Schedule C Form 2012

What is the Schedule C Form

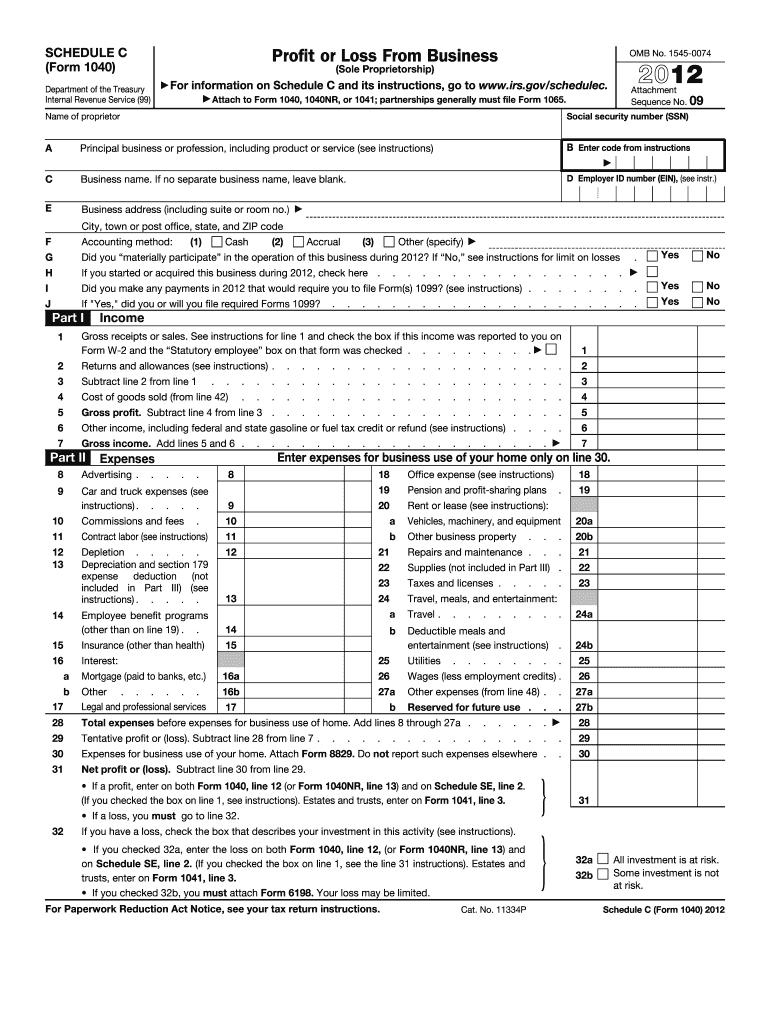

The Schedule C Form, officially known as the 2012 Form 1040 Schedule C, is a tax document used by sole proprietors to report income or loss from their business. This form is essential for individuals who are self-employed or operate a business as a single entity. It provides a comprehensive overview of the business's financial performance, including revenue, expenses, and net profit or loss. Completing this form accurately is crucial for ensuring compliance with IRS regulations and for determining the correct amount of taxes owed.

How to use the Schedule C Form

Using the Schedule C Form involves several steps. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form by providing details about your business, such as its name, address, and the nature of the business activities. Report all income earned during the tax year, followed by listing allowable business expenses. Ensure that you categorize expenses correctly, as this can affect your taxable income. Finally, calculate your net profit or loss and transfer this information to your Form 1040 when filing your taxes.

Steps to complete the Schedule C Form

Completing the Schedule C Form requires careful attention to detail. Start by entering your business information at the top of the form. Then, proceed to report your gross receipts or sales, ensuring that you include all income generated. After that, list your business expenses, which may include costs for supplies, utilities, and other operational expenses. Be diligent in categorizing these expenses to maximize your deductions. Once all sections are filled out, calculate your net profit or loss by subtracting total expenses from total income. Finally, review the form for accuracy before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C Form. It is important to refer to the IRS instructions for the 2012 Schedule C, which outline acceptable business expenses and reporting requirements. Familiarize yourself with the definitions of various expense categories to ensure compliance. The IRS also emphasizes the importance of maintaining accurate records to support the information reported on the form. This documentation may be required in the event of an audit. Following these guidelines helps to avoid penalties and ensures that your tax return is processed smoothly.

Filing Deadlines / Important Dates

For the 2012 tax year, the deadline for filing the Schedule C Form is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file your tax return, including the Schedule C, by this deadline to avoid late fees and penalties. Additionally, if you need more time, you can file for an extension, but be aware that this does not extend the time to pay any taxes owed.

Required Documents

To complete the Schedule C Form accurately, you will need several key documents. These include income statements that detail all revenue generated from your business, as well as receipts and invoices for business-related expenses. Bank statements, credit card statements, and any other financial records that support your income and expenses are also essential. Keeping organized records throughout the year can simplify the process of filling out the form and ensure that you do not miss any deductions.

Quick guide on how to complete schedule c 2012 form 6876775

Complete Schedule C Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule C Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Schedule C Form without hassle

- Locate Schedule C Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Schedule C Form and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c 2012 form 6876775

Create this form in 5 minutes!

How to create an eSignature for the schedule c 2012 form 6876775

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 1040 Schedule C 2012 form used for?

The 1040 Schedule C 2012 form is used by sole proprietors to report income or loss from their business. This form is essential for accurately reporting taxation on profits earned throughout the year. By using the 1040 Schedule C 2012, you ensure compliance with IRS requirements.

-

How can airSlate SignNow help with completing the 1040 Schedule C 2012?

airSlate SignNow streamlines the document signing and submission process, which can be particularly useful when completing the 1040 Schedule C 2012. With eSigning capabilities, you can quickly get necessary approvals from partners or clients without delays. This saves time and ensures that your tax documents are processed efficiently.

-

Are there any features specifically beneficial for users of the 1040 Schedule C 2012?

Yes, airSlate SignNow offers features that cater to users of the 1040 Schedule C 2012, such as customizable templates and secure cloud storage. These features allow users to create, store, and manage their tax documents effectively. Additionally, the ability to add multiple signers simplifies the process of gathering necessary signatures.

-

What pricing options does airSlate SignNow offer for users needing the 1040 Schedule C 2012?

airSlate SignNow offers several pricing plans that cater to different needs, including individuals and businesses that require assistance with the 1040 Schedule C 2012. The plans are designed to be cost-effective, ensuring you get great value for managing your documents. Additionally, there may be discounts available for annual subscriptions.

-

Is airSlate SignNow compatible with other tax software for filling out the 1040 Schedule C 2012?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the experience for users completing the 1040 Schedule C 2012. These integrations can help you sync data and reduce manual entry errors. This ultimately improves efficiency and accuracy when managing your tax documents.

-

How secure is the data when completing the 1040 Schedule C 2012 using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 1040 Schedule C 2012. The platform uses advanced encryption and industry-standard security protocols to protect your data. You can have peace of mind knowing that your information is safe while using our services.

-

Can I access the 1040 Schedule C 2012 form from my mobile device with airSlate SignNow?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to access and complete the 1040 Schedule C 2012 on your smartphone or tablet. This mobile functionality ensures that you can manage your important tax documents anywhere, anytime, making it convenient for busy professionals.

Get more for Schedule C Form

- Forms department of revenue kentucky

- Gepf self service form

- Vaccineform health ny gov

- Annexure e1 hssc form

- Form 941 x rev october 2020 internal revenue service

- Ae form 608 10 1a june 2014 lcd vers 0100 child youth and school services health assessmentsports physical

- C4 3 form

- How to make an online application for an irish visa form

Find out other Schedule C Form

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release