Schedule D Form 2010

What is the Schedule D Form

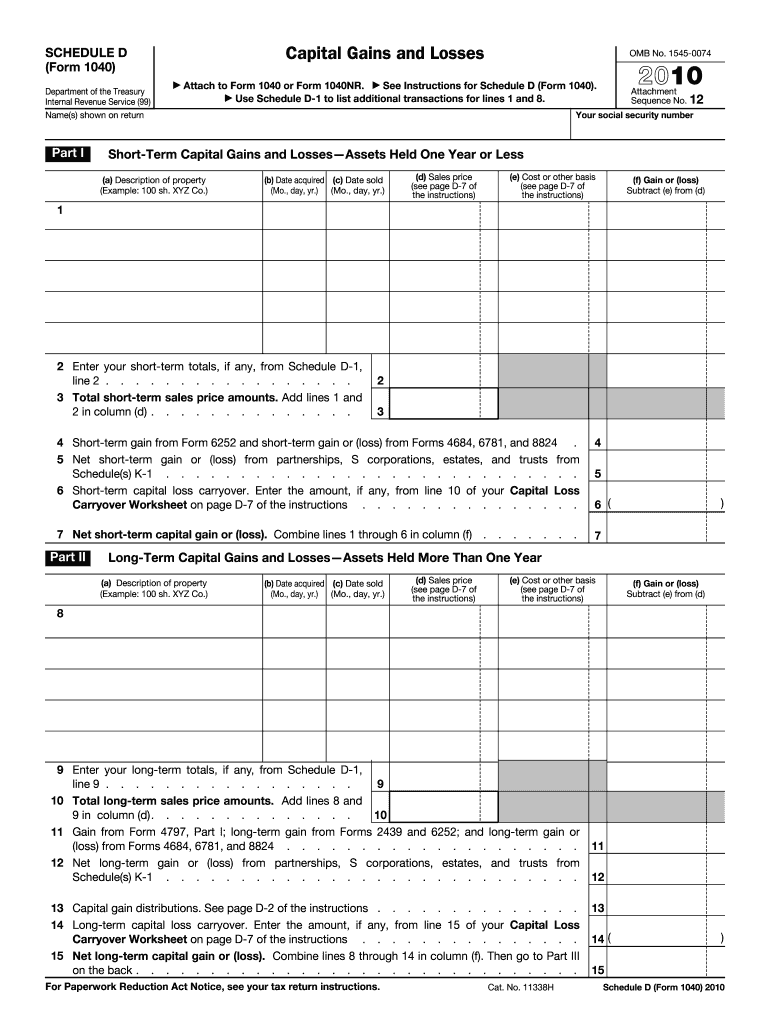

The Schedule D Form is a tax document used by taxpayers in the United States to report capital gains and losses from the sale of securities and other assets. This form is essential for individuals and businesses who have engaged in transactions involving stocks, bonds, or real estate. By detailing the gains and losses, taxpayers can calculate their overall tax liability and determine if they owe additional taxes or are eligible for refunds. The Schedule D Form is typically filed alongside the IRS Form 1040 during the annual tax filing process.

How to use the Schedule D Form

To effectively use the Schedule D Form, taxpayers must first gather all relevant information regarding their capital transactions. This includes details of each sale, such as the date of acquisition, date of sale, purchase price, and sale price. Once this information is compiled, taxpayers will fill out the form by categorizing their transactions into short-term and long-term gains or losses. Short-term gains are those from assets held for one year or less, while long-term gains apply to assets held for more than one year. After completing the form, it should be attached to the main tax return for submission.

Steps to complete the Schedule D Form

Completing the Schedule D Form involves several key steps:

- Gather all records of capital transactions, including purchase and sale documents.

- Determine the holding period for each asset to differentiate between short-term and long-term transactions.

- Calculate gains and losses for each transaction by subtracting the purchase price from the sale price.

- Fill out the Schedule D Form by entering the calculated amounts in the appropriate sections.

- Transfer the totals to the main tax return, Form 1040, and ensure all forms are signed and dated before submission.

Legal use of the Schedule D Form

The Schedule D Form is legally recognized by the IRS as a valid document for reporting capital gains and losses. To ensure compliance with tax laws, it is crucial that taxpayers accurately report all transactions and maintain supporting documentation. Failure to properly complete the form can lead to penalties, including fines and interest on unpaid taxes. Using a reliable eSignature solution can further enhance the legality of the document, ensuring that all signatures are authenticated and that the form is submitted securely.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule D Form. Generally, the deadline for filing individual tax returns, including the Schedule D, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. For those who require additional time, an extension can be filed, typically allowing for an extra six months. However, it is important to note that any taxes owed are still due by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Schedule D Form can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online: Taxpayers can file electronically using tax preparation software that supports the Schedule D Form.

- Mail: The completed form can be printed and mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Some taxpayers may choose to deliver their forms directly to a local IRS office, although this method is less common.

Quick guide on how to complete 2010 schedule d form

Effortlessly prepare Schedule D Form on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with every tool needed to create, edit, and electronically sign your documents swiftly without delays. Manage Schedule D Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign Schedule D Form with ease

- Locate Schedule D Form and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any preferred device. Edit and electronically sign Schedule D Form while ensuring superior communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 schedule d form

Create this form in 5 minutes!

How to create an eSignature for the 2010 schedule d form

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is a Schedule D Form?

The Schedule D Form is a supplement to the IRS U.S. Individual Income Tax Return that allows taxpayers to report capital gains and losses. This form is crucial for individuals who have sold stocks, bonds, or other capital assets during the tax year. By accurately completing the Schedule D Form, taxpayers can determine their tax liabilities and optimize their financial outcomes.

-

How can airSlate SignNow assist with the Schedule D Form?

airSlate SignNow empowers users to easily send and eSign the Schedule D Form online. With our intuitive platform, you can quickly prepare your tax documents, ensuring they are signed and submitted with minimal hassle. This streamlines the entire process, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Schedule D Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, whether you are an individual or a business. Our cost-effective solutions provide powerful features to help you manage your Schedule D Form and other documents efficiently. For detailed pricing information, please visit our pricing page.

-

What features does airSlate SignNow offer for the Schedule D Form?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and secure electronic signatures for the Schedule D Form. Users can easily collaborate and manage documents, ensuring that all stakeholders are on the same page. These features enhance the efficiency and accuracy of your tax document preparation.

-

Can I integrate airSlate SignNow with other software for my Schedule D Form?

Absolutely! airSlate SignNow supports integrations with numerous applications, making it easy to sync your Schedule D Form with tax preparation software and other essential tools. This interoperability helps streamline workflows and enhances overall productivity, ensuring that you can manage all aspects of your tax documents seamlessly.

-

What benefits does electronic signing bring to the Schedule D Form?

Electronic signing with airSlate SignNow simplifies the process of completing your Schedule D Form. It eliminates the need for printing, scanning, or faxing documents, offering a more secure and efficient method of obtaining signatures. This not only saves time but also ensures that your documents are completed accurately and promptly.

-

How does airSlate SignNow ensure the security of my Schedule D Form?

AirSlate SignNow takes security seriously, implementing advanced encryption and data protection protocols to keep your Schedule D Form secure. Our platform is compliant with regulatory standards, ensuring that your sensitive information remains confidential and protected. You can trust us to safeguard your documents during the entire signing process.

Get more for Schedule D Form

- Colorado exceptions processing form

- Alaska 507 form

- Hqp slf 066 form 2020

- Msvs pag ibig form

- Issuing partner bank form

- Board for contractors dpor virginiagov form

- Inz 1017 visitor visa application ctripinz 1017 visitor visa application ctripvisa application how to apply indian visaindia form

- Application for certification in industrial radiography form

Find out other Schedule D Form

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free