Form ST 100619New York State and Local Quarterly Sales and Use Tax Returnst100 2020

What is the Form ST 100619 New York State And Local Quarterly Sales And Use Tax Returns t100

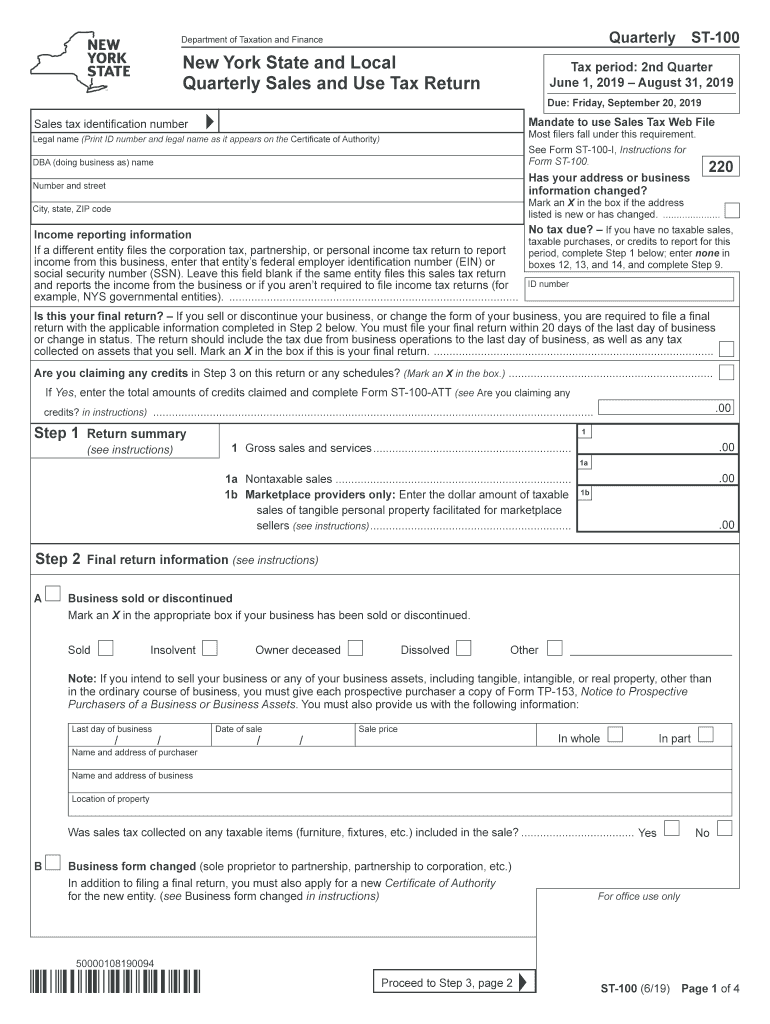

The Form ST 100619 is a crucial document used for reporting sales and use tax in New York State. This form is specifically designed for businesses to declare their sales tax liability to both state and local jurisdictions on a quarterly basis. It is essential for compliance with New York tax laws and helps ensure that businesses accurately report their taxable sales and remit the appropriate amount of sales tax collected from customers.

How to use the Form ST 100619 New York State And Local Quarterly Sales And Use Tax Returns t100

To effectively use Form ST 100619, businesses must first gather all necessary sales records for the reporting period. This includes total sales, exempt sales, and any purchases subject to use tax. After compiling this information, businesses can fill out the form by entering their total taxable sales, deductions, and the calculated sales tax due. It is important to review the completed form for accuracy before submission to avoid penalties or delays in processing.

Steps to complete the Form ST 100619 New York State And Local Quarterly Sales And Use Tax Returns t100

Completing the Form ST 100619 involves several key steps:

- Gather all relevant sales data for the quarter.

- Fill in the business identification information, including the name and address.

- Report total sales and any exemptions accurately.

- Calculate the total sales tax due based on the reported sales.

- Sign and date the form to certify its accuracy.

Once completed, the form can be submitted electronically or via mail, depending on the preferred method of filing.

Legal use of the Form ST 100619 New York State And Local Quarterly Sales And Use Tax Returns t100

The legal use of Form ST 100619 is governed by New York State tax regulations. To be considered valid, the form must be filled out completely and accurately. It is legally binding once signed by the authorized representative of the business. Electronic submissions are acceptable, provided they comply with the necessary eSignature regulations, ensuring the form is recognized as legally enforceable.

Filing Deadlines / Important Dates

Filing deadlines for Form ST 100619 are typically set on a quarterly basis. Businesses must submit their returns by the end of the month following the close of each quarter. For example, the deadlines usually fall on:

- April 30 for the first quarter (January - March)

- July 31 for the second quarter (April - June)

- October 31 for the third quarter (July - September)

- January 31 for the fourth quarter (October - December)

Timely submission is crucial to avoid penalties and interest on late payments.

Form Submission Methods (Online / Mail / In-Person)

Form ST 100619 can be submitted through various methods to accommodate different business preferences. The available submission methods include:

- Online: Businesses can file electronically through the New York State Department of Taxation and Finance website.

- Mail: The completed form can be printed and mailed to the appropriate tax office address as indicated in the form instructions.

- In-Person: Some businesses may choose to deliver the form directly to a local tax office, although this is less common.

Choosing the right submission method can enhance efficiency and ensure compliance with filing requirements.

Quick guide on how to complete form st 100619new york state and local quarterly sales and use tax returnst100

Complete Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100 effortlessly on any device

Web-based document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and electronically sign Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100 with ease

- Obtain Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specializes in for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searches, or mistakes that necessitate printing fresh document copies. airSlate SignNow manages all your needs in document management with just a few clicks from your chosen device. Modify and electronically sign Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100 while ensuring superior communication at any phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 100619new york state and local quarterly sales and use tax returnst100

Create this form in 5 minutes!

How to create an eSignature for the form st 100619new york state and local quarterly sales and use tax returnst100

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100?

Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100 is a tax return used by businesses to report and pay sales and use tax in New York. This form provides a comprehensive overview of taxable sales, purchases, and the amount owed to the state. Understanding how to properly complete this form is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow assist with completing Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100?

airSlate SignNow simplifies the process of completing Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100 by providing an intuitive platform for document management. Users can easily fill, sign, and send their tax forms directly through the platform. This saves time and reduces the likelihood of errors that could occur when filling out the form manually.

-

Is there a cost associated with using airSlate SignNow for Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100?

Yes, there is a cost associated with using airSlate SignNow, which offers various pricing plans tailored to different business needs. These plans are designed to be cost-effective, ensuring you get the best value for managing documents like Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100. Explore our pricing options to find the plan that suits your organization.

-

What features does airSlate SignNow offer for managing Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100?

airSlate SignNow offers a range of features that enhance document management for Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100. These include eSignature capabilities, templates for quick assembly of the form, and tracking options for submissions. Additionally, our platform ensures documents are securely stored and easily accessible.

-

Are there any integrations available for airSlate SignNow to handle Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100?

Absolutely! airSlate SignNow integrates with various applications to streamline the process of handling Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100. Integrations with accounting software, CRM systems, and other productivity tools are available to ensure seamless workflow and data management.

-

What are the benefits of using airSlate SignNow for Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100?

Using airSlate SignNow for Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100 brings numerous benefits, including efficiency, accuracy, and security. The platform speeds up the document signing process and helps in maintaining compliance by ensuring all submissions are tracked and managed properly. This results in signNow time and cost savings for businesses.

-

Can airSlate SignNow help with other tax forms besides Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100?

Yes, airSlate SignNow can assist with a variety of tax forms in addition to Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100. Our platform supports multiple document types, allowing you to manage all of your tax-related documents efficiently in one place. This versatility enhances your overall tax compliance strategy.

Get more for Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100

Find out other Form ST 100619New York State And Local Quarterly Sales And Use Tax Returnst100

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement