Schedule D 2022

What is the Schedule D

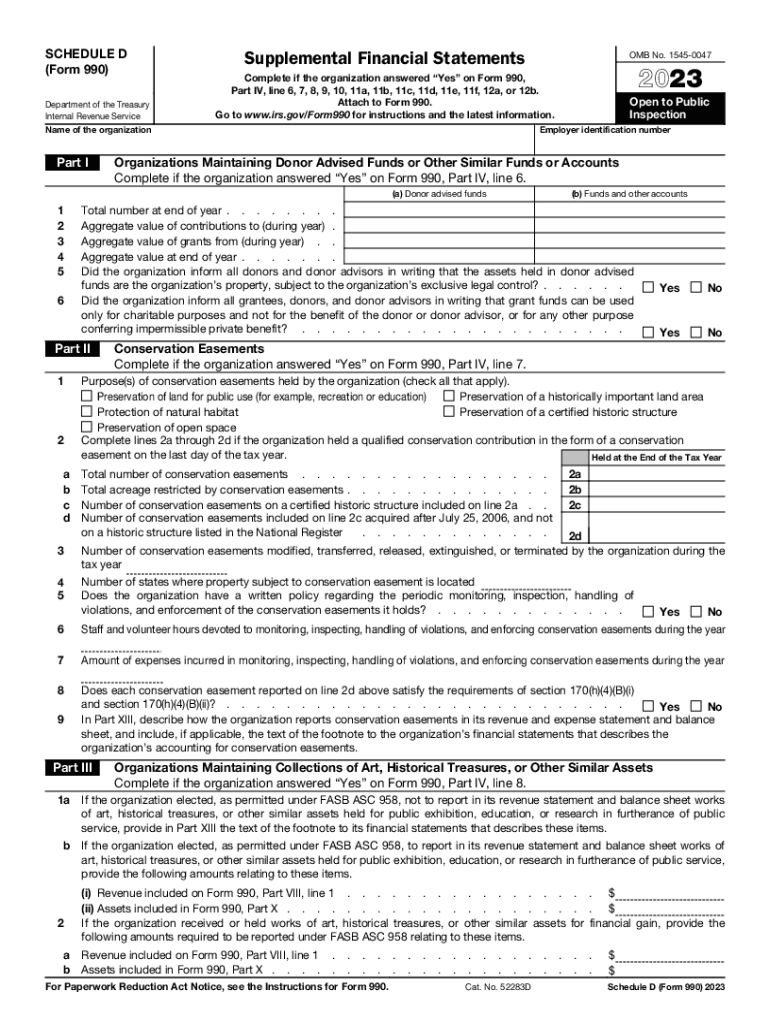

The Schedule D is a crucial component of IRS Form 990, primarily used by tax-exempt organizations to report information about their financial activities, particularly regarding capital gains and losses. This form provides a detailed account of the organization’s investments and helps in determining the tax implications of these transactions. Understanding the Schedule D is essential for ensuring compliance with IRS regulations and maintaining transparency in financial reporting.

How to use the Schedule D

To effectively use the Schedule D, organizations must accurately report their capital gains and losses from the sale of assets. This involves detailing the types of assets sold, the dates of acquisition and sale, and the amounts realized from these transactions. The information reported on Schedule D must align with the organization’s overall financial statements, ensuring consistency and accuracy in reporting.

Steps to complete the Schedule D

Completing the Schedule D involves several key steps:

- Gather all relevant financial documents, including records of asset purchases and sales.

- List each asset sold, including its acquisition date, sale date, and sale price.

- Calculate the capital gain or loss for each transaction by subtracting the asset's basis from the sale price.

- Summarize the total capital gains and losses, ensuring that all calculations are accurate.

- Attach the completed Schedule D to the IRS Form 990 when filing.

Legal use of the Schedule D

The Schedule D must be used in accordance with IRS guidelines to ensure legal compliance. Organizations are required to report all capital gains and losses accurately, as failure to do so can result in penalties or loss of tax-exempt status. It is important for organizations to maintain thorough records and to consult tax professionals if there are uncertainties regarding the reporting requirements.

Key elements of the Schedule D

Key elements of the Schedule D include:

- Identification of the type of asset sold, such as stocks, bonds, or real estate.

- Details of the acquisition and sale dates.

- The basis of the asset, which is typically the purchase price plus any associated costs.

- The sale price, which is the amount received from the sale.

- Calculations of capital gains or losses for each transaction.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Schedule D as part of their Form 990 submission. Generally, the due date for Form 990 is the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically falls on May fifteenth. It is crucial to be aware of these deadlines to avoid late filing penalties.

Quick guide on how to complete schedule d 702367391

Prepare Schedule D effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Schedule D on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Schedule D without any hassle

- Obtain Schedule D and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow parts of your documents or obscure sensitive information with specialized tools offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Schedule D and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d 702367391

Create this form in 5 minutes!

How to create an eSignature for the schedule d 702367391

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 990 acquisition in the context of airSlate SignNow?

990 acquisition refers to the process of obtaining and utilizing the eSigning capabilities provided by airSlate SignNow. This feature enables businesses to streamline document signing processes, enhancing efficiency and reducing turnaround times for important agreements.

-

How does airSlate SignNow support my business's 990 acquisition goals?

AirSlate SignNow supports 990 acquisition by simplifying the documentation processes with an easy-to-use interface. This platform allows you to automate workflows, ensuring that your team can focus on strategic initiatives instead of getting bogged down by paperwork.

-

What pricing options are available for 990 acquisition with airSlate SignNow?

AirSlate SignNow offers several pricing plans tailored to fit different business needs regarding 990 acquisition. You can choose from monthly or annual subscriptions, allowing you to select a plan that aligns with your usage and organizational requirements.

-

What features are included in the airSlate SignNow 990 acquisition plan?

The 990 acquisition plan includes key features such as customizable templates, real-time tracking of documents, and integrations with other applications. These tools help you enhance your document management processes, ensuring a seamless eSigning experience.

-

Can airSlate SignNow integrate with other tools to improve my 990 acquisition process?

Yes, airSlate SignNow can integrate with various tools and applications that your business may already be using. This capability allows for a more cohesive workflow, enabling you to automate tasks and improve the efficiency of your 990 acquisition.

-

What benefits can I expect from using airSlate SignNow for 990 acquisition?

Utilizing airSlate SignNow for 990 acquisition can lead to faster document turnaround times, increased accuracy, and reduced costs associated with traditional paper-based processes. These benefits contribute to a more efficient business operation overall.

-

Is airSlate SignNow compliant with legal standards for 990 acquisition?

Yes, airSlate SignNow is compliant with essential legal standards and regulations regarding electronic signatures. This compliance ensures that your 990 acquisition and document signing processes meet all necessary legal requirements.

Get more for Schedule D

- Tax return for trustees of registered pension schemes form

- Change of circumstances form for eu students gov uk

- Bds membership renewal form british driving society

- Hs302 duel residents claim form

- Florida supreme court approved family law form 12 990c1 final judgment of dissolution of marriage with dependent or minor

- Florida supreme court approved family law form 12 982d consent for change of name minor children 0218 florida supreme court

- Instructions for florida supreme court approved family law form 12 980h request for confidential filing of address 0618 florida

- Casesjustia dockets ampampamp filings form

Find out other Schedule D

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word