Homestead Exemption Montgomery County Ohio Form 2019

What is the Homestead Exemption Montgomery County Ohio Form

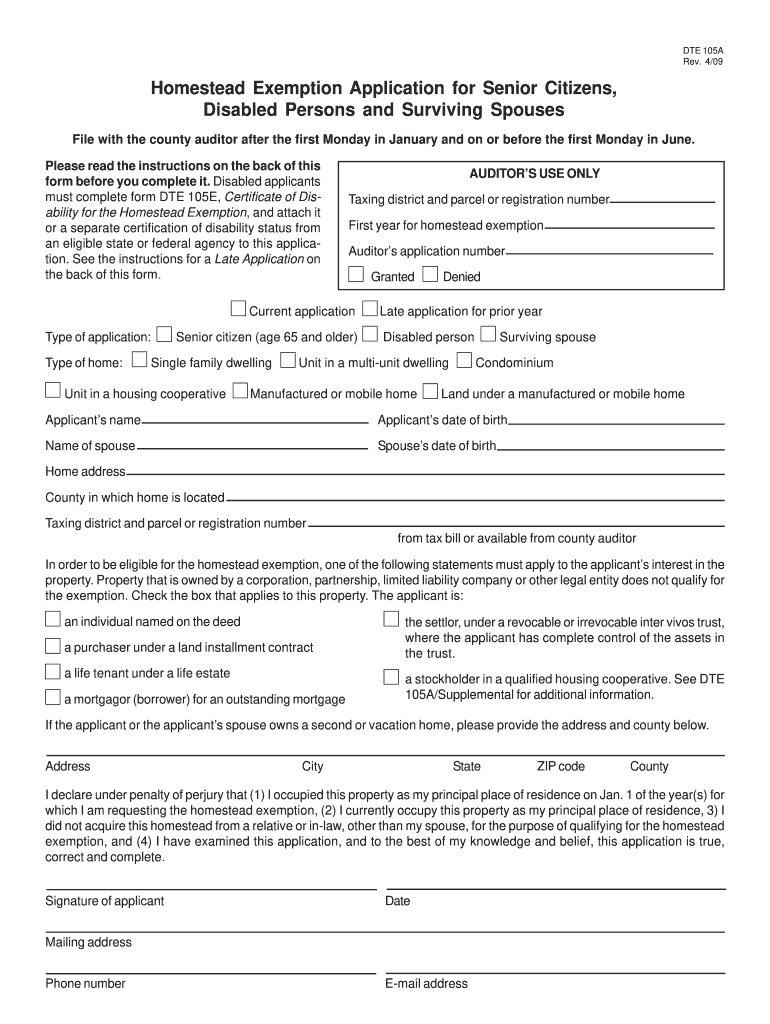

The Homestead Exemption Montgomery County Ohio Form is a legal document that allows eligible homeowners in Montgomery County to reduce their property tax burden. This exemption is designed to provide financial relief to senior citizens, disabled individuals, and certain low-income homeowners. By filing this form, qualified applicants can receive a reduction in the assessed value of their property, which directly lowers their property tax bills. Understanding the purpose and benefits of this form is essential for those looking to take advantage of the homestead exemption program.

Steps to complete the Homestead Exemption Montgomery County Ohio Form

Completing the Homestead Exemption Montgomery County Ohio Form involves a series of straightforward steps. First, gather all necessary information, including your property details and personal identification. Next, accurately fill out the form, ensuring that all sections are complete and correct. Pay particular attention to eligibility criteria, as this will determine your qualification for the exemption. After completing the form, review it for accuracy before submission. Finally, submit the form through your preferred method, whether online, by mail, or in person.

Eligibility Criteria

To qualify for the Homestead Exemption Montgomery County Ohio Form, applicants must meet specific eligibility criteria. Generally, applicants must be at least sixty-five years old, permanently and totally disabled, or meet certain income limits. Additionally, the property must be the applicant's primary residence, and they must have owned the property for a specified period. It is important to review the detailed eligibility requirements to ensure compliance and maximize the chances of approval.

Required Documents

When preparing to submit the Homestead Exemption Montgomery County Ohio Form, certain documents are required to support your application. These may include proof of age, disability documentation, and income verification, such as tax returns or pay stubs. Additionally, you may need to provide proof of property ownership, such as a deed or property tax statement. Ensuring that all required documents are included with your application can help facilitate a smooth review process.

Form Submission Methods

The Homestead Exemption Montgomery County Ohio Form can be submitted through various methods to accommodate different preferences. Homeowners may choose to complete and submit the form online for convenience. Alternatively, the form can be printed, filled out by hand, and mailed to the appropriate county office. In-person submission is also an option for those who prefer direct interaction with county officials. Each method has its own advantages, so consider which is best for your situation.

Legal use of the Homestead Exemption Montgomery County Ohio Form

The legal use of the Homestead Exemption Montgomery County Ohio Form is governed by state laws and regulations. This form must be filled out accurately and submitted within the designated timeframes to ensure compliance with local tax laws. Failure to adhere to these legal requirements may result in the denial of the exemption or potential penalties. Understanding the legal implications of this form is crucial for homeowners seeking to benefit from the homestead exemption.

Quick guide on how to complete homestead exemption montgomery county ohio form

Complete Homestead Exemption Montgomery County Ohio Form effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It offers a convenient eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without hold-ups. Manage Homestead Exemption Montgomery County Ohio Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and eSign Homestead Exemption Montgomery County Ohio Form without hassle

- Acquire Homestead Exemption Montgomery County Ohio Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or black out sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Alter and eSign Homestead Exemption Montgomery County Ohio Form and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homestead exemption montgomery county ohio form

Create this form in 5 minutes!

How to create an eSignature for the homestead exemption montgomery county ohio form

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Homestead Exemption Montgomery County Ohio Form?

The Homestead Exemption Montgomery County Ohio Form is an application used by eligible homeowners to receive property tax reductions. This form allows senior citizens and permanently disabled individuals to benefit from a decrease in their property tax burden, making homeownership more affordable.

-

How can I obtain the Homestead Exemption Montgomery County Ohio Form?

You can easily obtain the Homestead Exemption Montgomery County Ohio Form by visiting the official Montgomery County website or your local tax office. Additionally, many online platforms provide downloadable versions of the form for your convenience.

-

Are there any fees associated with submitting the Homestead Exemption Montgomery County Ohio Form?

No, there are no fees for submitting the Homestead Exemption Montgomery County Ohio Form. The application process is provided at no cost to eligible applicants, allowing them to benefit from tax savings without financial barriers.

-

How often do I need to reapply for the Homestead Exemption Montgomery County Ohio Form?

Once approved, the Homestead Exemption Montgomery County Ohio Form typically does not require reapplication each year unless there are signNow changes to your property ownership status. It’s crucial to keep the county updated with any relevant changes to maintain your exemption.

-

What documents do I need to complete the Homestead Exemption Montgomery County Ohio Form?

To complete the Homestead Exemption Montgomery County Ohio Form, you will generally need to provide proof of eligibility such as identification, income statements, and documentation of your disability or age. Check with your local tax office for a full list of required documents.

-

Can I file the Homestead Exemption Montgomery County Ohio Form online?

Yes, you can file the Homestead Exemption Montgomery County Ohio Form online through the Montgomery County tax office website. This convenient option allows you to submit your application securely from the comfort of your home.

-

What are the benefits of applying for the Homestead Exemption Montgomery County Ohio Form?

Applying for the Homestead Exemption Montgomery County Ohio Form can signNowly reduce your property taxes, making it easier for eligible homeowners to manage their finances. This exemption can provide peace of mind and financial relief for seniors and those with disabilities.

Get more for Homestead Exemption Montgomery County Ohio Form

- Nbcrfli provident fund balance check form

- Angle puzzle worksheet answers pdf form

- Minutes writing format pdf

- Verification of working life residence in australia form

- Certificado de empadronamiento form

- Ndis continence assessment template form

- Hiv test form pdf 10735885

- Domiciliary letters 50223486 form

Find out other Homestead Exemption Montgomery County Ohio Form

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online