740 V Kentucky Department of Revenue 2020

What is the 2020 Kentucky 740 Form?

The 2020 Kentucky 740 form is the state income tax return used by residents of Kentucky to report their income and calculate their tax liability for the year 2020. This form is essential for individuals and families who earn income in Kentucky, as it ensures compliance with state tax laws. The 740 form allows taxpayers to detail their income sources, claim deductions, and determine any tax credits for which they may be eligible.

Steps to Complete the 2020 Kentucky 740 Form

Completing the 2020 Kentucky 740 form involves several steps to ensure accuracy and compliance. Start by gathering all necessary documents, such as W-2s, 1099s, and other income statements. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, dividends, and interest.

- Claim any applicable deductions, such as standard deductions or itemized deductions.

- Calculate your tax liability using the tax tables provided with the form.

- Include any credits you qualify for, such as the earned income credit.

- Sign and date the form before submitting it.

Required Documents for Filing the 2020 Kentucky 740 Form

To accurately complete the 2020 Kentucky 740 form, you will need several documents that provide proof of income and deductions. These documents include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any relevant tax credit documentation.

Form Submission Methods for the 2020 Kentucky 740 Form

Taxpayers have several options for submitting the 2020 Kentucky 740 form. You can choose to file electronically using approved e-filing software, which often provides a quicker processing time and immediate confirmation of receipt. Alternatively, you can print the completed form and mail it to the Kentucky Department of Revenue. Ensure that you send it to the correct address based on whether you are expecting a refund or owe taxes. In-person filing is also an option at designated tax offices.

Key Elements of the 2020 Kentucky 740 Form

The 2020 Kentucky 740 form contains several key elements that are crucial for accurate tax reporting. These include:

- Personal identification section for taxpayer information.

- Income reporting sections for various sources of income.

- Deductions and credits sections to reduce taxable income.

- Signature line to validate the submission.

- Instructions for completing the form, ensuring compliance with state tax laws.

Legal Use of the 2020 Kentucky 740 Form

The 2020 Kentucky 740 form is legally binding once signed and submitted. It must be completed accurately to avoid penalties or audits from the Kentucky Department of Revenue. Understanding the legal implications of the information provided on the form is essential for taxpayers. This includes being aware that any false information or omissions can lead to legal consequences, including fines or criminal charges.

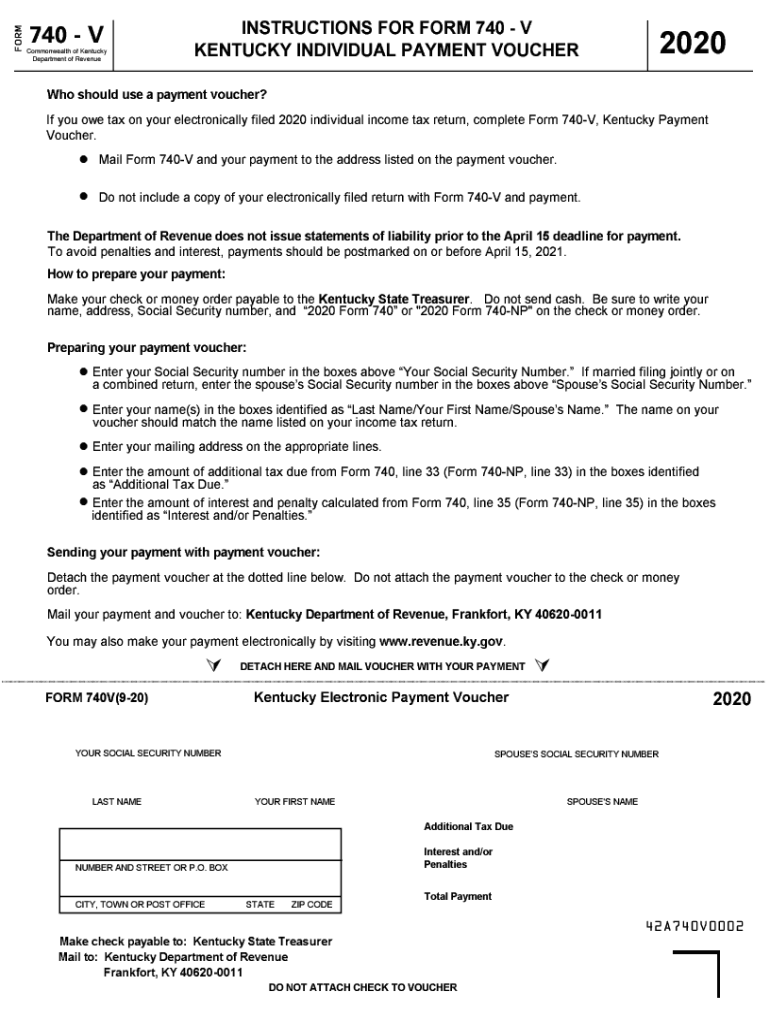

Quick guide on how to complete 740 v kentucky department of revenue

Complete 740 V Kentucky Department Of Revenue effortlessly on any device

Online document management has become widely embraced by organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 740 V Kentucky Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign 740 V Kentucky Department Of Revenue seamlessly

- Locate 740 V Kentucky Department Of Revenue and click on Get Form to initiate.

- Make use of the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Produce your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign 740 V Kentucky Department Of Revenue and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 740 v kentucky department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 740 v kentucky department of revenue

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 2020 ky 740 form, and why do I need it?

The 2020 ky 740 form is the individual income tax return form used by residents of Kentucky. It's essential for reporting your income, claiming deductions, and ensuring compliance with state tax laws. Properly completing your 2020 ky 740 can help you avoid penalties and secure any refunds you're entitled to.

-

How can airSlate SignNow help me with my 2020 ky 740 submissions?

airSlate SignNow simplifies the process of submitting your 2020 ky 740 by allowing you to electronically sign and send documents securely. This platform makes it easy to manage your tax documents and keep track of your submissions, ensuring you stay organized during tax season.

-

Is there a cost associated with using airSlate SignNow for my 2020 ky 740?

AirSlate SignNow offers various pricing plans to accommodate different business needs, including options for individual users who need to file their 2020 ky 740 form. With competitive pricing, you can leverage a cost-effective solution for all your e-signature needs, making it easier to manage your documents without breaking the bank.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow provides features like electronic signatures, document workflows, and template creation, which are perfect for managing your 2020 ky 740 form. Its user-friendly interface allows you to collaborate with tax professionals or family members while ensuring your documents remain secure and accessible.

-

Can I integrate airSlate SignNow with my accounting software to manage the 2020 ky 740?

Yes, airSlate SignNow offers integrations with various accounting software solutions, allowing you to streamline the process of managing your 2020 ky 740 and other financial documents. This integration helps maintain accurate records and simplifies collaboration with your financial team.

-

What are the benefits of using airSlate SignNow for my tax documents?

By using airSlate SignNow for your 2020 ky 740 submissions, you benefit from enhanced security, increased efficiency, and reduced turnaround times. The platform ensures your documents are securely signed and sent, signNowly speeding up the tax filing process and providing peace of mind.

-

Is airSlate SignNow suitable for small businesses filing the 2020 ky 740?

Absolutely! AirSlate SignNow is tailored for businesses of all sizes, including small businesses needing to file the 2020 ky 740 form. Its affordability and user-friendly features make it an ideal solution for small business owners looking to manage their tax documentation efficiently.

Get more for 740 V Kentucky Department Of Revenue

Find out other 740 V Kentucky Department Of Revenue

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer