1096 Form 2015

What is the 1096 Form

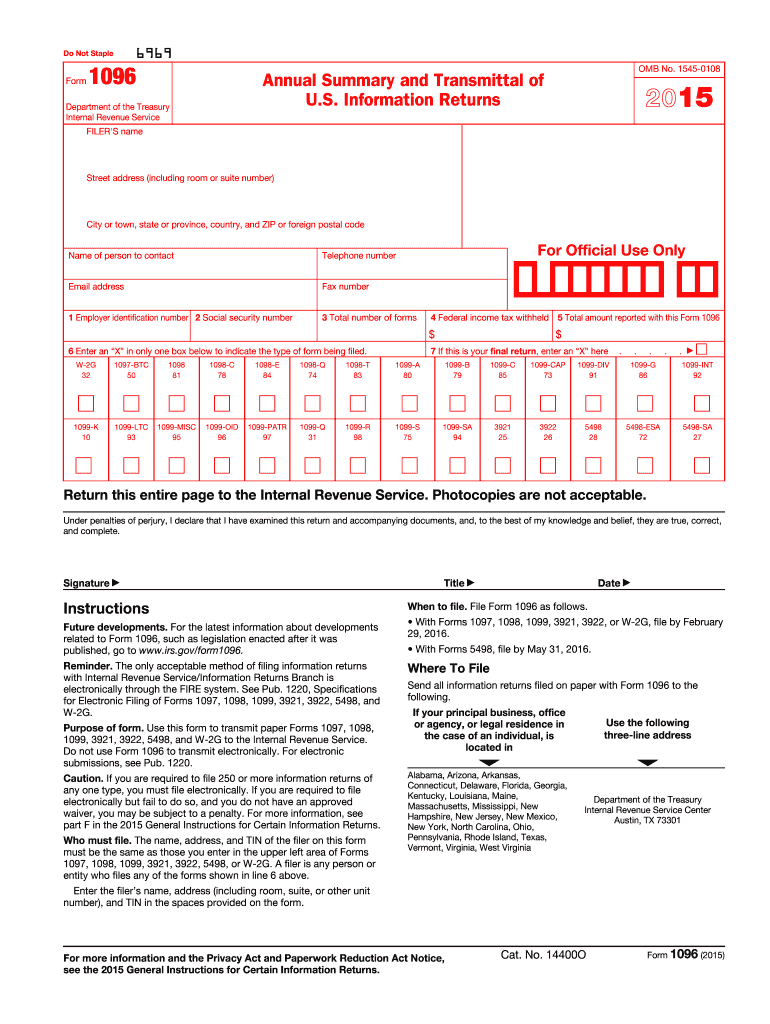

The 1096 Form is a summary form used by businesses to report various types of income to the Internal Revenue Service (IRS). Specifically, it is utilized to transmit paper forms such as the 1099 series, which detail payments made to independent contractors, freelancers, and other non-employees. The 1096 Form provides the IRS with essential information about the total amount of income reported on the accompanying 1099 forms. This form is crucial for ensuring accurate reporting and compliance with federal tax regulations.

How to use the 1096 Form

Using the 1096 Form involves several steps to ensure accurate reporting of income. First, gather all relevant 1099 forms that report payments made to non-employees. Next, complete the 1096 Form by filling in the required information, including the total amount reported on the 1099 forms, the number of forms being submitted, and the payer's information. Once completed, the 1096 Form should be submitted along with the accompanying 1099 forms to the IRS by the specified deadline. It is essential to retain copies of all submitted documents for your records.

Steps to complete the 1096 Form

Completing the 1096 Form involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all 1099 forms that you are reporting.

- Enter your business name, address, and taxpayer identification number (TIN) in the designated fields.

- Indicate the total number of 1099 forms being submitted.

- Calculate and input the total amount reported on all 1099 forms.

- Sign and date the form, certifying that the information provided is accurate.

After completing the form, ensure it is submitted to the IRS along with the corresponding 1099 forms.

Legal use of the 1096 Form

The 1096 Form is legally required for businesses that report payments made to non-employees via 1099 forms. To ensure legal compliance, it is crucial to file the form accurately and on time. The IRS mandates that the 1096 Form be submitted along with the 1099 forms by the annual deadline, typically at the end of January for the previous tax year. Failure to comply with these regulations can result in penalties, making it essential for businesses to understand their obligations regarding this form.

Filing Deadlines / Important Dates

Filing deadlines for the 1096 Form are critical for compliance. Generally, the 1096 Form must be submitted to the IRS by January thirty-first of the year following the tax year being reported. If you are filing electronically, the deadline may differ slightly, often extending to March thirty-first. It is important to mark these dates on your calendar to avoid late submissions, which can incur penalties. Always verify the specific deadlines for the current tax year, as they may change.

Penalties for Non-Compliance

Failure to file the 1096 Form on time or inaccuracies in the form can lead to significant penalties imposed by the IRS. Penalties for late filing can range from one hundred to several thousand dollars, depending on how late the form is submitted. Additionally, if the form contains incorrect information, businesses may face further fines. To avoid these penalties, it is essential to ensure timely and accurate filing of the 1096 Form and its accompanying 1099 forms.

Quick guide on how to complete 2015 1096 form

Complete 1096 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 1096 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign 1096 Form with ease

- Find 1096 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1096 Form and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1096 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1096 form

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the 1096 Form and why is it important?

The 1096 Form is a summary of information returns submitted to the IRS and is essential for reporting various types of income. Understanding the 1096 Form is crucial for accurate tax compliance and avoiding penalties. By using airSlate SignNow, businesses can easily manage, send, and eSign the necessary documents related to the 1096 Form.

-

How can airSlate SignNow help with filling out the 1096 Form?

airSlate SignNow provides an intuitive platform for filling out the 1096 Form electronically. This allows users to complete their forms accurately and efficiently, minimizing errors and saving time. The eSigning feature ensures that all required signatures are obtained, streamlining the entire process.

-

Are there any fees associated with using airSlate SignNow for the 1096 Form?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those specifically for managing the 1096 Form. You can choose a plan that fits your budget while gaining access to features that simplify document management and signing. Pricing is transparent, with no hidden fees, making it easy to manage costs.

-

What features does airSlate SignNow offer for handling the 1096 Form?

airSlate SignNow offers features like customizable templates, automatic reminders, and real-time tracking to handle the 1096 Form efficiently. Users can also collaborate with team members securely, ensuring that all contributions are incorporated before submission. These features improve workflow and ensure deadlines are met.

-

Can airSlate SignNow integrate with other software for the 1096 Form?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software to facilitate the management of the 1096 Form. This integration helps streamline processes by transferring data directly between platforms, reducing manual entry, and minimizing errors. It enhances overall efficiency for users and businesses.

-

Is it easy to access the 1096 Form through airSlate SignNow?

Absolutely! airSlate SignNow makes accessing the 1096 Form straightforward and user-friendly. Users can quickly retrieve templates and previous submissions, allowing for efficient reuse and modification. This ease of access ensures that businesses can stay organized year-round.

-

How secure is the information provided in the 1096 Form via airSlate SignNow?

The security of your information is a top priority at airSlate SignNow. The platform uses advanced encryption technologies to protect all data associated with the 1096 Form. Additionally, strict compliance with industry standards helps ensure that your personal and financial information remains safe and confidential.

Get more for 1096 Form

Find out other 1096 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors