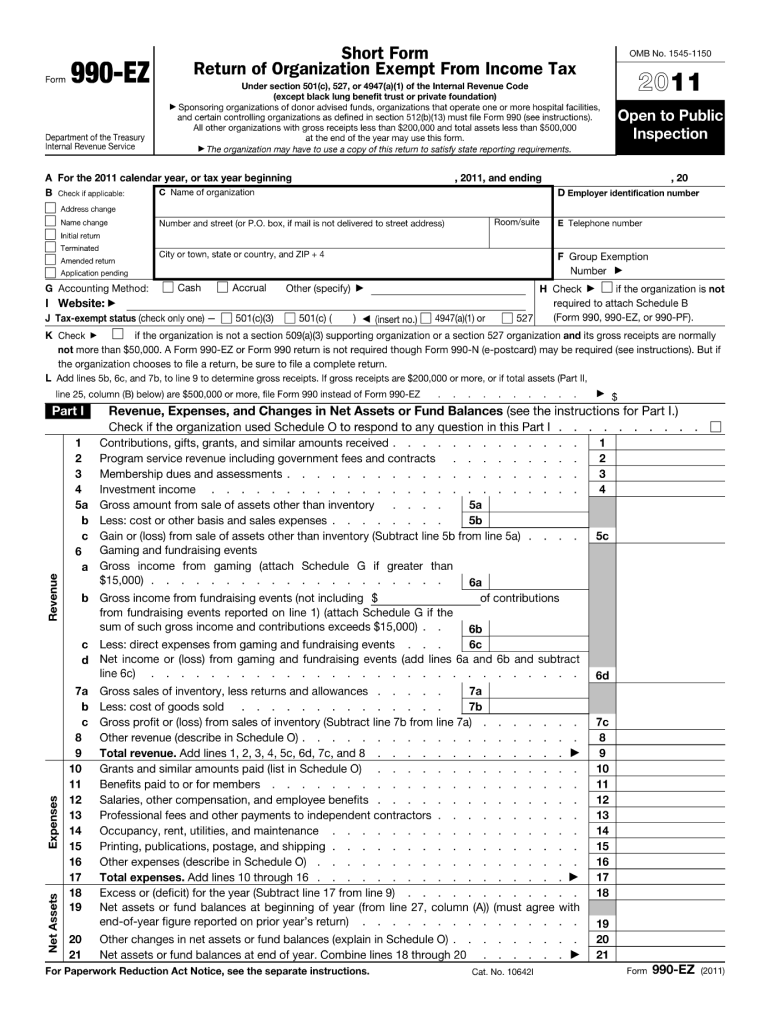

Irs Form 990 Ez 2011

What is the IRS Form 990 EZ

The IRS Form 990 EZ is a simplified version of the standard Form 990, designed for small tax-exempt organizations, including charities and non-profits, with gross receipts under two hundred fifty thousand dollars and total assets under five hundred thousand dollars. This form allows these organizations to report their financial information to the IRS, ensuring compliance with federal regulations. By using Form 990 EZ, organizations can provide essential details about their mission, programs, and financial activities without the complexity of the full Form 990.

How to use the IRS Form 990 EZ

Using the IRS Form 990 EZ involves several steps to ensure accurate reporting. Organizations must first gather necessary financial records, including income statements, balance sheets, and details of any program services. After collecting this information, organizations can complete the form by filling out sections related to their mission, programs, and financial data. It is essential to ensure that all provided information is accurate and complete, as this form serves as a public document and is available for public inspection.

Steps to complete the IRS Form 990 EZ

Completing the IRS Form 990 EZ requires careful attention to detail. Here are the steps involved:

- Gather financial records: Collect all relevant financial documents, including income statements and balance sheets.

- Fill out the form: Begin with the organization’s basic information, followed by financial data, including revenue, expenses, and net assets.

- Detail program services: Describe the organization’s primary activities and how they align with its mission.

- Review and verify: Double-check all entries for accuracy to avoid potential issues with the IRS.

- Sign and date: Ensure that the form is signed by an authorized individual within the organization.

Legal use of the IRS Form 990 EZ

The IRS Form 990 EZ is a legally mandated document for eligible tax-exempt organizations. It must be filed annually with the IRS to maintain tax-exempt status. Failure to file this form can result in penalties, including the loss of tax-exempt status. Organizations should also be aware that the information contained in the form is public and can be accessed by donors, grant-making institutions, and the general public. Therefore, accuracy and transparency in reporting are crucial.

Filing Deadlines / Important Dates

The filing deadline for the IRS Form 990 EZ is typically the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this means the form is due by May fifteenth. If the deadline falls on a weekend or holiday, organizations may file on the next business day. Organizations can apply for a six-month extension by submitting Form 8868, but this extension only applies to the filing deadline, not the payment of any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 990 EZ can be submitted through various methods. Organizations have the option to file electronically using the IRS e-file system, which is often the fastest and most efficient method. Alternatively, organizations may choose to mail a paper copy of the form to the appropriate IRS address, based on their location. In-person submission is generally not available for this form, as the IRS encourages electronic filing to streamline the process and reduce processing times.

Quick guide on how to complete 2011 irs form 990 ez

Prepare Irs Form 990 Ez effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly and without holdups. Manage Irs Form 990 Ez on any device using airSlate SignNow's Android or iOS applications and streamline your document-related process today.

The easiest method to edit and eSign Irs Form 990 Ez effortlessly

- Locate Irs Form 990 Ez and then click Obtain Form to initiate.

- Utilize the resources we provide to finalize your document.

- Emphasize signNow sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Complete button to preserve your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you choose. Modify and eSign Irs Form 990 Ez and guarantee exceptional communication throughout the entirety of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 irs form 990 ez

Create this form in 5 minutes!

How to create an eSignature for the 2011 irs form 990 ez

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is IRS Form 990 EZ and who needs to file it?

IRS Form 990 EZ is a simplified version of Form 990 that smaller tax-exempt organizations use to report their annual income and expenses. Typically, organizations with gross receipts of less than $200,000 and total assets of less than $500,000 can file this form. Filing IRS Form 990 EZ is essential to maintain compliance with IRS regulations and ensure that your organization remains in good standing.

-

How does airSlate SignNow facilitate the completion of IRS Form 990 EZ?

airSlate SignNow streamlines the process of completing IRS Form 990 EZ by providing easy-to-use templates and electronic signing options. With our platform, users can fill out, sign, and send the form quickly, reducing the time spent on paperwork. This efficiency helps organizations focus more on their mission rather than administrative tasks.

-

What are the pricing options for using airSlate SignNow for IRS Form 990 EZ?

airSlate SignNow offers flexible pricing plans to accommodate various organizational needs, including options for individuals, small businesses, and larger enterprises. Each plan includes access to essential features suitable for completing IRS Form 990 EZ effectively. You can explore our pricing page for more details on specific features and pricing tiers.

-

Does airSlate SignNow integrate with accounting software for IRS Form 990 EZ?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage financial data when completing IRS Form 990 EZ. These integrations help ensure that all relevant data is synchronized, allowing for more accurate reporting and reduced errors. Simplifying these tasks enhances the overall efficiency of your compliance process.

-

What are the key features of airSlate SignNow that are beneficial for IRS Form 990 EZ?

AirSlate SignNow offers several key features that streamline the preparation of IRS Form 990 EZ, including customizable templates, secure electronic signatures, and real-time collaboration. These features provide enhanced convenience and ensure that necessary documents can be easily sent and signed by multiple stakeholders. This functionality makes IRS Form 990 EZ management straightforward and efficient.

-

How does electronic signing help in preparing IRS Form 990 EZ?

Electronic signing through airSlate SignNow accelerates the completion process of IRS Form 990 EZ by allowing authorized individuals to sign documents from anywhere, at any time. This flexibility leads to quicker approvals and a more efficient workflow, especially for organizations that may have multiple signers. Ultimately, it helps eliminate delays associated with traditional paper-based signatures.

-

Can I track the status of my IRS Form 990 EZ submissions with airSlate SignNow?

Absolutely! AirSlate SignNow provides features that allow users to track the status of their IRS Form 990 EZ submissions easily. This tracking capability ensures that you remain informed about who has signed and when documents are completed, which is crucial for meeting deadlines and maintaining compliance with IRS regulations.

Get more for Irs Form 990 Ez

Find out other Irs Form 990 Ez

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure