Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members Schedule UBINS Form

Understanding the Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members

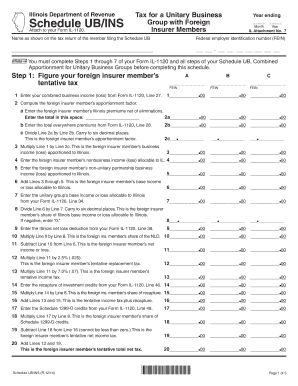

The Schedule UBINS is a tax form specifically designed for unitary business groups that include foreign insurer members. This form is essential for reporting income, deductions, and other tax-related information pertinent to these groups. It allows businesses to comply with state tax regulations while ensuring that all foreign insurer activities are accurately reported. Understanding the nuances of this form is crucial for maintaining compliance and optimizing tax obligations.

How to Use the Schedule UBINS Tax Form

Using the Schedule UBINS involves several steps to ensure accurate completion. First, gather all relevant financial information related to the unitary business group and foreign insurer members. This includes income statements, balance sheets, and any applicable deductions. Next, fill out the form with precise details, ensuring that all entries align with the financial data. Finally, review the completed form for accuracy before submission to avoid potential penalties.

Steps to Complete the Schedule UBINS Tax Form

Completing the Schedule UBINS requires a systematic approach:

- Collect necessary documentation, including financial records for the unitary business group and foreign insurers.

- Begin filling out the form by entering the business group’s identifying information.

- Report income and deductions accurately, ensuring that figures correspond to the collected documentation.

- Provide details about foreign insurer members, including their contributions to the business group.

- Double-check all entries for accuracy and completeness before finalizing the form.

Legal Use of the Schedule UBINS Tax Form

The Schedule UBINS is legally mandated for unitary business groups with foreign insurer members. Proper use of this form ensures compliance with state tax laws and regulations. Failure to file or inaccuracies in reporting can lead to legal repercussions, including fines and audits. Therefore, understanding the legal implications of this form is essential for businesses operating in this sector.

Required Documents for the Schedule UBINS Tax Form

To successfully complete the Schedule UBINS, certain documents are required:

- Financial statements for the unitary business group.

- Tax identification numbers for all foreign insurer members.

- Documentation of income and deductions related to foreign insurance activities.

- Any prior year forms or amendments that may impact the current filing.

Filing Deadlines for the Schedule UBINS Tax Form

Filing deadlines for the Schedule UBINS vary by state but generally align with the annual tax filing deadlines. It is important for businesses to be aware of these dates to ensure timely submission. Late filings may incur penalties or interest charges, affecting the overall tax liability of the unitary business group.

Quick guide on how to complete schedule ubins tax for a unitary business group with foreign insurer members schedule ubins

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary forms and securely preserve them online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents quickly and without delays. Manage [SKS] on any system with airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Alter and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or conceal sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred way to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ubins tax for a unitary business group with foreign insurer members schedule ubins

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members?

The Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members is a tax form used to report the income and tax liabilities of a unitary business group that includes foreign insurers. This form helps ensure compliance with tax regulations while providing a clear overview of the group's financial obligations.

-

How can airSlate SignNow help with the Schedule UBINS process?

airSlate SignNow simplifies the process of preparing and submitting the Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members. Our platform allows users to easily eSign documents, ensuring that all necessary forms are completed accurately and efficiently.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document templates, secure eSigning, and real-time collaboration, which are essential for managing tax documents like the Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members. These tools streamline the workflow and enhance productivity.

-

Is there a cost associated with using airSlate SignNow for Schedule UBINS?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion of the Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, making it easier to manage the Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members. This integration helps streamline your workflow and keeps all your documents organized.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members, offers numerous benefits. These include enhanced security, reduced processing time, and improved accuracy, all of which contribute to a more efficient tax filing process.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents like the Schedule UBINS Tax for a Unitary Business Group with Foreign Insurer Members. You can trust that your information is safe and secure while using our platform.

Get more for Schedule UBINS Tax For A Unitary Business Group With Foreign Insurer Members Schedule UBINS

Find out other Schedule UBINS Tax For A Unitary Business Group With Foreign Insurer Members Schedule UBINS

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement