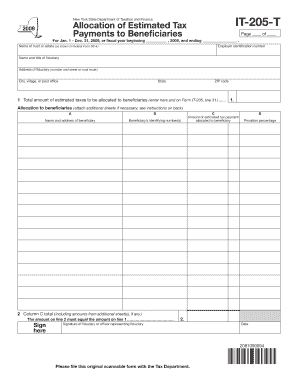

Form it 205 T Allocation of Estimated Tax Payments to 2020

What is the Form IT 205 T Allocation Of Estimated Tax Payments To

The Form IT 205 T Allocation Of Estimated Tax Payments To is a tax form used by individuals and businesses in the United States to allocate estimated tax payments among various tax liabilities. This form is particularly relevant for taxpayers who need to distribute their estimated tax payments to different accounts or tax years, ensuring that their payments are accurately applied. It is essential for maintaining compliance with tax obligations and can help prevent underpayment penalties.

Steps to complete the Form IT 205 T Allocation Of Estimated Tax Payments To

Completing the Form IT 205 T involves several key steps:

- Gather necessary information, including your Social Security number or Employer Identification Number.

- Identify the tax year for which you are allocating estimated payments.

- Fill in the amounts of estimated tax payments you wish to allocate to each specific tax liability.

- Review the completed form for accuracy, ensuring that all figures are correct and properly aligned with your tax obligations.

- Sign and date the form to validate your submission.

How to obtain the Form IT 205 T Allocation Of Estimated Tax Payments To

The Form IT 205 T can be obtained through various channels. Taxpayers can download the form directly from the official state tax authority website or request a physical copy by contacting their local tax office. Additionally, many tax preparation software programs include the form, allowing for easy access and completion as part of the tax filing process.

Legal use of the Form IT 205 T Allocation Of Estimated Tax Payments To

The legal use of the Form IT 205 T is governed by federal and state tax laws. It serves as a formal document that ensures your estimated tax payments are allocated correctly, which is critical for compliance. Proper completion and submission of this form can protect taxpayers from potential penalties associated with misallocated payments or underpayment of taxes.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form IT 205 T. Generally, the form should be submitted by the estimated tax payment deadlines set forth by the IRS or state tax authorities. Missing these deadlines can result in penalties or interest on unpaid taxes. Taxpayers should consult the official tax calendar for specific dates relevant to their situation.

Examples of using the Form IT 205 T Allocation Of Estimated Tax Payments To

Examples of scenarios where the Form IT 205 T may be used include:

- A self-employed individual allocating estimated payments to both federal and state taxes.

- A business distributing payments among various tax accounts due to changes in income.

- Taxpayers who have overpaid in one year and wish to apply those payments to future tax liabilities.

Quick guide on how to complete form it 205 t2009 allocation of estimated tax payments to

Effortlessly Prepare Form IT 205 T Allocation Of Estimated Tax Payments To on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Form IT 205 T Allocation Of Estimated Tax Payments To on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Edit and Electronically Sign Form IT 205 T Allocation Of Estimated Tax Payments To

- Obtain Form IT 205 T Allocation Of Estimated Tax Payments To and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form IT 205 T Allocation Of Estimated Tax Payments To while ensuring effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 205 t2009 allocation of estimated tax payments to

Create this form in 5 minutes!

How to create an eSignature for the form it 205 t2009 allocation of estimated tax payments to

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Form IT 205 T Allocation Of Estimated Tax Payments To?

The Form IT 205 T Allocation Of Estimated Tax Payments To is a tax form used by New York residents to allocate their estimated tax payments to various income sources. This form enables taxpayers to ensure proper distribution of their tax credits and payments among different taxes. Using airSlate SignNow can simplify the process of filling and submitting this form electronically.

-

How can airSlate SignNow help with the Form IT 205 T Allocation Of Estimated Tax Payments To?

airSlate SignNow streamlines the preparation and submission of the Form IT 205 T Allocation Of Estimated Tax Payments To by allowing you to fill it out and eSign it online. This reduces paperwork and enhances accuracy, ensuring your allocations are correctly submitted. Additionally, our platform maintains a secure environment for all your sensitive tax-related documents.

-

What are the costs associated with using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including features for managing documents like the Form IT 205 T Allocation Of Estimated Tax Payments To. Our solution is designed to be cost-effective, providing excellent value for the capabilities offered, including eSigning and cloud storage. For specific pricing details, please visit our website.

-

Is the Form IT 205 T Allocation Of Estimated Tax Payments To compatible with other tax software?

Yes, the Form IT 205 T Allocation Of Estimated Tax Payments To can be easily integrated with various tax software systems. airSlate SignNow enhances this integration capability by ensuring documents can be exported seamlessly. This ensures you have a smooth experience when managing your tax forms and payments.

-

What features does airSlate SignNow offer for managing the Form IT 205 T Allocation Of Estimated Tax Payments To?

airSlate SignNow provides features like digital signing, document sharing, and tracking for managing the Form IT 205 T Allocation Of Estimated Tax Payments To. These features improve collaboration and legal compliance, as all signatures are securely recorded. The platform also offers templates specific to tax forms which can save time.

-

How secure is airSlate SignNow when using forms like Form IT 205 T Allocation Of Estimated Tax Payments To?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Form IT 205 T Allocation Of Estimated Tax Payments To. We employ advanced encryption and comply with data protection regulations to ensure your information is safe. Thus, you can eSign and store your tax documents with complete peace of mind.

-

Can I access my completed Form IT 205 T Allocation Of Estimated Tax Payments To anytime?

Yes, with airSlate SignNow, you can access your completed Form IT 205 T Allocation Of Estimated Tax Payments To at any time from anywhere. Our cloud-based solution allows you to securely store and retrieve documents whenever needed. This flexibility ensures that you always have access to your important tax documents.

Get more for Form IT 205 T Allocation Of Estimated Tax Payments To

- Family attitude scale pdf form

- Cit 0049 form

- Position description form sample

- Idaho release of interest form

- Certificate of conformity pdf

- M5 cashback claim form

- Lira clinical training manual 2 1 16 pdf form

- Mr 69 04 procuration autorisation relative la communication de renseignements ou rvocation form

Find out other Form IT 205 T Allocation Of Estimated Tax Payments To

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed