 v kentucky electronic payment voucher revenue ky

Your assistance manual on how to prepare your 740 V Kentucky Electronic Payment Voucher Revenue Ky

If you’re wondering how to finalize and submit your 740 V Kentucky Electronic Payment Voucher Revenue Ky, here are some concise instructions to simplify tax submission.

To begin, you just need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, create, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to modify answers when necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and convenient sharing.

Complete the steps below to finish your 740 V Kentucky Electronic Payment Voucher Revenue Ky in just a few minutes:

- Create your account and start processing PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through variants and schedules.

- Press Get form to access your 740 V Kentucky Electronic Payment Voucher Revenue Ky in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to incorporate your legally-binding eSignature (if necessary).

- Review your document and amend any discrepancies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper may lead to more errors and slower refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 740 v kentucky electronic payment voucher revenue ky

Create this form in 5 minutes!

How to create an eSignature for the 740 v kentucky electronic payment voucher revenue ky

How to make an eSignature for the 740 V Kentucky Electronic Payment Voucher Revenue Ky online

How to generate an eSignature for the 740 V Kentucky Electronic Payment Voucher Revenue Ky in Google Chrome

How to make an eSignature for signing the 740 V Kentucky Electronic Payment Voucher Revenue Ky in Gmail

How to create an eSignature for the 740 V Kentucky Electronic Payment Voucher Revenue Ky from your mobile device

How to generate an electronic signature for the 740 V Kentucky Electronic Payment Voucher Revenue Ky on iOS devices

How to generate an eSignature for the 740 V Kentucky Electronic Payment Voucher Revenue Ky on Android

People also ask

-

What is the 740 V Kentucky Electronic Payment Voucher Revenue Ky?

The 740 V Kentucky Electronic Payment Voucher Revenue Ky is a form used by taxpayers in Kentucky to pay their tax obligations electronically. This voucher simplifies the payment process, ensuring accurate and timely submissions to the state revenue department.

-

How can airSlate SignNow help with the 740 V Kentucky Electronic Payment Voucher Revenue Ky?

airSlate SignNow provides an efficient platform to electronically sign and submit the 740 V Kentucky Electronic Payment Voucher Revenue Ky. This streamlines the tax payment process, allowing users to complete their obligations quickly and securely.

-

What are the benefits of using the 740 V Kentucky Electronic Payment Voucher Revenue Ky?

Using the 740 V Kentucky Electronic Payment Voucher Revenue Ky helps alleviate the complexities of tax payments. It ensures higher accuracy in payments, reduces the risk of errors, and speeds up the processing time with Kentucky’s revenue department.

-

Is there any cost associated with eSigning the 740 V Kentucky Electronic Payment Voucher Revenue Ky through airSlate SignNow?

While airSlate SignNow offers various pricing plans, the cost-effective solution allows users to eSign the 740 V Kentucky Electronic Payment Voucher Revenue Ky without unnecessary expenses. Users can choose from flexible plans suited to their needs.

-

Can I integrate airSlate SignNow with other software for managing the 740 V Kentucky Electronic Payment Voucher Revenue Ky?

Yes, airSlate SignNow offers integrations with various accounting and tax software. This makes it easy to manage your financial documents and incorporate the 740 V Kentucky Electronic Payment Voucher Revenue Ky into your existing workflows.

-

What features does airSlate SignNow offer for managing the 740 V Kentucky Electronic Payment Voucher Revenue Ky?

airSlate SignNow offers features like easy document uploading, customizable templates, and secure signing for the 740 V Kentucky Electronic Payment Voucher Revenue Ky. These features enhance productivity and ensure a smooth payment experience.

-

How secure is the electronic submission of the 740 V Kentucky Electronic Payment Voucher Revenue Ky?

The submission of the 740 V Kentucky Electronic Payment Voucher Revenue Ky through airSlate SignNow is highly secure. The platform employs encryption and other security measures to protect sensitive information during the signing and submission process.

Get more for 740 V Kentucky Electronic Payment Voucher Revenue Ky

- 13848 ventura blvd sherman oaks ca 91423p tauber arons azdor form

- Ca 1 form epsb

- Endo advantage form

- Runwal foundation form

- Selbstauskunftverm gensauskunft frankfurter sparkasse frankfurter sparkasse form

- Optumrx prior auth form

- Fbla computer problem solving study guide form

- Alabama school bus driver record ampamp report book form

Find out other 740 V Kentucky Electronic Payment Voucher Revenue Ky

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online