1120 S Form 2014

What is the 1120 S Form

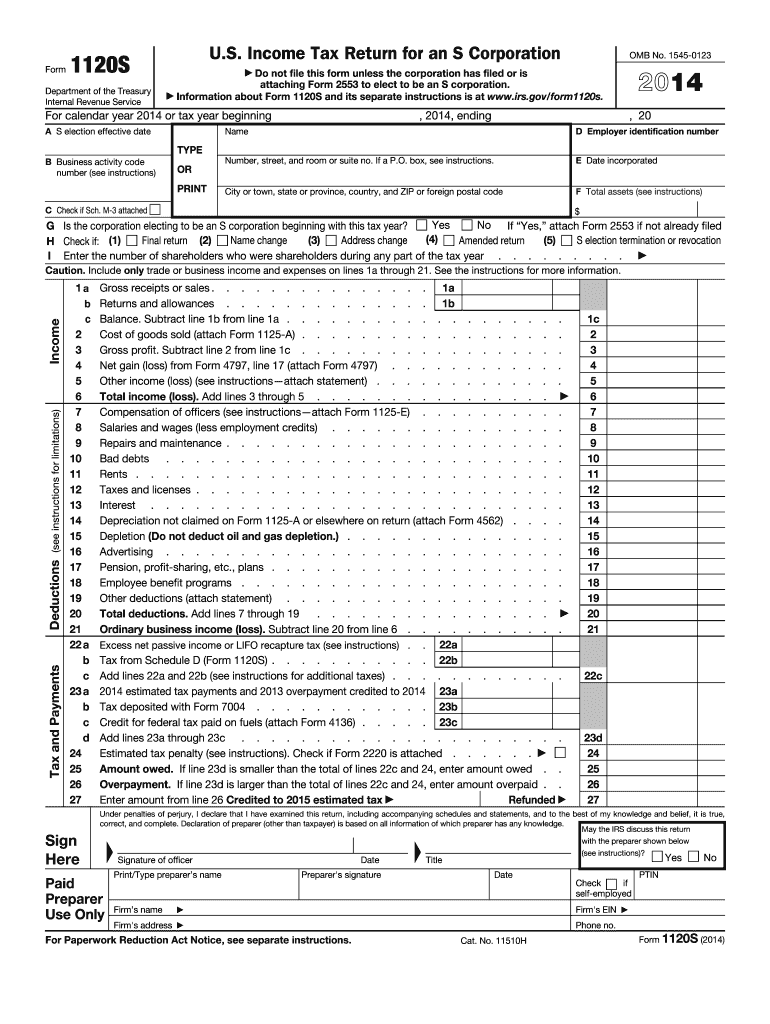

The 1120 S Form is a tax document used by S corporations in the United States to report income, deductions, and other tax information. This form is crucial for S corporations as it allows them to pass corporate income, losses, deductions, and credits directly to their shareholders. The shareholders then report this information on their personal tax returns, avoiding double taxation. The 1120 S Form must be filed annually with the Internal Revenue Service (IRS) and is essential for maintaining the S corporation's status.

How to use the 1120 S Form

Using the 1120 S Form involves several steps to ensure accurate reporting of your corporation's financial activities. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by entering your corporation's income, deductions, and credits in the appropriate sections. It's important to provide accurate information to avoid penalties. Once completed, the form must be submitted to the IRS by the designated deadline, typically the 15th day of the third month after the end of the corporation's tax year.

Steps to complete the 1120 S Form

Completing the 1120 S Form requires careful attention to detail. Follow these steps:

- Gather financial records, including income and expense statements.

- Fill out the top section with your corporation's name, address, and Employer Identification Number (EIN).

- Report total income on the appropriate lines, including sales and other revenue.

- Deduct allowable expenses, such as salaries, rent, and utilities, to calculate the taxable income.

- Complete the sections for credits and other adjustments as necessary.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Timely filing of the 1120 S Form is crucial to avoid penalties. The standard deadline for filing is the 15th day of the third month after the end of your corporation's tax year. For corporations that operate on a calendar year, this means the form is due by March 15. If additional time is needed, you can file for an extension, which typically provides an additional six months to submit the form. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Legal use of the 1120 S Form

The 1120 S Form must be used in compliance with IRS regulations to ensure its legal validity. This includes accurately reporting all income and deductions and adhering to the specific guidelines set forth by the IRS for S corporations. Failure to comply can result in penalties, including the loss of S corporation status. It's also important to maintain proper documentation and records to support the information reported on the form, as the IRS may request this documentation during audits.

Who Issues the Form

The 1120 S Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides the form and detailed instructions on how to complete it, ensuring that S corporations have the necessary resources to fulfill their tax obligations. It is important to use the most current version of the form, as updates may occur that reflect changes in tax law or reporting requirements.

Quick guide on how to complete 1120 s 2014 form

Prepare 1120 S Form effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed files, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage 1120 S Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The simplest method to modify and eSign 1120 S Form with ease

- Find 1120 S Form and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign 1120 S Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 s 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 1120 s 2014 form

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is an 1120 S Form?

The 1120 S Form is a tax return used by S corporations to report income, deductions, and credits. This form helps businesses ensure compliance with IRS regulations while providing detailed financial data. Understanding the 1120 S Form is crucial for accurate tax reporting and maximizing potential deductions.

-

How can airSlate SignNow assist with the 1120 S Form?

airSlate SignNow streamlines the process of completing and submitting the 1120 S Form by allowing for easy document creation and eSigning. Our platform ensures that forms are filled out accurately and securely signed by all required parties. This efficiency helps reduce the time spent on tax preparation and submission.

-

Is there a cost associated with using airSlate SignNow for the 1120 S Form?

Yes, airSlate SignNow offers various pricing plans designed to meet the needs of different businesses. Each plan includes access to features that simplify eSigning and document management for the 1120 S Form. Our cost-effective solutions help ensure your business can easily manage tax-related documents without breaking the bank.

-

What features does airSlate SignNow offer for handling the 1120 S Form?

airSlate SignNow provides features like customizable templates, multi-party signing, and secure document storage, specifically tailored for the 1120 S Form. These tools make it easier to gather signatures and manage documents efficiently. Additionally, our platform is user-friendly, ensuring a smooth experience throughout the tax preparation process.

-

Can I integrate airSlate SignNow with other software for 1120 S Form management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software solutions, enhancing your 1120 S Form management. These integrations allow for automatic data transfer and easy access to necessary tax documents, simplifying the entire tax filing process.

-

What benefits does airSlate SignNow provide for eSigning the 1120 S Form?

Using airSlate SignNow for eSigning the 1120 S Form offers the benefit of reduced turnaround time in obtaining necessary signatures. Our digital solution enhances security and compliance while eliminating the need for physical paperwork. This modern approach not only improves efficiency but also ensures that your forms are submitted on time.

-

How does airSlate SignNow ensure the security of my 1120 S Form?

airSlate SignNow prioritizes the security of your 1120 S Form through advanced encryption, secure cloud storage, and user authentication. These security features protect sensitive financial data from unauthorized access. You can confidently store and manage your tax forms knowing that they are safeguarded by industry-leading security measures.

Get more for 1120 S Form

Find out other 1120 S Form

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free