Reimbursement of Expenses F3056 English Version October 1 2015

What is the Reimbursement Of Expenses F3056 English Version October 1

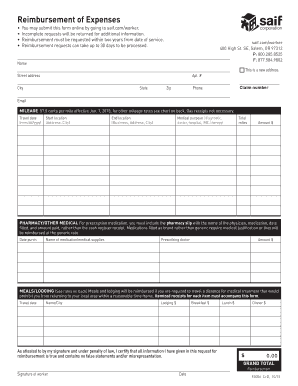

The Reimbursement Of Expenses F3056 English Version October 1 is a specific form used by individuals and businesses to request reimbursement for expenses incurred during the course of their work or business activities. This form is essential for documenting expenses that are eligible for reimbursement, ensuring that all claims are properly recorded and processed. It is commonly utilized in various sectors, including corporate environments, non-profit organizations, and government agencies. The form serves as an official record, helping to maintain transparency and accountability in financial transactions.

How to use the Reimbursement Of Expenses F3056 English Version October 1

Using the Reimbursement Of Expenses F3056 English Version October 1 involves several straightforward steps. First, gather all necessary receipts and documentation related to the expenses you wish to claim. Next, fill out the form with accurate details, including your name, the date of the expenses, and a description of each item. Be sure to include the total amount for reimbursement. After completing the form, submit it to the appropriate department or individual responsible for processing reimbursements within your organization. Keeping a copy of the submitted form and receipts is advisable for your records.

Steps to complete the Reimbursement Of Expenses F3056 English Version October 1

Completing the Reimbursement Of Expenses F3056 English Version October 1 requires careful attention to detail. Follow these steps for successful submission:

- Collect all relevant receipts and documentation for the expenses incurred.

- Fill in your personal information, including your name and contact details.

- List each expense with corresponding dates, descriptions, and amounts.

- Calculate the total reimbursement amount and ensure it matches your receipts.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the designated authority within your organization.

Required Documents

To successfully complete the Reimbursement Of Expenses F3056 English Version October 1, certain documents are required. These typically include:

- Receipts for all expenses being claimed, clearly showing the date and amount.

- A detailed explanation of each expense, including its purpose and relevance to your work.

- Any additional forms or documentation required by your organization’s reimbursement policy.

Eligibility Criteria

Eligibility for reimbursement using the Reimbursement Of Expenses F3056 English Version October 1 generally depends on the nature of the expenses and the policies of the organization. Common eligibility criteria include:

- Expenses must be work-related and necessary for the performance of job duties.

- Receipts must be provided for all claimed expenses.

- Claims must be submitted within a specified time frame set by the organization.

Form Submission Methods

The Reimbursement Of Expenses F3056 English Version October 1 can typically be submitted through various methods, depending on the policies of your organization. Common submission methods include:

- Online submission via a designated portal or email.

- Mailing the completed form and receipts to the appropriate department.

- In-person submission to the finance or human resources department.

Quick guide on how to complete reimbursement of expenses f3056 english version october 1

Effortlessly Prepare Reimbursement Of Expenses F3056 English Version October 1 on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Reimbursement Of Expenses F3056 English Version October 1 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Reimbursement Of Expenses F3056 English Version October 1 with Ease

- Find Reimbursement Of Expenses F3056 English Version October 1 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Reimbursement Of Expenses F3056 English Version October 1 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reimbursement of expenses f3056 english version october 1

Create this form in 5 minutes!

How to create an eSignature for the reimbursement of expenses f3056 english version october 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Reimbursement Of Expenses F3056 English Version October 1?

The Reimbursement Of Expenses F3056 English Version October 1 is a standardized form used for documenting and processing expense reimbursements. This form ensures that all necessary information is captured for efficient processing and compliance with organizational policies.

-

How can airSlate SignNow help with the Reimbursement Of Expenses F3056 English Version October 1?

airSlate SignNow streamlines the process of sending and eSigning the Reimbursement Of Expenses F3056 English Version October 1. Our platform allows users to easily fill out, sign, and send the form electronically, reducing paperwork and speeding up reimbursement times.

-

Is there a cost associated with using airSlate SignNow for the Reimbursement Of Expenses F3056 English Version October 1?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the Reimbursement Of Expenses F3056 English Version October 1 without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the Reimbursement Of Expenses F3056 English Version October 1?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning capabilities for the Reimbursement Of Expenses F3056 English Version October 1. These features enhance efficiency and ensure that all documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for the Reimbursement Of Expenses F3056 English Version October 1?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Reimbursement Of Expenses F3056 English Version October 1 alongside your existing tools. This integration capability enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the Reimbursement Of Expenses F3056 English Version October 1?

Using airSlate SignNow for the Reimbursement Of Expenses F3056 English Version October 1 provides numerous benefits, including faster processing times, reduced errors, and improved compliance. Our platform simplifies the entire reimbursement process, making it easier for both employees and administrators.

-

Is airSlate SignNow secure for handling the Reimbursement Of Expenses F3056 English Version October 1?

Yes, airSlate SignNow prioritizes security and compliance. We utilize advanced encryption and security protocols to ensure that all documents, including the Reimbursement Of Expenses F3056 English Version October 1, are protected from unauthorized access and bsignNowes.

Get more for Reimbursement Of Expenses F3056 English Version October 1

- Buy agreement montana form

- Az quitclaim 1 individual to 2 individuals form

- Gift deed form

- New mexico real estate offer form

- New mexico single member limited liability company llc operating agreement form

- North dakota fiduciary deed for use by executors trustees trustors administrators and other fiduciaries form

- Maryland notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial form

- Health care directives minnesota form

Find out other Reimbursement Of Expenses F3056 English Version October 1

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe