990ez Form 2015

What is the 990ez Form

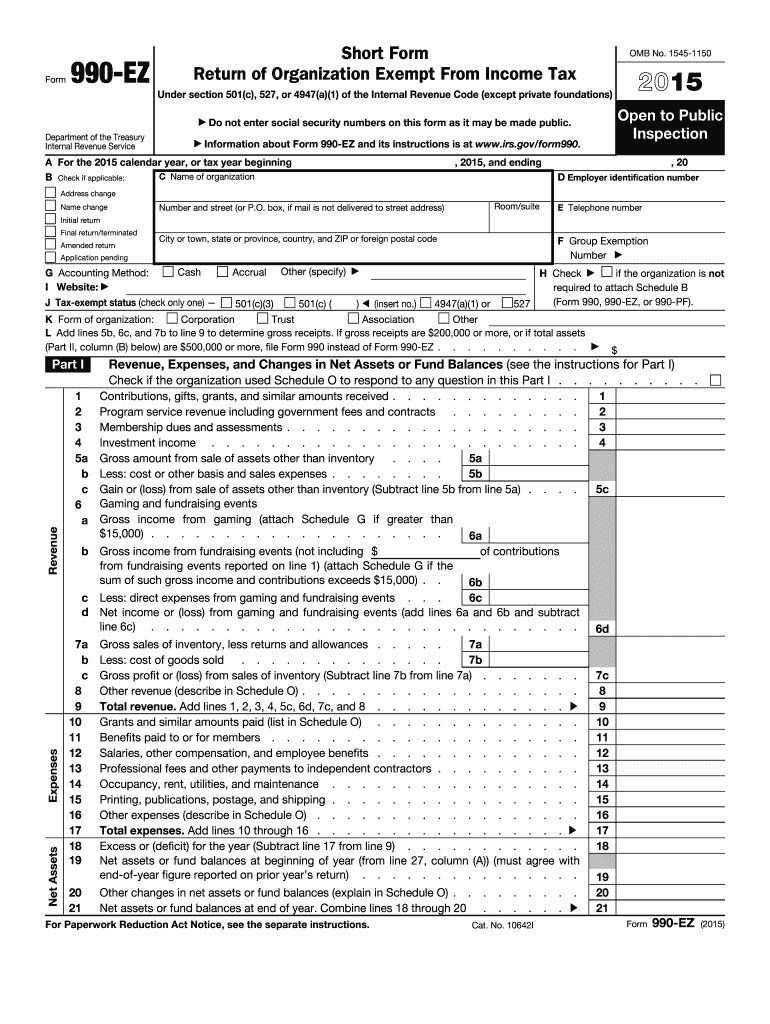

The 990ez Form is a simplified version of the IRS Form 990, designed for smaller tax-exempt organizations. It is used to provide the IRS with information about the organization’s activities, governance, and financial status. This form is particularly beneficial for organizations with gross receipts under two hundred fifty thousand dollars and total assets under five hundred thousand dollars. By using the 990ez Form, eligible organizations can fulfill their annual reporting requirements in a more straightforward manner.

How to obtain the 990ez Form

To obtain the 990ez Form, organizations can visit the IRS website, where the form is available for download in PDF format. It is also possible to request a paper copy by contacting the IRS directly. Additionally, many tax preparation software programs include the 990ez Form, allowing organizations to complete and file it electronically. Ensuring you have the correct version for the tax year is crucial, as forms may be updated annually.

Steps to complete the 990ez Form

Completing the 990ez Form involves several key steps:

- Gather necessary information: Collect financial statements, details about the organization’s mission, and information regarding board members.

- Fill out the form: Enter the required information in the designated sections. This includes revenue, expenses, and net assets.

- Review for accuracy: Double-check all entries to ensure compliance with IRS guidelines and accuracy of reported figures.

- Sign and date the form: Ensure that an authorized individual signs the form before submission.

- Submit the form: File the completed form electronically or via mail, adhering to the specified deadlines.

Legal use of the 990ez Form

The 990ez Form is legally binding when completed accurately and submitted in accordance with IRS regulations. Organizations must ensure that all information is truthful and complete to avoid penalties. The form serves as a public document, allowing transparency regarding the organization’s operations and finances. Compliance with legal requirements is essential to maintain tax-exempt status and avoid potential audits.

Filing Deadlines / Important Dates

Organizations must be aware of specific deadlines for filing the 990ez Form. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically falls on May fifteenth. Extensions may be available, but organizations must file Form 8868 to request additional time. It is crucial to adhere to these deadlines to avoid penalties and maintain good standing with the IRS.

Penalties for Non-Compliance

Failure to file the 990ez Form on time or submitting inaccurate information can result in significant penalties. The IRS may impose fines based on the organization’s gross receipts, with penalties increasing for repeated failures to comply. Additionally, non-compliance can jeopardize an organization’s tax-exempt status, leading to further financial and legal repercussions. Organizations are encouraged to prioritize timely and accurate filing to avoid these risks.

Quick guide on how to complete 2015 990ez form

Complete 990ez Form effortlessly on any device

Online document handling has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage 990ez Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign 990ez Form seamlessly

- Locate 990ez Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require reprinting documents. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign 990ez Form while ensuring effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 990ez form

Create this form in 5 minutes!

How to create an eSignature for the 2015 990ez form

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 990ez Form and who needs it?

The 990ez Form is a simplified version of the IRS Form 990, designed for tax-exempt organizations with less complex financial situations. Nonprofits with gross receipts under $200,000 and total assets under $500,000 typically need to file this form. Understanding how to properly fill out the 990ez Form is essential for compliance and maintaining tax-exempt status.

-

How does airSlate SignNow simplify the signing process for the 990ez Form?

airSlate SignNow streamlines the signing process for the 990ez Form by allowing users to send, sign, and store documents securely online. With its user-friendly interface, organizations can easily gather electronic signatures from board members or stakeholders, ensuring a fast and efficient filing process. This eliminates the hassle of paper documents and speeds up compliance.

-

What are the pricing plans for using airSlate SignNow to manage the 990ez Form?

airSlate SignNow offers various pricing plans to cater to different organizational needs, making it cost-effective for nonprofits handling the 990ez Form. Plans start with a free trial that allows users to explore features, followed by affordable monthly subscriptions that provide full access to document management and eSignature capabilities. This flexibility ensures that even small organizations can afford to stay compliant.

-

Can I integrate airSlate SignNow with other software for 990ez Form management?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing your 990ez Form management process. Whether you use CRM systems, cloud storage solutions, or accounting software, these integrations allow for a more streamlined workflow. This means you can manage documents and signatures without switching between multiple platforms.

-

What security features does airSlate SignNow offer for the 990ez Form?

airSlate SignNow prioritizes security with features such as end-to-end encryption, secure cloud storage, and customizable access controls. These measures ensure that sensitive information related to the 990ez Form is protected from unauthorized access. Compliance with industry standards provides peace of mind for organizations managing important financial documents.

-

Is airSlate SignNow mobile-friendly for signing the 990ez Form?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing users to sign the 990ez Form from any device, anywhere. This flexibility is crucial for busy nonprofit leaders who may need to review and sign documents on the go. The mobile app ensures that you can keep your filing process efficient and timely.

-

What support does airSlate SignNow provide for users filing the 990ez Form?

airSlate SignNow offers comprehensive support for users dealing with the 990ez Form, including tutorials, FAQs, and a dedicated customer support team. Whether you need help with document preparation or technical issues, their resources are designed to assist you effectively. This support ensures that you can navigate the signing and filing process without difficulties.

Get more for 990ez Form

- Credit facility application form

- Sole and joint account opening pack abn amro private banking abnamroprivatebanking form

- Fixed deposit requisition form community first co

- Bank application form pdf

- Mortgage loan origination agreement 250722351 form

- Verbal voe form

- Sagestream form

- Notification suspected form

Find out other 990ez Form

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim