2441 Form 2012

What is the 2441 Form

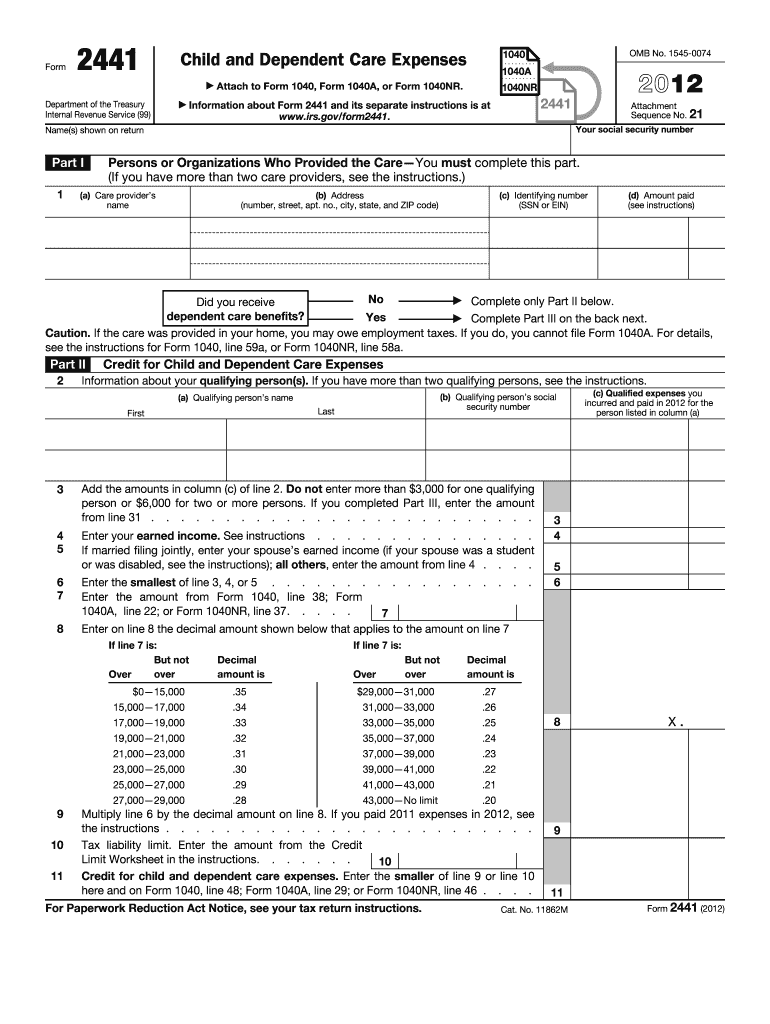

The 2441 Form, officially known as the Child and Dependent Care Expenses form, is a tax document used by taxpayers in the United States to claim a credit for expenses incurred for the care of qualifying individuals. This form is essential for those who pay for childcare or dependent care services, enabling them to reduce their tax liability. The form requires detailed information about the care provider, the amount spent on care, and the relationship of the care recipient to the taxpayer.

How to use the 2441 Form

Using the 2441 Form involves several key steps. First, gather all necessary information, including the names and addresses of care providers, the total amount spent on care, and the Social Security numbers of qualifying individuals. Next, accurately fill out the form, ensuring that all calculations reflect the actual expenses incurred. After completing the form, attach it to your tax return when filing, whether electronically or via mail. It is crucial to keep records of all expenses and provider information in case of an audit.

Steps to complete the 2441 Form

Completing the 2441 Form requires attention to detail. Follow these steps:

- Gather necessary documentation, including receipts and provider information.

- Fill out the taxpayer's information at the top of the form.

- Provide details about the qualifying individuals, including their names and Social Security numbers.

- List the care providers, including their names, addresses, and taxpayer identification numbers.

- Calculate the total care expenses and enter them in the appropriate sections.

- Review the form for accuracy before submission.

Legal use of the 2441 Form

The legal use of the 2441 Form is governed by IRS regulations. To ensure compliance, taxpayers must adhere to specific guidelines regarding eligibility for the child and dependent care credit. This includes meeting income limits, ensuring that care is provided for qualifying individuals, and maintaining accurate records of all expenses. The form must be filed with the taxpayer's annual return to claim the credit legally.

Filing Deadlines / Important Dates

Filing deadlines for the 2441 Form align with the standard tax return deadlines. Typically, taxpayers must submit their forms by April fifteenth of the following year. If additional time is needed, taxpayers can file for an extension, allowing them until October fifteenth to submit their tax returns and accompanying forms. It is essential to be aware of these deadlines to avoid penalties and ensure timely processing of tax credits.

Required Documents

To complete the 2441 Form, certain documents are necessary. These include:

- Receipts or invoices from care providers detailing the services rendered.

- Social Security numbers of qualifying individuals and care providers.

- Records of total expenses incurred for child or dependent care.

Having these documents readily available will facilitate a smoother completion process and ensure accuracy.

Quick guide on how to complete 2441 2012 form

Complete 2441 Form effortlessly on any device

Digital document management has become favored by companies and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle 2441 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign 2441 Form with ease

- Locate 2441 Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign 2441 Form while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2441 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 2441 2012 form

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is a 2441 Form and why do I need it?

The 2441 Form is a critical document used for tax filing, particularly for reporting care expenses for dependents. Using airSlate SignNow to eSign the 2441 Form streamlines the process, ensuring accuracy and compliance. This electronic solution saves time and eliminates paperwork, making tax season much more manageable.

-

How does airSlate SignNow simplify filling out the 2441 Form?

airSlate SignNow simplifies filling out the 2441 Form by providing an intuitive platform for quick document completion. You can easily fill, sign, and send the form electronically, reducing the hassle of paper forms. Our solution also ensures that essential fields are filled accurately, minimizing errors in tax filings.

-

Can I integrate airSlate SignNow with other software for the 2441 Form?

Yes, airSlate SignNow offers robust integrations with various software tools to enhance your workflow for the 2441 Form. This makes it easy to connect with popular accounting, CRM, and productivity tools. These integrations allow for a seamless experience in managing documents and data efficiently.

-

What are the pricing options for using airSlate SignNow for the 2441 Form?

airSlate SignNow offers flexible pricing plans to cater to different business needs for handling the 2441 Form. Plans are designed to be cost-effective while providing extensive features for eSigning and document management. You can choose from monthly or annual subscriptions, ensuring you pay for what you truly need.

-

Is it secure to eSign the 2441 Form with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, fully encrypting all documents, including the 2441 Form. We comply with strict regulations to protect your data, ensuring that your eSignatures are legally binding and secure. You can trust us to safeguard your sensitive information.

-

Can multiple signers collaborate on the 2441 Form using airSlate SignNow?

Yes, airSlate SignNow allows multiple signers to collaborate on the 2441 Form seamlessly. Our platform facilitates easy delegation and tracking of document status, ensuring that everyone involved can contribute efficiently. This feature enhances collaboration and speeds up the signing process.

-

What features does airSlate SignNow offer for managing the 2441 Form?

airSlate SignNow includes features like templates, automated workflows, and real-time tracking to streamline the management of the 2441 Form. You can create reusable templates to save time on future submissions, ensuring consistency and accuracy. These features enhance your overall efficiency.

Get more for 2441 Form

- Non resident tax required to be withheld form

- Form st 108 sales tax affidavit untitled transport trailer office

- T2 tax returnt2 corporate income tax software form

- Form st 101 sales tax resale or exemption certificate

- Dont staple form

- 2016 form canada fin 360web british columbia fill online

- Form st 104hm tax exemption on lodging accommodations and instructions

- Get and sign rc151 2017 2019 form fill out and sign

Find out other 2441 Form

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple