Form M11A, Fire Insurance Tax Minnesota Department of Revenue State Mn

What is the Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn

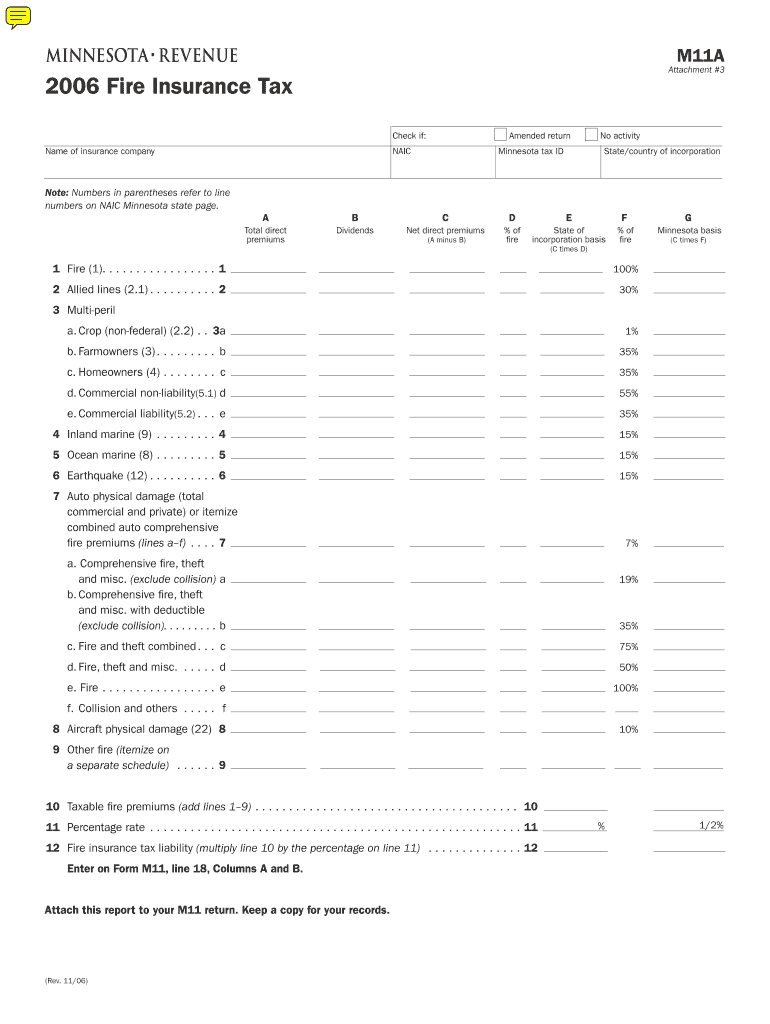

The Form M11A is a tax form used in Minnesota for reporting fire insurance premiums. This form is specifically designed for insurance companies that collect fire insurance premiums and are required to remit a portion of these premiums to the state. The Minnesota Department of Revenue oversees the collection of this tax, which is essential for funding various state programs and services. Understanding the purpose and requirements of this form is crucial for compliance and accurate reporting.

How to use the Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn

Using the Form M11A involves several steps to ensure accurate completion and submission. First, insurance companies must gather all relevant information regarding the fire insurance premiums collected during the reporting period. This includes details about the policyholders and the total premiums received. Next, the form requires specific calculations to determine the amount of tax owed based on the premiums. Once completed, the form must be submitted to the Minnesota Department of Revenue by the specified deadline to avoid penalties.

Steps to complete the Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn

Completing the Form M11A involves the following steps:

- Gather necessary documentation related to fire insurance premiums.

- Fill in the insurer's information, including name, address, and tax identification number.

- Report the total fire insurance premiums collected during the reporting period.

- Calculate the tax amount based on the applicable tax rate.

- Review the form for accuracy before submission.

- Submit the completed form to the Minnesota Department of Revenue by the deadline.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form M11A. Typically, the form must be filed annually, with specific due dates set by the Minnesota Department of Revenue. Missing these deadlines can result in penalties and interest on the unpaid tax amount. Keeping a calendar of important dates can help ensure timely filing and compliance with state regulations.

Penalties for Non-Compliance

Failure to file the Form M11A on time can lead to significant penalties. The Minnesota Department of Revenue imposes fines for late submissions, which can increase over time. Additionally, interest may accrue on any unpaid tax amounts. It is essential for insurance companies to adhere to the filing requirements to avoid these financial repercussions and maintain good standing with state authorities.

Legal use of the Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn

The Form M11A serves a legal purpose in the context of tax compliance for fire insurance premiums. Insurance companies are mandated by state law to report and remit taxes on the premiums they collect. Proper use of this form ensures that companies fulfill their legal obligations, contributing to state revenue and supporting public services. Understanding the legal implications of this form is vital for insurance providers operating in Minnesota.

Quick guide on how to complete form m11a fire insurance tax minnesota department of revenue state mn

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-conscious substitute to conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly and efficiently. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign [SKS] without effort

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for these tasks.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m11a fire insurance tax minnesota department of revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn?

Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn, is a tax form used by insurance companies to report fire insurance premiums collected in Minnesota. This form is essential for compliance with state tax regulations and ensures that companies fulfill their tax obligations accurately.

-

How can airSlate SignNow help with Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn. Our solution simplifies the document management process, ensuring that your forms are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can efficiently manage Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn.

-

What features does airSlate SignNow offer for managing Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn. These tools streamline the process, making it easier to manage your tax forms and maintain compliance.

-

Are there any benefits to using airSlate SignNow for Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn?

Using airSlate SignNow for Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution helps you save time and resources while ensuring your documents are handled securely.

-

Can airSlate SignNow integrate with other software for Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to manage Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn alongside your existing tools. This integration enhances your workflow and ensures that all your documents are easily accessible.

-

Is airSlate SignNow user-friendly for completing Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effortlessly.

Get more for Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn

Find out other Form M11A, Fire Insurance Tax Minnesota Department Of Revenue State Mn

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy