8812 Schedule Form 2012

What is the 8812 Schedule Form

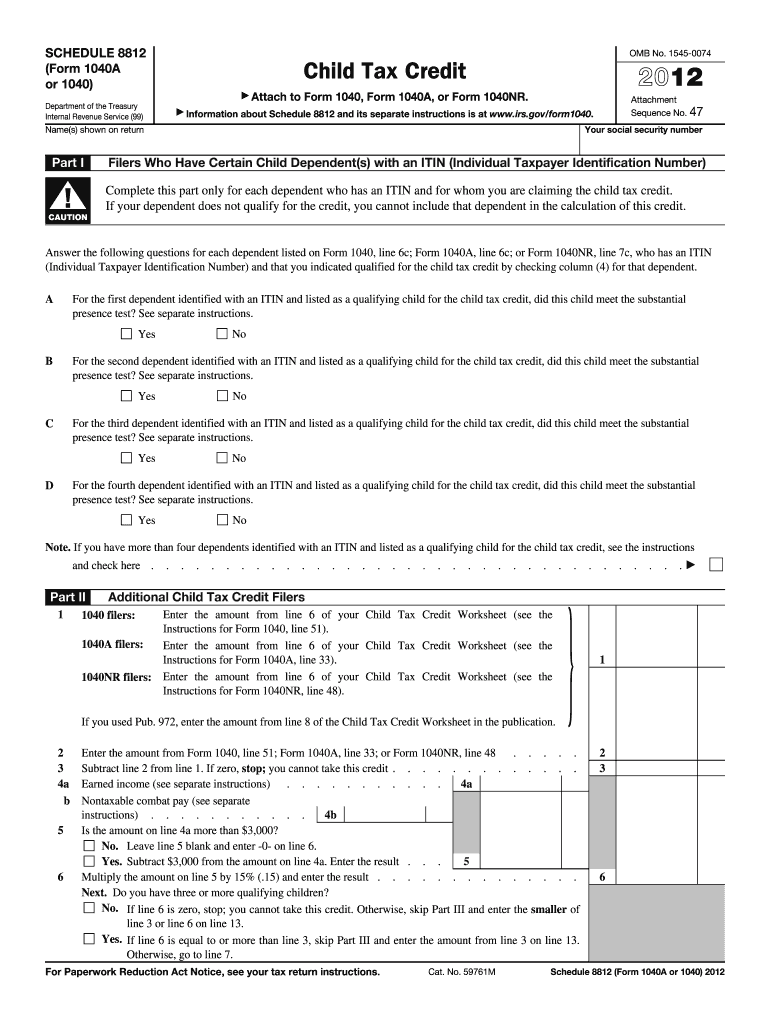

The 8812 Schedule Form, officially known as the Additional Child Tax Credit, is a tax form used by eligible taxpayers to claim a refundable credit for qualifying children. This form is particularly relevant for individuals who may not have received the full amount of the Child Tax Credit through their tax returns. The 8812 Schedule Form allows taxpayers to calculate and claim any additional credit they may be entitled to, providing essential financial support for families with dependents.

How to use the 8812 Schedule Form

Using the 8812 Schedule Form involves several steps to ensure accurate completion and submission. Taxpayers should first gather necessary information, including Social Security numbers for all qualifying children and income details. After obtaining the form, individuals can fill it out by following the instructions provided by the IRS. It is crucial to double-check calculations to avoid errors that could delay processing. Once completed, the form can be submitted along with the main tax return, either electronically or by mail.

Steps to complete the 8812 Schedule Form

Completing the 8812 Schedule Form requires careful attention to detail. Here are the essential steps:

- Gather required documentation, including your tax return and information on qualifying children.

- Download the 8812 Schedule Form from the IRS website or obtain it through tax preparation software.

- Fill out the form, ensuring all necessary fields are completed accurately.

- Calculate the additional child tax credit based on the provided guidelines.

- Review the form for any errors or omissions before submission.

- Submit the form with your tax return, either electronically or via mail.

Legal use of the 8812 Schedule Form

The 8812 Schedule Form is legally recognized as a valid document for claiming tax credits. To ensure its legal use, taxpayers must adhere to IRS guidelines and provide accurate information. The form must be submitted within the designated tax filing period to avoid penalties. Additionally, maintaining proper records of all documentation related to the form is essential for compliance and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the 8812 Schedule Form align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of each year. If taxpayers require more time, they may file for an extension, which grants an additional six months. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties. Staying aware of these dates is crucial for ensuring timely submission of the form.

Eligibility Criteria

To qualify for the Additional Child Tax Credit via the 8812 Schedule Form, taxpayers must meet specific eligibility criteria. Primarily, the taxpayer must have qualifying children under the age of 17 at the end of the tax year. Additionally, the taxpayer's income must fall within certain limits established by the IRS. These criteria ensure that the credit is directed toward families who need it most, providing financial relief to those raising children.

Quick guide on how to complete 8812 2012 schedule form

Prepare 8812 Schedule Form effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct format and securely preserve it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly and efficiently. Manage 8812 Schedule Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign 8812 Schedule Form without hassle

- Find 8812 Schedule Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your choice. Edit and eSign 8812 Schedule Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8812 2012 schedule form

Create this form in 5 minutes!

How to create an eSignature for the 8812 2012 schedule form

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 8812 Schedule Form and how can airSlate SignNow help?

The 8812 Schedule Form is used to calculate the Additional Child Tax Credit. With airSlate SignNow, you can easily fill out, sign, and send your 8812 Schedule Form electronically, ensuring a smooth and efficient filing process.

-

How much does it cost to use airSlate SignNow for the 8812 Schedule Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need to manage the 8812 Schedule Form or other documents, our affordable plans provide value without compromising on features.

-

Can I integrate airSlate SignNow with other software for managing the 8812 Schedule Form?

Yes, airSlate SignNow seamlessly integrates with various applications, enabling you to streamline your workflow when handling the 8812 Schedule Form. Popular integrations include Google Drive, Dropbox, and CRM software, enhancing your document management experience.

-

What features does airSlate SignNow offer for filling out the 8812 Schedule Form?

airSlate SignNow provides user-friendly features like templates, customizable fields, and electronic signatures specifically designed to simplify the completion of the 8812 Schedule Form. These tools help ensure accuracy and compliance.

-

Is airSlate SignNow secure for submitting my 8812 Schedule Form?

Absolutely! airSlate SignNow prioritizes your security with advanced encryption and authentication measures. You can confidently submit your 8812 Schedule Form knowing that your sensitive information is protected.

-

Can I access the 8812 Schedule Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage your 8812 Schedule Form on the go. This flexibility ensures you can complete your tasks anytime, anywhere.

-

What are the benefits of using airSlate SignNow for the 8812 Schedule Form compared to traditional methods?

Using airSlate SignNow for your 8812 Schedule Form eliminates the hassle of printing, scanning, and mailing documents. This digital solution saves time, reduces errors, and improves efficiency, making tax filing a breeze.

Get more for 8812 Schedule Form

Find out other 8812 Schedule Form

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template