Schedule M1LTI Sequence #15 Long Term Care Insurance Credit Your First Name and Initial Last Name Social Security Number If You Form

Understanding the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

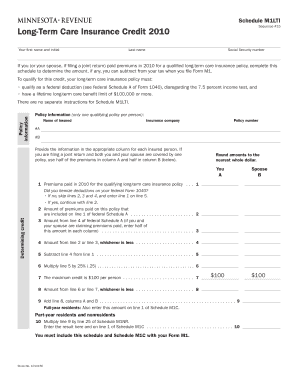

The Schedule M1LTI Sequence #15 Long Term Care Insurance Credit is a tax form used by individuals in the United States to claim a credit for premiums paid for qualified long-term care insurance. This form is particularly relevant for taxpayers who wish to reduce their taxable income by accounting for the costs associated with long-term care insurance. It is essential to accurately complete this form to ensure compliance with IRS regulations and maximize potential tax benefits.

Steps to Complete the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

Completing the Schedule M1LTI Sequence #15 requires careful attention to detail. Follow these steps to ensure accurate completion:

- Gather necessary information, including your first name, initial last name, and Social Security number.

- Determine if you or your spouse, if filing jointly, paid premiums for qualified long-term care insurance during the tax year.

- Fill out the form by entering the total amount of premiums paid in the designated section.

- Double-check all entries for accuracy to avoid processing delays.

Eligibility Criteria for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

To qualify for the credit, taxpayers must meet specific eligibility criteria. These include:

- Being a U.S. citizen or resident alien.

- Having paid premiums for qualified long-term care insurance policies.

- Filing a tax return, either individually or jointly, where the credit can be claimed.

Required Documents for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

When preparing to file the Schedule M1LTI Sequence #15, it is important to have the following documents ready:

- Proof of premium payments, such as receipts or bank statements.

- Your Social Security number and that of your spouse if filing jointly.

- Any additional documentation required by the IRS to substantiate your claim.

IRS Guidelines for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

The IRS provides specific guidelines for completing and submitting the Schedule M1LTI Sequence #15. Key points include:

- Ensure that the form is filled out completely and accurately to avoid delays.

- Submit the form along with your annual tax return by the due date.

- Keep copies of all submitted documents for your records.

Form Submission Methods for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

Taxpayers have several options for submitting the Schedule M1LTI Sequence #15. These methods include:

- Filing electronically through tax preparation software that supports the form.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete schedule m1lti sequence 15 long term care insurance credit your first name and initial last name social security number if you 11331971

Effortlessly Create [SKS] on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and electronically sign your documents swiftly and without delay. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you would like to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors requiring the printing of new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m1lti sequence 15 long term care insurance credit your first name and initial last name social security number if you 11331971

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

The Schedule M1LTI Sequence #15 Long Term Care Insurance Credit allows taxpayers to claim a credit for premiums paid for qualified long-term care insurance. This credit is available if you or your spouse, when filing a joint return, have paid premiums in for a qualified long-term care insurance policy. It's essential to provide your first name, initial last name, and Social Security number when claiming this credit.

-

How can I apply for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

To apply for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit, you need to complete the appropriate tax forms and include your first name, initial last name, and Social Security number. Ensure that you have documentation of the premiums paid for qualified long-term care insurance. This information will help streamline the application process.

-

What are the eligibility requirements for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

Eligibility for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit requires that you or your spouse have paid premiums for a qualified long-term care insurance policy. Additionally, you must be filing a joint return to claim this credit. It's important to verify that the insurance policy meets the necessary qualifications.

-

What benefits does the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit provide?

The Schedule M1LTI Sequence #15 Long Term Care Insurance Credit provides financial relief by reducing your tax liability based on the premiums paid for qualified long-term care insurance. This credit can help offset the costs associated with long-term care, making it more affordable for you and your family. It encourages individuals to invest in long-term care insurance for better financial security.

-

Are there any limitations on the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

Yes, there are limitations on the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit, including caps on the amount of premiums that can be claimed based on age and policy type. Additionally, the credit is only available for premiums paid for qualified long-term care insurance. It's advisable to consult the latest tax guidelines to understand these limitations.

-

How does airSlate SignNow assist with the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

airSlate SignNow simplifies the process of managing documents related to the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit. With our easy-to-use platform, you can securely send and eSign necessary documents, ensuring that all information, including your first name, initial last name, and Social Security number, is accurately captured. This streamlines your tax filing process.

-

What features does airSlate SignNow offer for managing long-term care insurance documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure storage for managing long-term care insurance documents. These features help ensure that you can efficiently handle all paperwork related to the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit. Our platform is designed to make document management straightforward and efficient.

Get more for Schedule M1LTI Sequence #15 Long Term Care Insurance Credit Your First Name And Initial Last Name Social Security Number If You

Find out other Schedule M1LTI Sequence #15 Long Term Care Insurance Credit Your First Name And Initial Last Name Social Security Number If You

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT