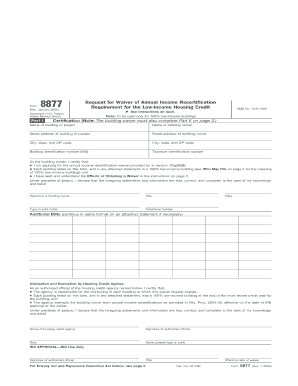

Irs Form 8877

What is the IRS Form 8877?

The IRS Form 8877 is a document used to request a credit for certain housing expenses. This form is particularly relevant for taxpayers who are eligible for specific housing credits under U.S. tax law. It serves as a formal request to the IRS, allowing individuals or businesses to claim credits that can significantly reduce their tax liability. Understanding the purpose of this form is essential for anyone looking to benefit from available housing-related tax credits.

How to Obtain the IRS Form 8877

The IRS Form 8877 can be easily obtained from the official IRS website. It is available for download in PDF format, which allows taxpayers to print and fill it out manually. Additionally, the form may also be accessible through various tax preparation software, which can streamline the process of completing and submitting the form. Ensuring you have the most current version of the form is crucial, as tax regulations may change from year to year.

Steps to Complete the IRS Form 8877

Completing the IRS Form 8877 involves several key steps:

- Gather necessary documentation, such as proof of housing expenses and eligibility criteria.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with your tax return to the IRS by the designated deadline.

Taking the time to carefully complete the form can help avoid delays in processing and ensure you receive any credits for which you qualify.

Key Elements of the IRS Form 8877

Understanding the key elements of the IRS Form 8877 is vital for accurate completion. The form typically includes sections for personal identification information, details about the housing expenses being claimed, and any relevant calculations for the credit amount. It is important to provide clear and precise information in each section to facilitate a smooth review process by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8877 align with the general tax filing deadlines in the United States. Typically, individual taxpayers must submit their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. Staying informed about these deadlines is crucial to ensure compliance and avoid potential penalties.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the IRS Form 8877 can result in penalties. This may include fines or the disallowance of the claimed credit. It is essential for taxpayers to understand the implications of non-compliance and to ensure that all forms are submitted accurately and on time to avoid these consequences.

Quick guide on how to complete irs form 8877

Manage Irs Form 8877 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Irs Form 8877 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to alter and eSign Irs Form 8877 with ease

- Find Irs Form 8877 and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Select pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that need.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, SMS, or invite link, or download it to your computer.

No more worries about lost or mislaid documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form 8877 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8877

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8877 annual requirement in airSlate SignNow?

The 8877 annual requirement refers to compliance needs for documents that must be electronically signed and maintained within a year. airSlate SignNow simplifies meeting this requirement by providing an intuitive platform for eSigning and document management, ensuring you remain compliant efficiently.

-

How does airSlate SignNow help with the 8877 annual requirement?

airSlate SignNow streamlines the process of managing documents subject to the 8877 annual requirement. With features like automated reminders and secure storage, the platform helps businesses ensure that necessary documents are signed, archived, and easily accessible when needed.

-

Is airSlate SignNow cost-effective for fulfilling the 8877 annual requirement?

Yes, airSlate SignNow offers flexible pricing plans designed to fit various budget needs while meeting the 8877 annual requirement. By using this cost-effective solution, businesses can reduce paper-related expenses and enhance their operational efficiency.

-

What features of airSlate SignNow support the 8877 annual requirement?

Key features of airSlate SignNow include customizable templates, automated workflows, and advanced security measures. These tools aid in efficiently handling the 8877 annual requirement, helping businesses comply while improving productivity and document accuracy.

-

Can airSlate SignNow integrate with other software to meet the 8877 annual requirement?

Absolutely, airSlate SignNow offers integrations with various popular applications like CRM systems and cloud storage. These seamless integrations enhance your document workflow and ensure compliance with the 8877 annual requirement by keeping all necessary documents connected and organized.

-

Are there any customer success stories related to the 8877 annual requirement?

Many businesses have successfully navigated the 8877 annual requirement using airSlate SignNow. Customers appreciate the enhanced efficiency and compliance, often sharing how the platform has simplified their eSigning processes and improved overall document management.

-

What are the benefits of using airSlate SignNow for the 8877 annual requirement?

Using airSlate SignNow for the 8877 annual requirement provides several benefits, such as increased efficiency, reduced errors in documentation, and a positive impact on compliance. These advantages contribute to a smoother workflow and help your organization focus on core activities.

Get more for Irs Form 8877

- The moral and legal obligations of bystanders to a vulnerable form

- Ut 02501pdf form

- I of county rhode form

- If recorded return to form

- Arkansas notice of requested information by corporation

- Form 8829

- Ea 800 info how do i turn in sell or store my firearmsand firearm parts judicial council forms

- Centrelink medical certificate form

Find out other Irs Form 8877

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple