Utah Ifta Form 2017-2026

What is the Utah Ifta Form

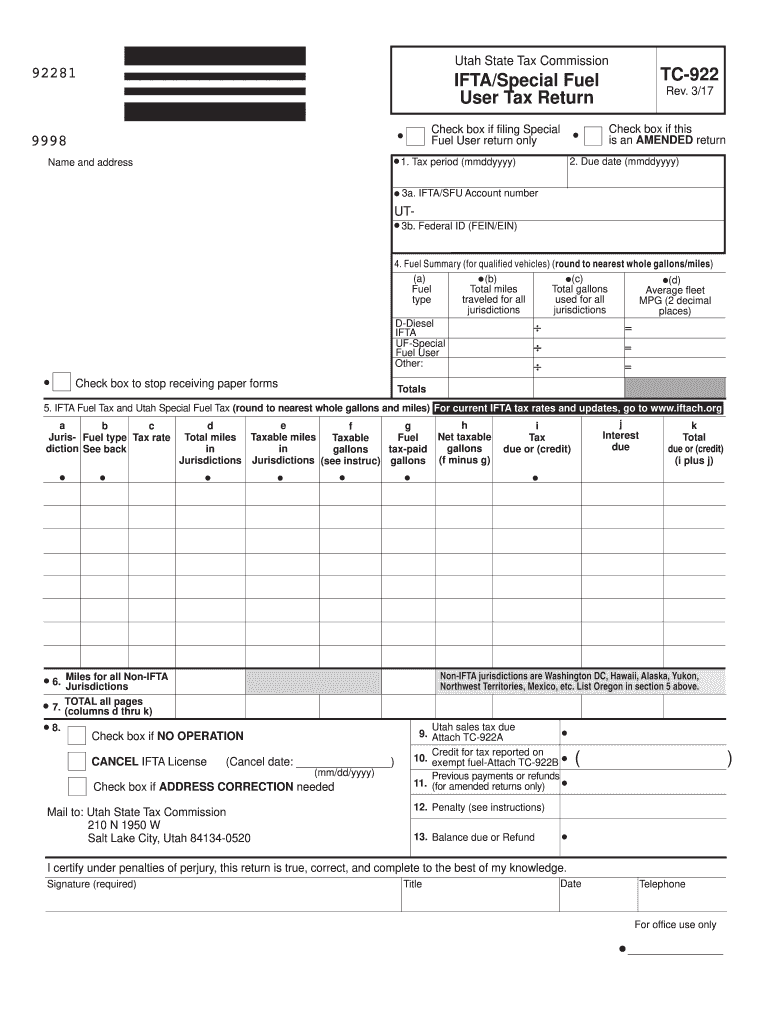

The Utah IFTA form, specifically known as the TC 922, is a crucial document for businesses that operate commercial vehicles across state lines. This form is used to report fuel consumption and calculate the taxes owed to various jurisdictions under the International Fuel Tax Agreement (IFTA). The TC 922 form simplifies the process by allowing carriers to report their fuel usage in a single form rather than filing separate reports for each state. This is essential for ensuring compliance with state regulations and for accurate tax reporting.

Steps to Complete the Utah Ifta Form

Completing the TC 922 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including fuel purchase receipts and mileage records for each jurisdiction. Next, fill out the form by entering details such as the total miles driven in each state and the gallons of fuel purchased. Be sure to calculate the total tax owed based on the rates applicable to each jurisdiction. After completing the form, review it for accuracy before submitting it to the appropriate state agency.

Legal Use of the Utah Ifta Form

The TC 922 form is legally recognized for reporting fuel taxes under the IFTA framework. It is important to use this form correctly to avoid penalties and ensure compliance with state and federal regulations. The form must be signed and dated by an authorized representative of the business, affirming that the information provided is accurate and complete. Businesses are encouraged to familiarize themselves with the legal requirements surrounding the use of this form to maintain compliance and avoid potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the TC 922 form are critical for maintaining compliance with IFTA regulations. Typically, the form must be submitted quarterly, with specific due dates set by the state of Utah. It is essential to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates can assist businesses in managing their filing schedule effectively.

Required Documents

To successfully complete the TC 922 form, several documents are required. These include fuel purchase receipts, mileage logs for each jurisdiction, and previous IFTA filings if applicable. Having these documents organized and readily available will streamline the completion process and help ensure that all necessary information is included, reducing the risk of errors.

Form Submission Methods (Online / Mail / In-Person)

The TC 922 form can be submitted through various methods, providing flexibility for businesses. Online submission is often the quickest and most efficient option, allowing for immediate processing. Alternatively, businesses can choose to mail the completed form to the appropriate state agency or submit it in person if preferred. Each method has its own processing times, so it is advisable to consider these factors when deciding how to submit the form.

Key Elements of the Utah Ifta Form

Understanding the key elements of the TC 922 form is vital for accurate completion. Essential components include sections for reporting total miles driven, gallons of fuel purchased, and taxes owed for each jurisdiction. Additionally, the form requires identification information for the business, including the IFTA account number and contact details. Familiarity with these elements will enhance the accuracy of the filing process.

Quick guide on how to complete tc 922 formpdffillercom 2017 2019

Your assistance manual on how to prepare your Utah Ifta Form

If you're curious about how to finalize and submit your Utah Ifta Form, here are a few brief pointers on how to simplify tax processing signNowly.

To get started, simply register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to adjust information as necessary. Streamline your tax oversight with advanced PDF editing, eSigning, and intuitive sharing.

Complete the following actions to finalize your Utah Ifta Form within moments:

- Set up your account and begin working on PDFs in a few minutes.

- Utilize our directory to find any IRS tax form; look through variations and schedules.

- Click Get form to access your Utah Ifta Form in our editor.

- Enter the necessary information into the fillable fields (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any errors.

- Save your modifications, print your copy, send it to the intended recipient, and download it to your device.

Use this guide to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can increase the likelihood of mistakes and delay refunds. Of course, before electronically filing your taxes, check the IRS website for submission guidelines in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct tc 922 formpdffillercom 2017 2019

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

What should I do if I filled out the FAFSA application for 2018-2019 instead of 2017-2018?

Speak with the financial aid office at the college if your choice to make sure that this is actually a problem.

Create this form in 5 minutes!

How to create an eSignature for the tc 922 formpdffillercom 2017 2019

How to generate an eSignature for the Tc 922 Formpdffillercom 2017 2019 in the online mode

How to make an electronic signature for your Tc 922 Formpdffillercom 2017 2019 in Google Chrome

How to create an eSignature for signing the Tc 922 Formpdffillercom 2017 2019 in Gmail

How to create an eSignature for the Tc 922 Formpdffillercom 2017 2019 straight from your mobile device

How to make an eSignature for the Tc 922 Formpdffillercom 2017 2019 on iOS

How to generate an eSignature for the Tc 922 Formpdffillercom 2017 2019 on Android

People also ask

-

What is the Utah Ifta Form and why is it important?

The Utah Ifta Form is a crucial document for businesses operating commercial vehicles in Utah that travel across state lines. This form helps in reporting fuel usage for interstate travel, ensuring compliance with tax regulations. By accurately completing the Utah Ifta Form, businesses can avoid penalties and streamline their reporting processes.

-

How can airSlate SignNow help with the Utah Ifta Form?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign the Utah Ifta Form. With features that allow for quick document management and storage, businesses can efficiently handle their IFTA filings. This not only saves time but also reduces the risk of errors in submission.

-

Is there a cost associated with using airSlate SignNow for the Utah Ifta Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the management of the Utah Ifta Form. The cost is competitive and provides access to a range of features that simplify document signing and management. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for the Utah Ifta Form?

airSlate SignNow includes features such as templates for the Utah Ifta Form, secure eSigning, and automated workflows. These features enhance efficiency and ensure that all necessary information is captured accurately. Additionally, the platform supports collaboration, allowing multiple stakeholders to review and sign the form seamlessly.

-

Can I integrate airSlate SignNow with other applications for managing the Utah Ifta Form?

Absolutely! airSlate SignNow offers integrations with various applications and services, making it easy to manage the Utah Ifta Form alongside other business processes. Whether you use accounting software or CRM systems, you can streamline your workflows and enhance productivity through these integrations.

-

What are the benefits of using airSlate SignNow for the Utah Ifta Form over traditional methods?

Using airSlate SignNow for the Utah Ifta Form offers several benefits over traditional paper methods, including increased efficiency, reduced paperwork, and improved accuracy. The digital platform allows for instant access to your forms and easy sharing with stakeholders. Furthermore, eSigning speeds up the approval process, helping you stay compliant without delays.

-

Is it safe to use airSlate SignNow for the Utah Ifta Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Utah Ifta Form is protected. The platform employs advanced encryption and security protocols to safeguard your documents and personal information. You can trust that your data is secure while you manage your IFTA filings.

Get more for Utah Ifta Form

- Ohio division of securities 3 q form

- Step by step ersatzstundenplan form

- Terminated employee overpayment letter form

- Charlotte checkers donation request form

- Uaw interdepartmental transfer form

- Teaming agreement template word form

- North carolina fire permit form

- Self billing agreement template 787747288 form

Find out other Utah Ifta Form

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document