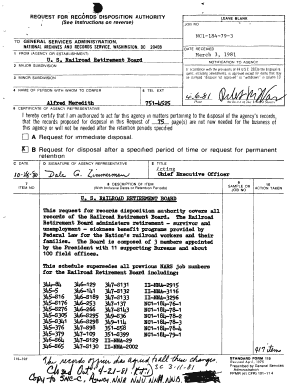

Railroad Retirement Schedule Final Drafts Form

Understanding the Railroad Retirement Schedule Final Drafts

The Railroad Retirement Schedule Final Drafts are essential documents used by individuals who are eligible for benefits under the Railroad Retirement Act. This schedule outlines the specific timeframes and requirements for filing claims, ensuring that beneficiaries receive their entitled retirement benefits in a timely manner. It is crucial for those involved in the railroad industry to familiarize themselves with this schedule to avoid any disruptions in their benefits.

How to Utilize the Railroad Retirement Schedule Final Drafts

Using the Railroad Retirement Schedule Final Drafts involves several steps. First, individuals should review the schedule to understand the filing deadlines and required documentation. Next, they need to gather all necessary information, including personal identification and employment history within the railroad sector. Once all documents are prepared, individuals can complete the required forms, ensuring that they follow the instructions provided in the schedule for accurate submission.

Obtaining the Railroad Retirement Schedule Final Drafts

The Railroad Retirement Schedule Final Drafts can be obtained through the official Railroad Retirement Board (RRB) website or by contacting their offices directly. It is advisable to access the most current version of the schedule to ensure compliance with any recent changes in regulations or procedures. Additionally, individuals may request assistance from RRB representatives if they encounter difficulties in obtaining the necessary documents.

Steps to Complete the Railroad Retirement Schedule Final Drafts

Completing the Railroad Retirement Schedule Final Drafts requires careful attention to detail. The following steps should be followed:

- Review the schedule to understand deadlines and requirements.

- Gather all necessary documents, including identification and employment records.

- Fill out the forms accurately, ensuring all information is complete.

- Double-check for any errors or omissions before submission.

- Submit the completed forms as instructed, either online or via mail.

Legal Considerations for the Railroad Retirement Schedule Final Drafts

It is important to understand the legal implications of the Railroad Retirement Schedule Final Drafts. These documents are governed by federal regulations, and failure to comply with the outlined procedures can result in delays or denial of benefits. Individuals should be aware of their rights and responsibilities under the Railroad Retirement Act and seek legal advice if they have questions regarding their eligibility or the filing process.

Key Elements of the Railroad Retirement Schedule Final Drafts

The key elements of the Railroad Retirement Schedule Final Drafts include:

- Filing deadlines for various benefit claims.

- Required documentation for eligibility verification.

- Instructions for completing and submitting the forms.

- Information on potential penalties for non-compliance.

Examples of Using the Railroad Retirement Schedule Final Drafts

Examples of utilizing the Railroad Retirement Schedule Final Drafts can help clarify the process. For instance, a retired railroad worker may need to submit a claim for retirement benefits by a specific deadline outlined in the schedule. Another example could involve a worker seeking disability benefits, where the schedule provides guidance on the necessary forms and documentation required for submission. These examples illustrate the practical application of the schedule in real-life scenarios.

Quick guide on how to complete railroad retirement schedule final drafts

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly preferred by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Access [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Way to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and select Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure outstanding communication throughout your entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Railroad Retirement Schedule Final Drafts

Create this form in 5 minutes!

How to create an eSignature for the railroad retirement schedule final drafts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Railroad Retirement Schedule Final Drafts feature in airSlate SignNow?

The Railroad Retirement Schedule Final Drafts feature in airSlate SignNow allows users to create, edit, and finalize important documents related to railroad retirement. This feature ensures that all necessary information is accurately captured and presented in a professional format, streamlining the retirement process.

-

How does airSlate SignNow help with the Railroad Retirement Schedule Final Drafts?

airSlate SignNow simplifies the creation of Railroad Retirement Schedule Final Drafts by providing easy-to-use templates and editing tools. Users can quickly customize their documents, ensuring compliance with railroad retirement regulations while saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for Railroad Retirement Schedule Final Drafts?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. Each plan includes access to features for creating Railroad Retirement Schedule Final Drafts, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other tools for managing Railroad Retirement Schedule Final Drafts?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow for Railroad Retirement Schedule Final Drafts. This allows you to connect with tools you already use, making document management more efficient and streamlined.

-

What benefits does airSlate SignNow provide for managing Railroad Retirement Schedule Final Drafts?

Using airSlate SignNow for Railroad Retirement Schedule Final Drafts offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. The platform's eSignature capabilities also ensure that your documents are legally binding and secure.

-

Is airSlate SignNow user-friendly for creating Railroad Retirement Schedule Final Drafts?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to create Railroad Retirement Schedule Final Drafts without extensive training. The intuitive interface allows users to navigate the platform effortlessly.

-

How secure is airSlate SignNow when handling Railroad Retirement Schedule Final Drafts?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your Railroad Retirement Schedule Final Drafts and sensitive information, ensuring that your documents are safe from unauthorized access.

Get more for Railroad Retirement Schedule Final Drafts

- I j city of albany form

- June july august form

- 08oc0041223 23rdcouncil info item doc www01 smgov form

- Fire safety bureau form

- Hotel motel application ehotelinsurance com ehotel insurance form

- Amazon web services building fault tolerant applications on aws form

- Application for exhibitor space 1 the undersigned person on behalf form

- Scholarship application for all michigan city high schools form

Find out other Railroad Retirement Schedule Final Drafts

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later