1099 R Form 2010

What is the 1099 R Form

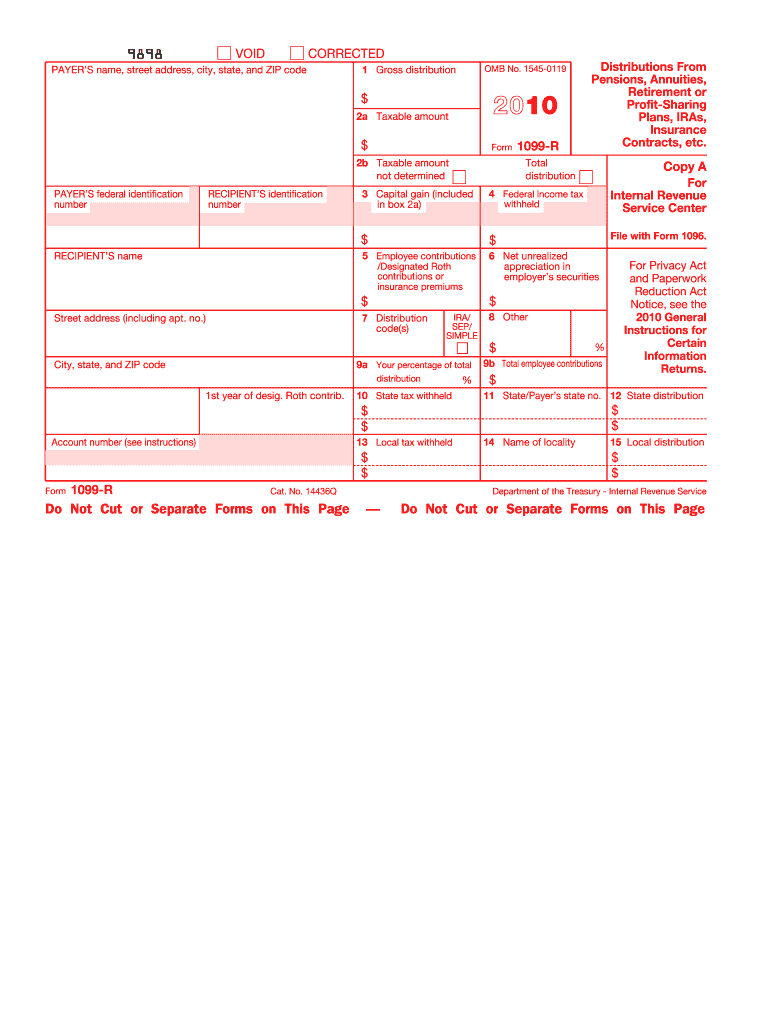

The 1099 R Form is a tax document used in the United States to report distributions from retirement plans, pensions, annuities, and other similar financial products. This form is crucial for individuals who have received payments from these sources, as it provides the Internal Revenue Service (IRS) with necessary information about the amount and type of distribution. Recipients of the 1099 R Form must use it to accurately report their income during tax filing. The form includes details such as the payer's information, the recipient's details, the distribution amount, and any federal income tax withheld.

How to obtain the 1099 R Form

To obtain the 1099 R Form, individuals typically receive it from the financial institution or retirement plan administrator that issued the distribution. It is usually mailed to recipients by January 31 of the year following the distribution. If you do not receive your form by this date, you can contact the issuer directly to request a copy. Additionally, many financial institutions provide electronic access to tax documents through their online portals, allowing users to download the form directly.

Steps to complete the 1099 R Form

Completing the 1099 R Form involves several steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information, including your personal details and the distribution amounts. Next, fill in the form by entering the payer’s information, your identification details, and the specific amounts received. It is essential to check for any federal tax withheld, as this will affect your overall tax liability. Finally, review the completed form for accuracy before submitting it along with your tax return.

Legal use of the 1099 R Form

The legal use of the 1099 R Form is essential for compliance with U.S. tax laws. This form serves as an official record of income received from retirement accounts and is required for accurate tax reporting. Failure to report the income indicated on the 1099 R Form can lead to penalties and interest charges from the IRS. It is important to retain a copy of the form for your records and ensure that all information is reported correctly to avoid any legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 R Form are critical for timely tax compliance. The form must be sent to recipients by January 31 of the year following the distribution. Additionally, the form must be filed with the IRS by February 28 if submitted by mail, or by March 31 if filed electronically. Keeping track of these dates is important to avoid penalties for late filing and to ensure that your tax return is processed smoothly.

Who Issues the Form

The 1099 R Form is issued by various entities, primarily financial institutions, retirement plan administrators, and insurance companies. These organizations are responsible for reporting distributions made to individuals from retirement accounts, pensions, and annuities. It is important for recipients to know the source of their 1099 R Form, as this will help them verify the accuracy of the information reported and ensure that they are compliant with tax obligations.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the 1099 R Form can result in significant penalties. If an individual fails to report income from this form, they may face fines and interest charges from the IRS. Additionally, the IRS may impose penalties on the issuer for failing to provide the form to recipients or for incorrect reporting. Understanding these penalties emphasizes the importance of accurately completing and filing the 1099 R Form in a timely manner.

Quick guide on how to complete 2010 1099 r form

Complete 1099 R Form seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct format and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without interruptions. Handle 1099 R Form on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign 1099 R Form effortlessly

- Locate 1099 R Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunts, or mistakes that necessitate reprinting copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign 1099 R Form to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 1099 r form

Create this form in 5 minutes!

How to create an eSignature for the 2010 1099 r form

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a 1099 R Form and why is it important?

A 1099 R Form is a tax document used to report distributions from pensions, annuities, retirement plans, and other similar accounts. It's important because it helps individuals and the IRS track income that may be taxable. Understanding how to manage and distribute your 1099 R Form can ensure compliance with tax regulations.

-

How does airSlate SignNow simplify the handling of 1099 R Forms?

airSlate SignNow streamlines the process of sending and eSigning your 1099 R Form, making it easy to manage tax documents digitally. With its user-friendly interface, you can quickly upload, customize, and send your forms for electronic signatures. This not only saves time but also enhances document security and tracking.

-

Is there a cost associated with using airSlate SignNow for 1099 R Forms?

Yes, airSlate SignNow offers a range of pricing plans designed to suit different business needs. You can choose a plan based on the volume of documents you handle, including 1099 R Forms. By opting for airSlate SignNow, you gain access to powerful features at a cost-effective price.

-

Can I integrate airSlate SignNow with my current accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms, allowing you to easily manage your 1099 R Form alongside other financial documents. This integration improves workflow efficiency and ensures that all your tax-related documents are organized in one place.

-

What types of documents can I send besides the 1099 R Form?

In addition to the 1099 R Form, airSlate SignNow allows you to send a wide range of documents for electronic signatures, including contracts, agreements, and other tax forms. This versatility makes airSlate SignNow a comprehensive solution for all your document management needs. You can handle all your signing tasks efficiently in one platform.

-

Is airSlate SignNow secure for handling sensitive documents like the 1099 R Form?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive items like the 1099 R Form. The platform uses advanced encryption and security features to protect your data during transmission and storage. You can confidently send and sign documents knowing they are safeguarded against unauthorized access.

-

What is the turnaround time for eSigning a 1099 R Form through airSlate SignNow?

The turnaround time for eSigning a 1099 R Form through airSlate SignNow is typically very quick, often just a few minutes. Recipients receive instant notifications to sign, leading to faster processing times. This efficiency is crucial, especially during tax season when timing is everything.

Get more for 1099 R Form

- Va dmv birth certificate form 112020

- Room tax municipality of anchorage form

- Vat431nb form and notes vat refund for diy housebuildings claim form and notes for new houses

- Form 503 assumed name certificate

- Kansas office of the secretary of state sos ks form

- Illinois articles of merger form

- Vision test report mv 619 520 form

- For faster processing the required statement for most corporations can be filed online at bizfile form

Find out other 1099 R Form

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template