July Sales Tax St 809 Form 2020

What is the July Sales Tax St 809 Form

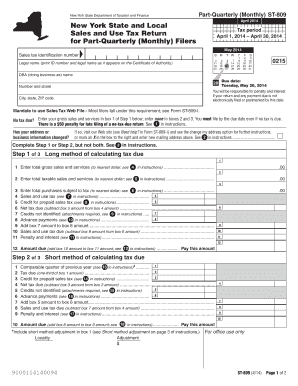

The July Sales Tax St 809 Form is a tax document used by businesses in the United States to report and remit sales tax collected during the month of July. This form is essential for ensuring compliance with state tax regulations. It provides a structured way for businesses to calculate the total sales tax owed based on their taxable sales for the month. The form typically includes sections for reporting gross sales, taxable sales, and the corresponding sales tax amount due.

How to use the July Sales Tax St 809 Form

Using the July Sales Tax St 809 Form involves several steps. First, businesses need to gather their sales records for July, including receipts and invoices. Next, they will fill out the form by entering their total gross sales, identifying which sales are taxable, and calculating the sales tax owed. After completing the form, it should be reviewed for accuracy before submission. This ensures that the reported figures align with the business's financial records, minimizing the risk of errors that could lead to penalties.

Steps to complete the July Sales Tax St 809 Form

Completing the July Sales Tax St 809 Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all sales records for July, including invoices and receipts.

- Calculate total gross sales and identify taxable sales.

- Determine the sales tax rate applicable to your business.

- Fill in the form with the calculated gross sales, taxable sales, and sales tax owed.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either online or by mail.

Legal use of the July Sales Tax St 809 Form

The July Sales Tax St 809 Form is legally binding when completed accurately and submitted on time. It serves as an official record of sales tax collected by a business, which must be remitted to the state. Compliance with state tax laws is critical, as failure to submit the form or incorrect reporting can result in penalties or legal repercussions. Businesses should ensure that they understand the legal implications of their sales tax obligations and maintain accurate records to support their filings.

Filing Deadlines / Important Dates

Filing deadlines for the July Sales Tax St 809 Form typically align with state tax regulations. Businesses are usually required to submit their sales tax forms by a specific date each month, often within a few weeks after the end of the reporting period. It is crucial to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submissions.

Who Issues the Form

The July Sales Tax St 809 Form is issued by the state tax authority in the jurisdiction where the business operates. Each state may have its own version of the form, and it is essential for businesses to use the correct form specific to their state. This ensures compliance with local tax laws and regulations. Businesses can typically obtain the form from the state tax authority's website or by contacting their office directly.

Quick guide on how to complete july 2012 sales tax st 809 form

Effortlessly prepare July Sales Tax St 809 Form on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage July Sales Tax St 809 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign July Sales Tax St 809 Form with ease

- Obtain July Sales Tax St 809 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and electronically sign July Sales Tax St 809 Form and ensure optimal communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct july 2012 sales tax st 809 form

Create this form in 5 minutes!

How to create an eSignature for the july 2012 sales tax st 809 form

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the July Sales Tax St 809 Form?

The July Sales Tax St 809 Form is a crucial document used by businesses in certain states to report sales tax collected during the month of July. This form ensures compliance with tax laws and helps in accurate reporting. Properly filling out the July Sales Tax St 809 Form can prevent potential fines and penalties.

-

How can airSlate SignNow help me with the July Sales Tax St 809 Form?

airSlate SignNow provides an easy-to-use platform that simplifies the process of completing and eSigning the July Sales Tax St 809 Form. With its intuitive interface, you can upload the form, fill it out, and send it for signature all in one go, making tax reporting hassle-free. Our solution also allows for secure storage and sharing of important tax documents.

-

Is there a cost associated with using airSlate SignNow for the July Sales Tax St 809 Form?

Yes, airSlate SignNow offers several pricing plans tailored to meet the needs of different businesses. Each plan provides access to features that facilitate the completion of the July Sales Tax St 809 Form, including unlimited eSigning and document storage. You'll find that our solution is both cost-effective and packed with features to enhance your productivity.

-

Can I integrate airSlate SignNow with other software for managing the July Sales Tax St 809 Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and finance software, allowing you to manage the July Sales Tax St 809 Form more effectively. This interoperability saves time as you can pull up necessary data and easily transfer it into your tax forms, ensuring accuracy and reducing manual input.

-

What are the benefits of using airSlate SignNow for tax documents like the July Sales Tax St 809 Form?

Using airSlate SignNow for your tax documents, including the July Sales Tax St 809 Form, offers numerous benefits. You can streamline your workflow, ensuring that documents are sent, signed, and stored securely. The platform also enhances collaboration, making it easy for multiple stakeholders to review and approve tax documents.

-

Does airSlate SignNow provide templates for the July Sales Tax St 809 Form?

Yes, airSlate SignNow offers customizable templates for the July Sales Tax St 809 Form and other tax documents. These templates are designed to help you quickly fill in the necessary fields, ensuring that you don’t miss any critical information. With templates, you can also maintain consistency across your tax filings.

-

How secure is my information when using airSlate SignNow for the July Sales Tax St 809 Form?

Security is a top priority at airSlate SignNow. When using our platform for the July Sales Tax St 809 Form, your data is protected with high-level encryption and secure access protocols. We implement strict security measures to ensure that your sensitive tax information remains confidential and safe during the entire signing process.

Get more for July Sales Tax St 809 Form

Find out other July Sales Tax St 809 Form

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online