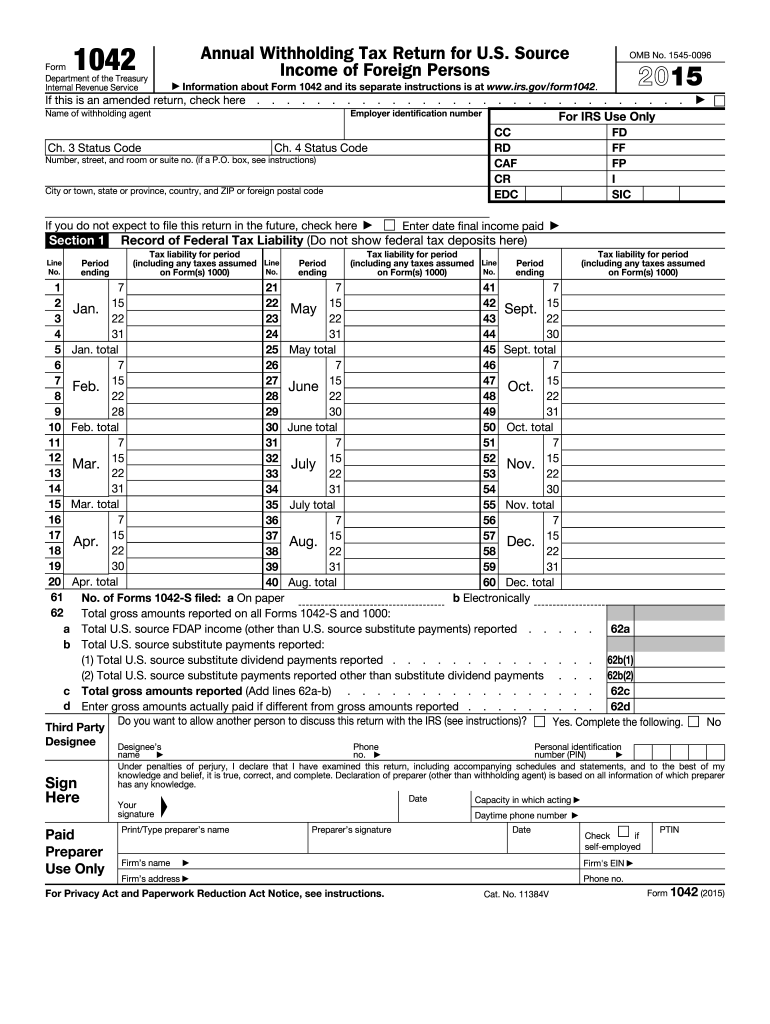

Form 1042 2015

What is the Form 1042

The Form 1042 is a tax document used by U.S. withholding agents to report income paid to foreign persons, including non-resident aliens and foreign entities. This form is primarily utilized to report amounts subject to withholding under the Internal Revenue Code, such as interest, dividends, rents, royalties, and compensation for services. It is crucial for ensuring compliance with U.S. tax laws regarding foreign transactions and is filed annually with the Internal Revenue Service (IRS).

How to use the Form 1042

To use the Form 1042 effectively, a withholding agent must first determine whether the payments made to foreign persons are subject to U.S. withholding tax. If applicable, the agent must complete the form, detailing the income paid, the amount withheld, and the recipient's information. The completed form must then be submitted to the IRS along with any required payments. It is essential to keep accurate records of all transactions and withholdings to ensure compliance and facilitate the filing process.

Steps to complete the Form 1042

Completing the Form 1042 involves several key steps:

- Identify the income types that require reporting, such as interest, dividends, or royalties.

- Gather information about the foreign recipients, including their names, addresses, and taxpayer identification numbers.

- Calculate the total income paid and the amount of tax withheld for each recipient.

- Fill out the form accurately, ensuring all necessary fields are completed.

- Review the form for accuracy before submission.

- Submit the completed Form 1042 to the IRS by the designated deadline.

Legal use of the Form 1042

The legal use of the Form 1042 is governed by U.S. tax laws, which require withholding agents to report and remit taxes on payments made to foreign persons. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid amounts. It is important for withholding agents to understand their responsibilities and ensure that they are using the form correctly to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042 are critical for compliance. Generally, the form must be filed with the IRS by March 15 of the year following the tax year in which the payments were made. Additionally, any tax payments withheld must also be submitted by this date. It is advisable to check for any updates or changes to deadlines annually, as they may vary.

Penalties for Non-Compliance

Non-compliance with the Form 1042 filing requirements can lead to significant penalties. The IRS imposes fines for late filings, inaccuracies, or failure to file altogether. Penalties can vary based on the severity of the violation, and interest may accrue on any unpaid taxes. Withholding agents should prioritize timely and accurate submissions to avoid these financial repercussions.

Quick guide on how to complete 2015 form 1042

Complete Form 1042 effortlessly on any gadget

Web-based document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the proper form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly and without delay. Manage Form 1042 on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form 1042 with ease

- Locate Form 1042 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive data using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to the computer.

Put an end to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 1042 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1042

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1042

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is Form 1042, and why is it important for businesses?

Form 1042 is a tax document that foreign entities use to report income subjected to withholding. It’s crucial for businesses dealing with international clients or payments, as it ensures compliance with U.S. tax regulations. Using airSlate SignNow can simplify the eSigning of Form 1042 to streamline your tax processes.

-

How can airSlate SignNow help me with Form 1042?

airSlate SignNow provides an easy-to-use platform for eSigning documents like Form 1042. With its secure and efficient features, you can quickly complete and manage Form 1042 submissions, reducing errors and saving time. Plus, you can track the signing process for better compliance.

-

What are the pricing options for using airSlate SignNow for Form 1042?

airSlate SignNow offers several pricing tiers designed to fit businesses of all sizes. These options provide access to essential features for completing Form 1042 and other critical documents. By choosing a suitable plan, you can enjoy cost-effective eSigning solutions tailored to your needs.

-

Does airSlate SignNow integrate with accounting software for Form 1042 compliance?

Yes, airSlate SignNow offers integration with various accounting software to enhance your Form 1042 compliance process. This integration allows for seamless data transfer, ensuring that the information you need for Form 1042 is accurately captured and easily accessible. This saves you time and minimizes errors.

-

What security features does airSlate SignNow offer for Form 1042 submissions?

Security is a top priority at airSlate SignNow. When dealing with sensitive documents like Form 1042, our platform provides encryption, secure access, and user authentication. This ensures that your Form 1042 submissions are protected from unauthorized access, giving you peace of mind.

-

Can I customize Form 1042 templates using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize templates for Form 1042 according to your business's unique requirements. This means you can add specific fields or company branding, ensuring that your Form 1042 aligns perfectly with your corporate identity and meets compliance needs.

-

Is there a mobile app for managing Form 1042 documents with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that enables you to manage and eSign Form 1042 documents on the go. This mobile functionality allows for increased flexibility and convenience, letting you handle important tax filings from anywhere, thus simplifying the completion of Form 1042.

Get more for Form 1042

Find out other Form 1042

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors