50 214 Dec2013 PDF 50 214 Dec2013 Application for Nonprofit Water Supply or Wastewater Service Corporation Property Tax Exemptio Form

What is the 50 214 Dec2013 Application for Nonprofit Water Supply or Wastewater Service Corporation Property Tax Exemption?

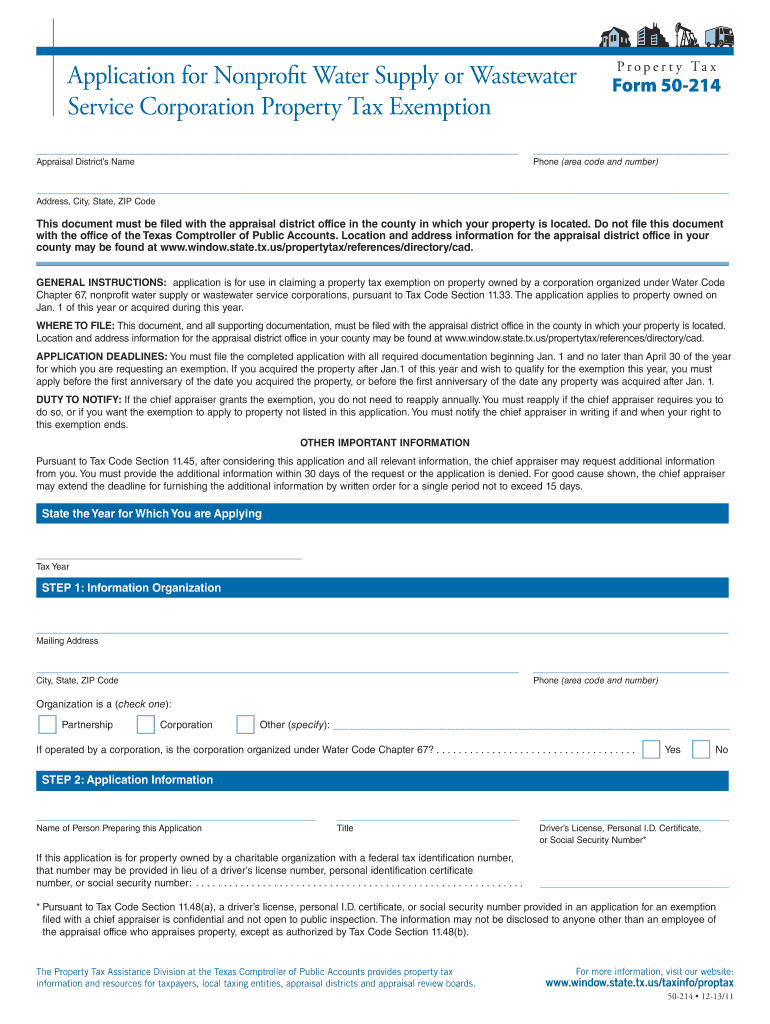

The 50 214 Dec2013 Application is a specific form used by nonprofit water supply or wastewater service corporations in Texas to apply for a property tax exemption. This exemption is designed to relieve qualifying organizations from certain property taxes, thereby supporting their mission to provide essential services to communities. The form requires detailed information about the organization, its operations, and the nature of the services provided to ensure compliance with state regulations.

Steps to Complete the 50 214 Dec2013 Application

Completing the 50 214 Dec2013 Application involves several key steps:

- Gather necessary documentation, including proof of nonprofit status and details about the services offered.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the application to the appropriate local tax authority, either online or via mail, depending on local guidelines.

Eligibility Criteria for the 50 214 Dec2013 Application

To qualify for the property tax exemption under the 50 214 Dec2013 Application, organizations must meet specific eligibility criteria:

- Must be a nonprofit organization providing water supply or wastewater services.

- Must demonstrate that the services provided are essential to the public and not for profit.

- Must comply with all relevant state laws and regulations regarding nonprofit operations.

Required Documents for Submission

When submitting the 50 214 Dec2013 Application, organizations must include several key documents:

- A copy of the organization's articles of incorporation or charter.

- Proof of nonprofit status, such as a 501(c)(3) designation letter from the IRS.

- Documentation detailing the services provided and their impact on the community.

Form Submission Methods

The 50 214 Dec2013 Application can be submitted through various methods, depending on local regulations:

- Online submission through the local tax authority's website, if available.

- Mailing the completed form and required documents to the designated tax office.

- In-person submission at the local tax authority office during business hours.

Legal Use of the 50 214 Dec2013 Application

The legal framework surrounding the 50 214 Dec2013 Application is defined by Texas state law, which outlines the eligibility and requirements for property tax exemptions for nonprofit organizations. It is essential for applicants to understand these laws to ensure compliance and avoid penalties. The application serves as a formal request for exemption, and any misinformation or failure to comply with legal standards may result in denial of the exemption.

Quick guide on how to complete 50 214 dec2013 pdf 50 214 dec2013 application for nonprofit water supply or wastewater service corporation property tax

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Alter and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 50 214 dec2013 pdf 50 214 dec2013 application for nonprofit water supply or wastewater service corporation property tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemption pdf Window Texas?

The 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemption pdf Window Texas is a form used by nonprofit organizations to apply for property tax exemptions related to water supply or wastewater services. This application helps eligible entities reduce their tax burden, allowing them to allocate more resources towards their community services.

-

How can airSlate SignNow assist with the 50 214 Dec2013 pdf application process?

airSlate SignNow streamlines the process of completing the 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemption pdf Window Texas by providing an easy-to-use platform for document preparation and eSigning. Users can fill out the application digitally, ensuring accuracy and efficiency, which can signNowly speed up the submission process.

-

What are the pricing options for using airSlate SignNow for the 50 214 Dec2013 pdf application?

airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for managing the 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemption pdf Window Texas. Plans are designed to accommodate both small organizations and larger entities, ensuring that everyone can benefit from its features.

-

What features does airSlate SignNow provide for the 50 214 Dec2013 pdf application?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of completing the 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemption pdf Window Texas. These tools help ensure that your application is completed accurately and submitted on time.

-

Are there any integrations available with airSlate SignNow for the 50 214 Dec2013 pdf application?

Yes, airSlate SignNow offers integrations with various platforms, allowing users to seamlessly incorporate the 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemption pdf Window Texas into their existing workflows. This flexibility helps organizations manage their documents more efficiently and enhances collaboration among team members.

-

What are the benefits of using airSlate SignNow for the 50 214 Dec2013 pdf application?

Using airSlate SignNow for the 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemption pdf Window Texas provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your sensitive information is protected while simplifying the application process.

-

Can I track the status of my 50 214 Dec2013 pdf application with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemption pdf Window Texas in real-time. This feature provides peace of mind, knowing that you can monitor the progress of your application and receive notifications when it has been signed or completed.

Get more for 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemptio

Find out other 50 214 Dec2013 pdf 50 214 Dec2013 Application For Nonprofit Water Supply Or Wastewater Service Corporation Property Tax Exemptio

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online