Form 4797 2011

What is the Form 4797

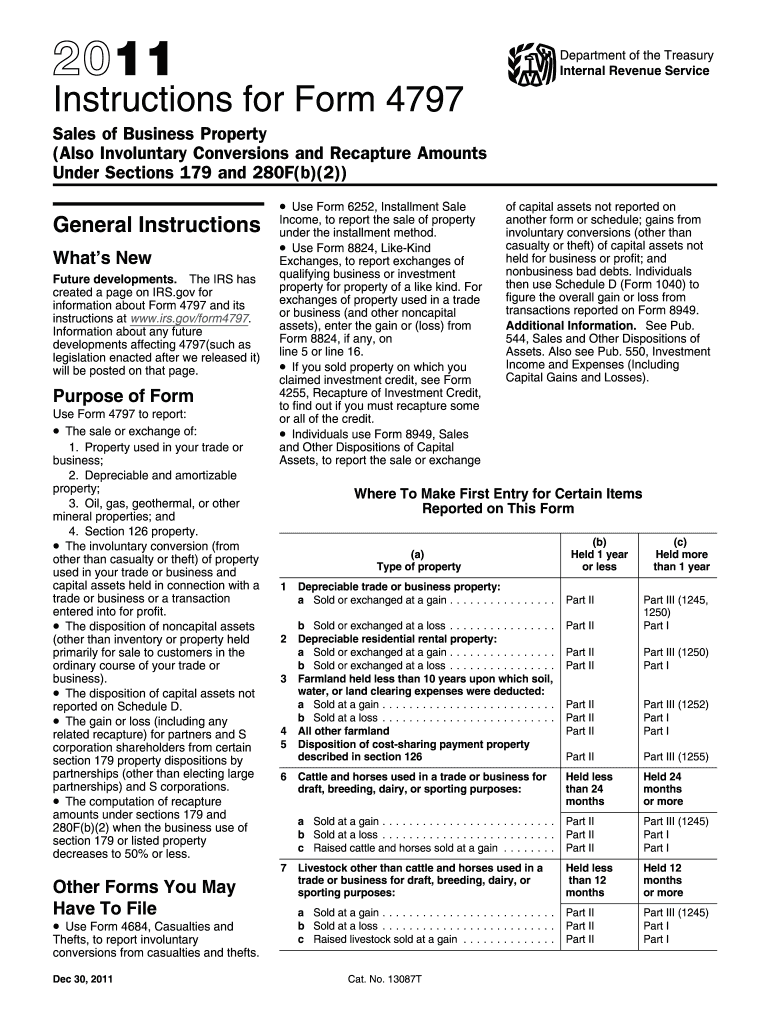

The Form 4797, officially known as the "Sales of Business Property," is a tax form used by businesses and individuals to report the sale or exchange of business property. This form is primarily utilized for reporting gains and losses from the sale of assets such as real estate, equipment, and other tangible property used in a trade or business. It is essential for taxpayers to accurately report these transactions to comply with IRS regulations and determine their tax liabilities.

How to use the Form 4797

Using the Form 4797 involves several key steps. First, taxpayers must gather information about the property sold, including the date of sale, the selling price, and the cost basis of the property. Next, the taxpayer will need to fill out the appropriate sections of the form, detailing the type of property and the nature of the sale. It is important to categorize the sale correctly, as this affects the tax treatment of any gain or loss. Finally, once completed, the form must be submitted along with the taxpayer's annual tax return.

Steps to complete the Form 4797

Completing the Form 4797 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including purchase and sale records.

- Determine the type of property being sold and its classification.

- Calculate the adjusted basis of the property, which includes the original cost plus improvements minus any depreciation.

- Fill out Part I for property held for more than one year or Part II for property held for one year or less.

- Report any gain or loss from the sale in the appropriate sections.

- Review the completed form for accuracy before submission.

Legal use of the Form 4797

The legal use of Form 4797 is governed by IRS regulations, which require taxpayers to report their sales of business property accurately. Proper completion of the form ensures compliance with tax laws and helps avoid potential penalties. The form must be filed in accordance with the deadlines set by the IRS, and any discrepancies may lead to audits or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for Form 4797 align with the general tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the following tax year. If additional time is needed, taxpayers can file for an extension, allowing for an extended deadline. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Examples of using the Form 4797

Form 4797 is commonly used in various scenarios, such as:

- When a business sells a piece of machinery that has been used for several years.

- If a property owner sells a commercial building that has appreciated in value.

- When an individual exchanges one piece of investment property for another.

Each of these examples illustrates the importance of accurately reporting transactions to ensure proper tax treatment.

Quick guide on how to complete form 4797 2011

Effortlessly prepare Form 4797 on any device

Digital document management has gained traction among businesses and individuals. It serves as a flawless eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form 4797 on any platform using airSlate SignNow's Android or iOS applications, and simplify your document-centric processes today.

Modify and eSign Form 4797 with ease

- Find Form 4797 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize crucial parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which is quick and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow covers all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 4797 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4797 2011

Create this form in 5 minutes!

How to create an eSignature for the form 4797 2011

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is Form 4797 and why is it important for businesses?

Form 4797 is a crucial tax form used to report the sale of business property. It is important for businesses as it helps in accurately calculating capital gains or losses, which can signNowly affect tax obligations. Using airSlate SignNow simplifies the signing and submission process for Form 4797, ensuring compliance and efficiency.

-

How can airSlate SignNow assist with completing Form 4797?

airSlate SignNow provides an intuitive platform that allows users to fill out, sign, and send Form 4797 securely. The digital workflow streamlines the entire process, reducing errors and the time spent on paperwork. Enhanced features such as templates and reminders make it easier to manage submissions.

-

Is there a cost associated with using airSlate SignNow for Form 4797?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, ensuring a cost-effective solution for handling Form 4797. Plans include essential features for small businesses as well as advanced tools for larger organizations. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for Form 4797 document management?

airSlate SignNow offers features such as customizable templates, document tracking, and secure cloud storage to manage Form 4797 efficiently. The platform allows users to collaborate easily, collect signatures from multiple parties, and ensure that every step of the process is documented. These tools enhance productivity and accuracy.

-

Can I integrate airSlate SignNow with other software for managing Form 4797?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, such as accounting and CRM software. This integration allows for better data management and streamlined workflows for Form 4797, ensuring that all relevant information is easily accessible and organized.

-

What are the security measures for using airSlate SignNow with Form 4797?

When using airSlate SignNow for Form 4797, your data is protected by industry-leading security measures, including end-to-end encryption and two-factor authentication. This ensures that sensitive information remains confidential and secure throughout the signing process. Trust in airSlate SignNow means peace of mind for your business.

-

How does airSlate SignNow enable collaboration on Form 4797?

airSlate SignNow fosters collaboration by allowing multiple users to work on Form 4797 simultaneously. Users can send documents for signatures, make comments, and track changes in real time. This collaborative approach enhances efficiency and ensures that all parties are aligned and informed throughout the process.

Get more for Form 4797

- Full text of ampquotirs seminar level 1 form 12027ampquot

- Republic of the philippines for bir bcs department of form

- To be filled out by bir dln form

- California resident income tax return form 540 2ez

- Csf form fill online printable fillable blankpdffiller

- Uhc v form

- Domestic builder unlimited registration application form

- Pdf d0992 order form rap mobility amp functional support products

Find out other Form 4797

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter