Company New Application Checklist WA Agency Requirements WASHINGTON CONSUMER LOAN COMPANY LICENSE This Document Includes Instruc Form

Understanding the Washington Consumer Loan Company License Application

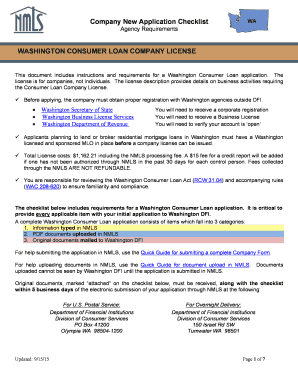

The Company New Application Checklist for the Washington Consumer Loan Company License outlines the necessary steps and documentation required for businesses seeking to operate as consumer loan companies in Washington state. This checklist serves as a comprehensive guide, ensuring that applicants meet all regulatory requirements set forth by the Washington State Department of Financial Institutions (DFI). The document includes detailed instructions on the application process, eligibility criteria, and essential forms needed for compliance.

Steps to Complete the Application Checklist

Completing the Company New Application Checklist involves several key steps. First, gather all required documentation, including business formation documents, financial statements, and personal identification for key stakeholders. Next, fill out the application form accurately, ensuring that all information is up-to-date and complete. After preparing the application, submit it along with the necessary fees to the appropriate agency. It is crucial to review the application thoroughly before submission to prevent delays in processing.

Required Documents for the Application

Applicants must provide specific documents to support their application for a Washington Consumer Loan Company License. These documents typically include:

- Business formation documents, such as articles of incorporation or organization.

- Financial statements that demonstrate the company's financial health.

- Background checks for all principal officers and directors.

- Proof of a physical business location in Washington.

- Compliance with state and federal regulations related to consumer lending.

Ensuring that all required documents are complete and accurate is essential for a smooth application process.

Eligibility Criteria for Applicants

To qualify for the Washington Consumer Loan Company License, applicants must meet specific eligibility criteria. These criteria include having a valid business entity registered in Washington, demonstrating financial stability, and having no significant legal or regulatory violations in the past. Additionally, all principal officers and directors must pass background checks to ensure they meet the ethical standards required for operating a consumer loan business.

Application Process and Approval Timeline

The application process for the Washington Consumer Loan Company License can vary in duration depending on several factors, including the completeness of the application and the volume of applications being processed. Typically, once the application is submitted, it may take several weeks to receive approval. During this time, the DFI may request additional information or clarification on certain aspects of the application. It is advisable for applicants to stay proactive and responsive to any inquiries from the agency to expedite the approval process.

State-Specific Rules and Regulations

Washington state has specific rules and regulations governing consumer lending practices that applicants must adhere to. These regulations include limits on interest rates, disclosure requirements for loan terms, and borrower protection measures. Familiarizing oneself with these state-specific rules is crucial for compliance and successful operation as a licensed consumer loan company in Washington. Failure to comply with these regulations can result in penalties or revocation of the license.

Quick guide on how to complete company new application checklist wa agency requirements washington consumer loan company license this document includes

Complete [SKS] seamlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents rapidly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the risk of lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Company New Application Checklist WA Agency Requirements WASHINGTON CONSUMER LOAN COMPANY LICENSE This Document Includes Instruc

Create this form in 5 minutes!

How to create an eSignature for the company new application checklist wa agency requirements washington consumer loan company license this document includes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for Company New Application Checklist WA Agency Requirements WASHINGTON CONSUMER LOAN COMPANY LICENSE This Document Includes Instruc

- Noel jones manual for preachers noel jones manual for preachers tzab form

- Reset form michigan department of treasury rev 1

- Form et 85 new york state estate tax certification revised 623

- Plaintiffs demand for jury trial cvc11f form

- Form g 45 periodic general exciseuse tax return rev

- 2 give exact time of accident date day and hour form

- Schedule ge form g 45g 49 rev general exciseuse tax schedule of exemptions and deductions

- Form g 49 annual general exciseuse tax return reconciliation rev

Find out other Company New Application Checklist WA Agency Requirements WASHINGTON CONSUMER LOAN COMPANY LICENSE This Document Includes Instruc

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT