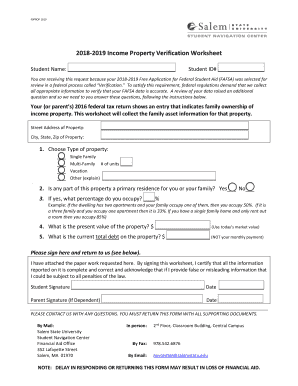

Income Property Verification Worksheet 2018

What is the Income Property Verification Worksheet

The Income Property Verification Worksheet is a crucial document used primarily by lenders and property managers to assess the income generated from rental properties. This worksheet helps in verifying the income reported by property owners and is often required during the mortgage application process or when applying for rental assistance. It typically includes sections for detailing rental income, expenses, and other relevant financial information related to the property.

How to use the Income Property Verification Worksheet

Using the Income Property Verification Worksheet involves several steps to ensure accurate reporting of income and expenses. Begin by gathering all necessary financial documents, such as rental agreements and receipts for expenses. Next, fill out the worksheet by entering the total rental income received, listing all expenses associated with the property, and providing any additional financial information required. Once completed, review the worksheet for accuracy before submitting it to the relevant party, such as a lender or property management company.

Steps to complete the Income Property Verification Worksheet

Completing the Income Property Verification Worksheet can be done in a systematic manner. Follow these steps:

- Gather all relevant documents, including lease agreements and expense receipts.

- Enter the total rental income for the reporting period.

- List all allowable expenses, such as maintenance costs, property taxes, and insurance.

- Provide any additional information requested, such as property management fees.

- Review the worksheet for completeness and accuracy.

- Sign and date the form to certify that the information provided is true.

Key elements of the Income Property Verification Worksheet

Several key elements are essential to include in the Income Property Verification Worksheet. These elements typically consist of:

- Property address and ownership details.

- Total rental income for the specified period.

- Detailed list of expenses related to the property.

- Net income calculation, which is the total income minus total expenses.

- Signature of the property owner or authorized representative.

Legal use of the Income Property Verification Worksheet

The Income Property Verification Worksheet must be used in compliance with applicable laws and regulations. It is important to ensure that the information provided is accurate and truthful, as providing false information can lead to legal consequences. Lenders and property managers may rely on this worksheet to make informed decisions, so maintaining integrity in the reporting process is crucial.

Who Issues the Form

The Income Property Verification Worksheet is typically issued by lenders, property management companies, or other financial institutions that require verification of rental income. It may also be provided by real estate professionals assisting property owners in preparing their financial documentation for loan applications or rental agreements.

Quick guide on how to complete 2018 2019 income property verification worksheet

The simplest method to obtain and sign Income Property Verification Worksheet

Across the entire scope of your business, ineffective procedures concerning paper approvals can utilize a signNow amount of work hours. Signing documents such as Income Property Verification Worksheet is an integral part of operations in any organization, which is why the effectiveness of each agreement’s lifecycle has a profound impact on the company’s overall productivity. With airSlate SignNow, signing your Income Property Verification Worksheet is as straightforward and quick as possible. You will discover with this platform the latest version of almost any form. Even better, you can sign it instantly without the need for third-party software on your computer or printing hard copies.

Steps to obtain and sign your Income Property Verification Worksheet

- Browse our collection by category or use the search box to locate the document you require.

- Examine the form preview by clicking Learn more to ensure it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your form and provide any necessary information using the toolbar.

- Once finished, click the Sign tool to sign your Income Property Verification Worksheet.

- Choose the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as necessary.

With airSlate SignNow, you have everything required to handle your documents effectively. You can find, fill out, modify, and even send your Income Property Verification Worksheet in a single tab without any complications. Enhance your procedures by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct 2018 2019 income property verification worksheet

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

Create this form in 5 minutes!

How to create an eSignature for the 2018 2019 income property verification worksheet

How to generate an eSignature for the 2018 2019 Income Property Verification Worksheet online

How to generate an eSignature for the 2018 2019 Income Property Verification Worksheet in Chrome

How to create an eSignature for signing the 2018 2019 Income Property Verification Worksheet in Gmail

How to generate an electronic signature for the 2018 2019 Income Property Verification Worksheet straight from your smart phone

How to generate an eSignature for the 2018 2019 Income Property Verification Worksheet on iOS devices

How to generate an eSignature for the 2018 2019 Income Property Verification Worksheet on Android OS

People also ask

-

What is the Income Property Verification Worksheet?

The Income Property Verification Worksheet is a crucial document designed to verify the rental income generated by investment properties. It helps real estate investors, lenders, and property managers document financial information accurately, ensuring that all data is presented clearly for financial assessments.

-

How can airSlate SignNow help with the Income Property Verification Worksheet?

airSlate SignNow provides an easy-to-use platform for sending, signing, and managing documents, including the Income Property Verification Worksheet. With our solution, you can streamline the process, reduce paperwork clutter, and ensure that your documents are securely stored and accessible anytime.

-

Is the Income Property Verification Worksheet customizable?

Yes, the Income Property Verification Worksheet can be customized within the airSlate SignNow platform. Users can modify fields, add company branding, and adjust formats to meet specific needs, ensuring it aligns perfectly with their business requirements.

-

What are the benefits of using airSlate SignNow for the Income Property Verification Worksheet?

Using airSlate SignNow for the Income Property Verification Worksheet offers multiple benefits, including enhanced efficiency, legally binding electronic signatures, and improved document tracking. This allows users to manage their verification process smoothly and effectively.

-

Are there any integrations for the Income Property Verification Worksheet with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing the workflow for users handling the Income Property Verification Worksheet. Whether you're using CRM systems, cloud storage solutions, or other business tools, integrations boost productivity and streamline document management.

-

What is the pricing model for using airSlate SignNow with the Income Property Verification Worksheet?

The pricing model for airSlate SignNow varies depending on the plan selected, offering cost-effective solutions for businesses of all sizes. Each plan includes features such as unlimited document sending and signing, making it a valuable investment for processing the Income Property Verification Worksheet efficiently.

-

Can I track the status of the Income Property Verification Worksheet with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their Income Property Verification Worksheet in real time. You will receive notifications when the document is viewed, signed, or completed, giving you full visibility throughout the signing process.

Get more for Income Property Verification Worksheet

- R38 form

- Dma 5032 ia pdf presumptive eligibility determination form for pregnancy related care info dhhs state nc

- District 75 form

- Vasopressor stewardship a case report and lessons bb ismp canada form

- Swis office discipline referral form ocde

- Customer information update form convmay2014 hsbc malaysia hsbc com

- Reporting like kind exchanges to the irs via form 8824

- Cant open a pdf requiring adobe reader 8 rtechsupport form

Find out other Income Property Verification Worksheet

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy