Reporting Like Kind Exchanges to the IRS Via Form 8824 2023

What is Form 8824 for Reporting Like Kind Exchanges?

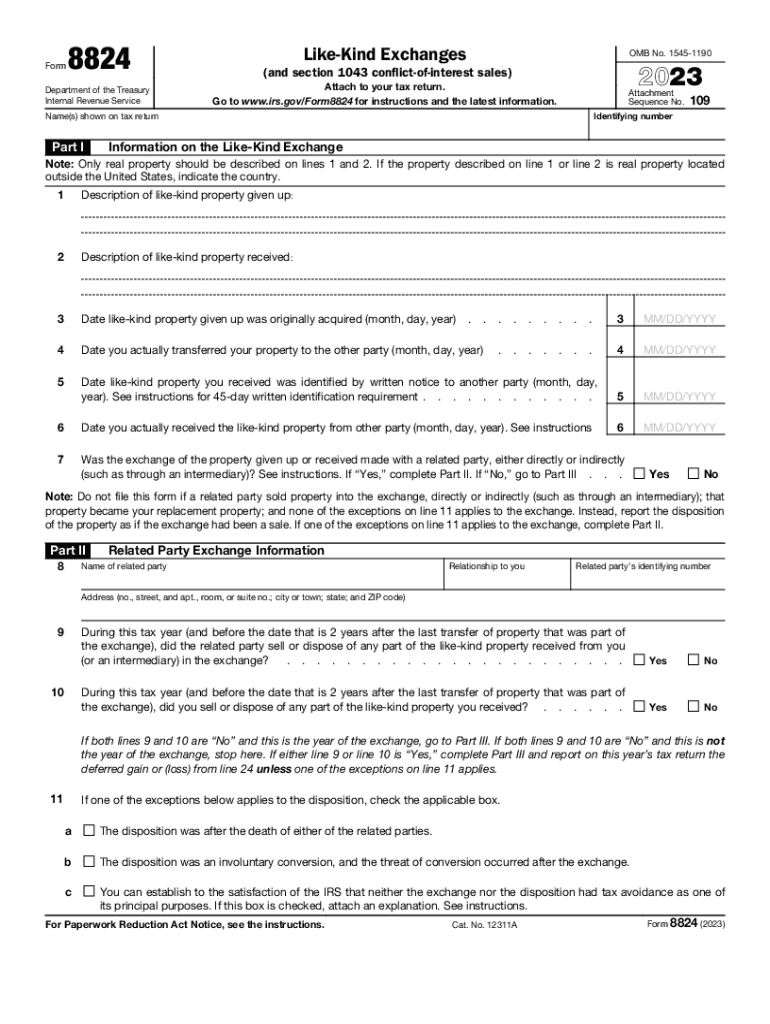

Form 8824 is a tax form used by U.S. taxpayers to report like-kind exchanges of real property. This form is essential for individuals and businesses that have engaged in transactions involving the exchange of similar types of property, allowing them to defer capital gains taxes. The IRS requires the completion of this form to ensure compliance with tax regulations regarding property exchanges. Understanding the purpose of Form 8824 is crucial for anyone involved in real estate transactions that qualify as like-kind exchanges.

Steps to Complete Form 8824

Completing Form 8824 involves several key steps to accurately report a like-kind exchange. First, gather all necessary information about the properties involved, including their fair market values and the dates of acquisition and exchange. Next, fill out the form by providing details about the relinquished and acquired properties. Ensure that you calculate any realized gain or loss correctly, as this will affect your tax obligations. Finally, review the form for accuracy before submitting it with your tax return.

Key Elements of Form 8824

Form 8824 consists of several important sections that taxpayers must complete. These include:

- Part I: Information about the relinquished property and the acquired property.

- Part II: Details regarding the exchange, including the dates and values of the properties.

- Part III: Calculation of any gain or loss realized from the exchange.

- Part IV: Information on any boot received, which may be subject to taxation.

Each part of the form is designed to capture specific information necessary for the IRS to assess the tax implications of the exchange.

IRS Guidelines for Form 8824

The IRS provides specific guidelines for completing Form 8824, which include instructions on what qualifies as a like-kind exchange, the types of properties that can be exchanged, and the timeline for reporting the exchange. Taxpayers should refer to the official IRS instructions for Form 8824 to ensure compliance with all requirements. Following these guidelines helps avoid potential issues with the IRS and ensures proper reporting of the exchange.

Filing Deadlines for Form 8824

Form 8824 must be filed along with your annual tax return, typically due by April fifteenth for most taxpayers. If you require additional time, you may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these deadlines is essential for ensuring compliance with tax obligations related to like-kind exchanges.

Examples of Using Form 8824

Consider a scenario where a taxpayer exchanges a rental property for another rental property of equal value. In this case, the taxpayer would complete Form 8824 to report the exchange, ensuring that any capital gains tax is deferred. Another example could involve a business exchanging commercial real estate for a different commercial property. In both scenarios, Form 8824 serves as a critical tool for accurately reporting the exchange and maintaining compliance with IRS regulations.

Quick guide on how to complete reporting like kind exchanges to the irs via form 8824

Effortlessly Prepare Reporting Like Kind Exchanges To The IRS Via Form 8824 on Any Device

Digital document management has gained traction among companies and individuals. It offers an optimal eco-friendly alternative to traditional printed and signed documents, enabling you to access the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly and without delays. Manage Reporting Like Kind Exchanges To The IRS Via Form 8824 on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The easiest method to modify and eSign Reporting Like Kind Exchanges To The IRS Via Form 8824 effortlessly

- Find Reporting Like Kind Exchanges To The IRS Via Form 8824 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Reporting Like Kind Exchanges To The IRS Via Form 8824 and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reporting like kind exchanges to the irs via form 8824

Create this form in 5 minutes!

How to create an eSignature for the reporting like kind exchanges to the irs via form 8824

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 8824 form and how does airSlate SignNow support it?

The 2018 8824 form is used to report like-kind exchanges of real estate for tax purposes. airSlate SignNow simplifies the process by allowing you to eSign and send the 2018 8824 form securely and efficiently, ensuring compliance and accuracy.

-

How much does it cost to use airSlate SignNow for the 2018 8824 form?

airSlate SignNow offers various pricing plans to fit your business needs. Whether you need a simple solution for the 2018 8824 form or extensive document management features, we have a plan that is cost-effective and competitive.

-

What features does airSlate SignNow offer for processing the 2018 8824 form?

airSlate SignNow provides robust features such as eSigning, document tracking, and templates specifically designed for the 2018 8824 form. These features enhance productivity and ensure that your forms are signed and returned promptly.

-

Are there any benefits to using airSlate SignNow for the 2018 8824 form?

Using airSlate SignNow for the 2018 8824 form offers several benefits including faster turnaround times, increased security, and simplified compliance. Our platform streamlines the process, making it easier for users to manage their tax-related documentation.

-

Can I integrate airSlate SignNow with other software for the 2018 8824 form?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM and accounting systems, allowing for efficient management of the 2018 8824 form. This integration ensures that your workflow remains uninterrupted and organized.

-

Is it easy to send the 2018 8824 form using airSlate SignNow?

Absolutely! Sending the 2018 8824 form through airSlate SignNow is straightforward. Our user-friendly interface enables you to upload, customize, and send your documents quickly and intuitively.

-

What types of users benefit from using airSlate SignNow for the 2018 8824 form?

Both businesses and individual users benefit from using airSlate SignNow for the 2018 8824 form. Whether you are a real estate professional or filing your taxes, our platform offers powerful tools to manage and submit your forms effectively.

Get more for Reporting Like Kind Exchanges To The IRS Via Form 8824

- City of laguna niguel plumbing contract services request for proposal form

- Section 1 of the bylaws form

- Ii i ii national center for state courts form

- Electrical home improvement contract form

- Lien and bond claim manual ahlers cressman ampamp sleight pllc form

- Attorney for or quotin pro perquot form

- Plaintiffs names form

- L his is1ifuampampfn fec form

Find out other Reporting Like Kind Exchanges To The IRS Via Form 8824

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now