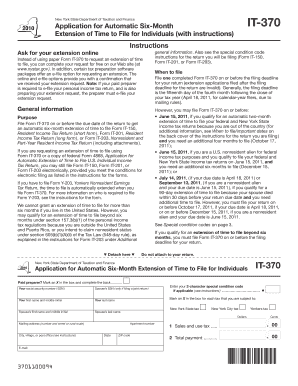

Application for Automatic Six Month Extension of Time to File for Individuals with Instructions Form

What is the Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions

The Application For Automatic Six Month Extension Of Time To File For Individuals is a tax form that allows eligible individuals to request an extension for filing their federal income tax returns. This form is particularly useful for those who may need additional time to gather necessary documentation or complete their tax returns accurately. By submitting this application, individuals can receive an automatic six-month extension, which typically moves the filing deadline from April 15 to October 15. It is important to note that this extension applies only to the filing of the tax return and does not extend the time to pay any taxes owed.

Steps to complete the Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions

Completing the Application For Automatic Six Month Extension Of Time To File For Individuals involves several straightforward steps:

- Obtain the form: You can download the application from the IRS website or request a paper form.

- Fill out personal information: Provide your name, address, and Social Security number as required.

- Estimate your tax liability: If you expect to owe taxes, include an estimate of the amount you plan to pay.

- Sign and date the form: Ensure that you sign the application to validate your request.

- Submit the form: Send the completed application to the appropriate IRS address based on your location.

Eligibility Criteria for the Application For Automatic Six Month Extension Of Time To File For Individuals

To be eligible for the automatic six-month extension, individuals must meet specific criteria. Primarily, the applicant must be a U.S. citizen or resident alien who is required to file a federal income tax return. Additionally, the extension is available to those who file Form 1040, Form 1040-SR, or Form 1040-NR. It is crucial to ensure that the application is submitted by the original due date of the tax return to qualify for the extension. Individuals who are outside the United States on the due date may have different rules regarding eligibility.

Filing Deadlines / Important Dates for the Application For Automatic Six Month Extension Of Time To File For Individuals

Understanding the filing deadlines is essential to avoid penalties. The original due date for most individual tax returns is April 15. If you submit the Application For Automatic Six Month Extension Of Time To File For Individuals by this date, you will receive an extension until October 15. It is important to remember that if October 15 falls on a weekend or holiday, the deadline may shift to the next business day. Additionally, any taxes owed must still be paid by April 15 to avoid interest and penalties.

Required Documents for the Application For Automatic Six Month Extension Of Time To File For Individuals

When completing the Application For Automatic Six Month Extension Of Time To File For Individuals, you may need to gather several key documents:

- Your previous year's tax return for reference.

- Income statements such as W-2s or 1099s to estimate your tax liability.

- Any relevant documentation that supports deductions or credits you plan to claim.

Having these documents ready will facilitate the completion of the application and ensure that you provide accurate information regarding your tax situation.

Form Submission Methods for the Application For Automatic Six Month Extension Of Time To File For Individuals

The Application For Automatic Six Month Extension Of Time To File For Individuals can be submitted through various methods. You can file the application electronically using tax software that supports e-filing, which is often the quickest method. Alternatively, you can mail a paper version of the form to the appropriate IRS address for your state. If you prefer to submit the form in person, you may visit a local IRS office. Regardless of the method chosen, ensure that you keep a copy of the submitted application for your records.

Quick guide on how to complete application for automatic six month extension of time to file for individuals with instructions

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign [SKS] seamlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your adjustments.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions

Create this form in 5 minutes!

How to create an eSignature for the application for automatic six month extension of time to file for individuals with instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions?

The Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions is a form that allows individuals to request an extension for filing their tax returns. This application provides clear guidelines on how to complete the process efficiently, ensuring you meet all necessary requirements.

-

How can airSlate SignNow help with the Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions?

airSlate SignNow simplifies the process of completing and submitting the Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions. Our platform allows you to fill out the form electronically, eSign it, and send it directly to the IRS, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring you can manage your Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions without breaking the bank.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions. You can easily customize these templates, track document status, and ensure compliance with tax regulations.

-

What benefits does airSlate SignNow provide for filing tax extensions?

Using airSlate SignNow for your Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive information is protected while streamlining the filing process.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to manage your Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions alongside your other financial documents. This integration enhances your workflow and ensures all your data is synchronized.

-

Is there customer support available for assistance with the Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding the Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions. Our support team is available via chat, email, or phone to ensure you have the help you need.

Get more for Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions

Find out other Application For Automatic Six Month Extension Of Time To File For Individuals with Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors