Irs Form 5500 Ez 2015

What is the IRS Form 5500 EZ

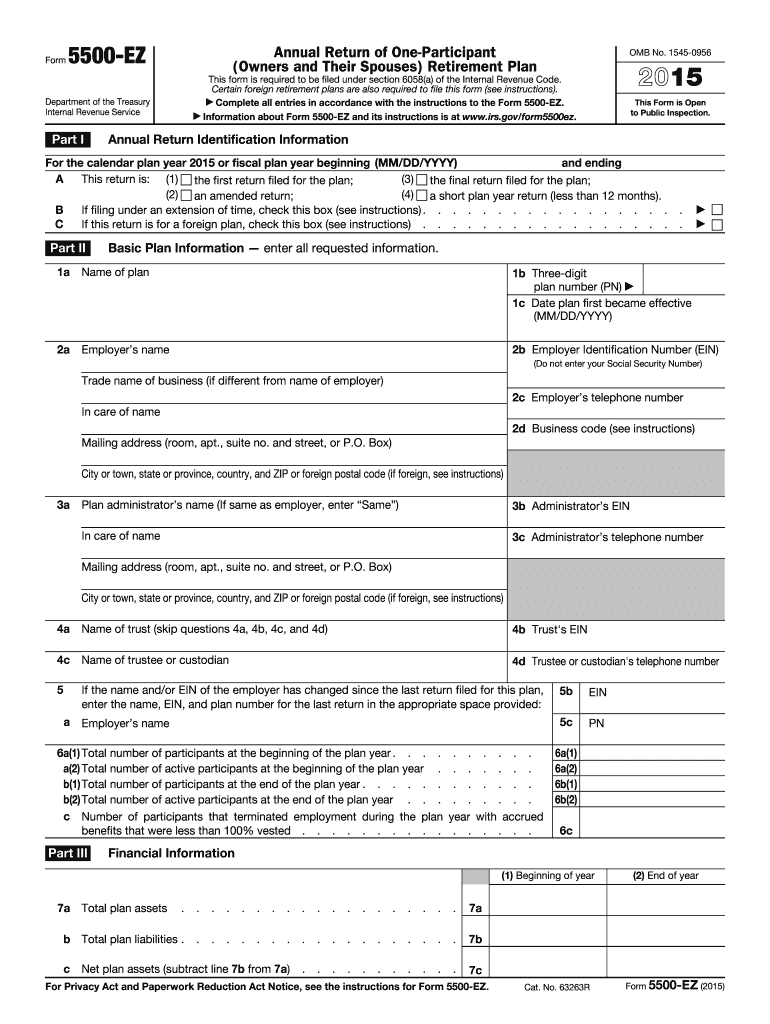

The IRS Form 5500 EZ is a simplified version of the Form 5500, designed specifically for one-participant retirement plans. This form is used to report information about the plan's financial condition, investments, and operations. It is primarily utilized by small businesses and self-employed individuals who maintain a retirement plan without any employees, excluding the owner and their spouse. The form helps ensure compliance with the Employee Retirement Income Security Act (ERISA) and provides essential data to the IRS and the Department of Labor.

How to use the IRS Form 5500 EZ

Using the IRS Form 5500 EZ involves several steps to ensure accurate completion and submission. First, gather all necessary financial information regarding the retirement plan, including assets, liabilities, and any contributions made during the year. Next, fill out the form with the required details, such as the plan's name, the plan sponsor's information, and the plan year. After completing the form, review it for accuracy and ensure that all required signatures are in place before submitting it to the IRS. The form can be filed electronically or by mail, depending on your preference.

Steps to complete the IRS Form 5500 EZ

Completing the IRS Form 5500 EZ involves a systematic approach:

- Gather financial documents related to the retirement plan, including bank statements and contribution records.

- Provide the plan's basic information, such as the name, type, and sponsor details.

- Report the plan's financial information, including total assets and liabilities.

- Include details about contributions made during the plan year.

- Review the form for any errors or missing information.

- Sign and date the form before submission.

Legal use of the IRS Form 5500 EZ

The IRS Form 5500 EZ is legally binding when completed accurately and submitted on time. It must comply with the regulations set forth by ERISA and the IRS. Failure to file the form can result in penalties, including fines and potential legal issues. It is crucial to ensure that all information provided is truthful and complete, as inaccuracies can lead to audits or other legal consequences.

Filing Deadlines / Important Dates

The filing deadline for the IRS Form 5500 EZ is typically the last day of the seventh month after the end of the plan year. For plans that operate on a calendar year, this means the form is due by July 31 of the following year. If additional time is needed, an extension can be requested, but it is essential to file the extension before the original deadline to avoid penalties.

Form Submission Methods

The IRS Form 5500 EZ can be submitted in two primary ways: electronically or by mail. Electronic filing is encouraged as it is more efficient and allows for quicker processing. To file electronically, you can use the IRS's EFAST2 system. Alternatively, if you prefer to submit by mail, ensure that the form is sent to the appropriate address specified by the IRS, and consider using certified mail for tracking purposes.

Quick guide on how to complete irs form 5500 ez 2015

Complete Irs Form 5500 Ez effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Irs Form 5500 Ez on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Irs Form 5500 Ez effortlessly

- Locate Irs Form 5500 Ez and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and select the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Form 5500 Ez and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 5500 ez 2015

Create this form in 5 minutes!

How to create an eSignature for the irs form 5500 ez 2015

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is IRS Form 5500 EZ?

IRS Form 5500 EZ is a streamlined version of the IRS Form 5500, designed for use by single-employer retirement plans. This form allows companies to report annual information about their retirement plans to the federal government, ensuring compliance and transparency. Utilizing airSlate SignNow can simplify the eSigning process for such forms.

-

How can airSlate SignNow help with IRS Form 5500 EZ?

AirSlate SignNow provides an efficient platform for businesses to electronically sign and send IRS Form 5500 EZ. This service ensures that all documents are securely signed and stored, making it easier to manage compliance-related paperwork. With a user-friendly interface, airSlate SignNow streamlines the preparation and submission process.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5500 EZ?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs. The cost of using airSlate SignNow for IRS Form 5500 EZ is dependent on the features required, such as document storage and team collaboration options. However, the solution is generally more cost-effective compared to traditional signing methods.

-

What features does airSlate SignNow offer for IRS Form 5500 EZ?

AirSlate SignNow offers features tailored for IRS Form 5500 EZ, including easy document upload, customizable templates, and real-time status tracking. Additionally, you can integrate it with other applications, allowing for seamless workflows. The built-in compliance features help ensure that your submissions meet IRS standards.

-

Can I use airSlate SignNow for multiple IRS forms, including Form 5500 EZ?

Absolutely! AirSlate SignNow is versatile enough to handle various IRS forms beyond Form 5500 EZ. This flexibility allows businesses to manage different compliance documents in one place, enhancing efficiency and reducing the risk of errors. Plus, all forms can benefit from the same secure eSigning features.

-

Are there integration options available with airSlate SignNow for IRS Form 5500 EZ?

Yes, airSlate SignNow offers seamless integration with numerous applications, including CRM systems, cloud storage services, and financial software. These integrations can enhance your workflow when preparing IRS Form 5500 EZ and other related documents. This connectivity makes it easier to streamline your document management processes.

-

How secure is airSlate SignNow when handling IRS Form 5500 EZ?

AirSlate SignNow prioritizes security and compliance, employing encryption and authentication measures to protect sensitive information related to IRS Form 5500 EZ. The platform meets stringent security standards, ensuring that your documents are safe from unauthorized access. This is essential for maintaining the integrity of your compliance submissions.

Get more for Irs Form 5500 Ez

Find out other Irs Form 5500 Ez

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile