T3ret Fillable Form 2016

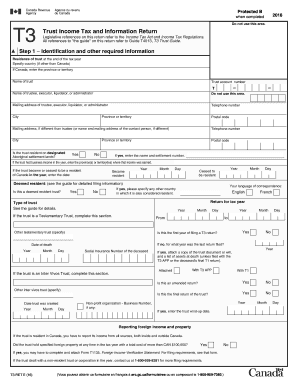

What is the T3ret Fillable Form

The T3ret Fillable Form is a specific document used primarily for reporting income and expenses related to certain financial activities. This form is essential for individuals and businesses that need to disclose their earnings accurately to the Internal Revenue Service (IRS). It serves as a vital tool for tax compliance and ensures that all financial information is reported in a standardized manner.

How to use the T3ret Fillable Form

Using the T3ret Fillable Form involves several straightforward steps. First, you need to download the form from a reliable source. Once you have the form, you can fill it out digitally, which allows for easier editing and submission. Make sure to provide accurate information in all required fields, as errors can lead to delays or complications in processing. After completing the form, review it thoroughly before submitting it to ensure all details are correct.

Steps to complete the T3ret Fillable Form

Completing the T3ret Fillable Form can be broken down into a few essential steps:

- Download the form from a trusted source.

- Open the form using a compatible PDF reader or editor.

- Carefully fill in all required fields, ensuring accuracy.

- Double-check the information for any errors or omissions.

- Save the completed form securely.

- Submit the form according to the specified submission methods.

Legal use of the T3ret Fillable Form

The legal use of the T3ret Fillable Form is crucial for ensuring compliance with tax regulations. When filled out correctly, this form serves as a legally binding document that can be used in case of audits or disputes with the IRS. It is important to adhere to all guidelines and requirements set forth by the IRS to avoid any legal repercussions.

Key elements of the T3ret Fillable Form

Several key elements must be included in the T3ret Fillable Form to ensure its validity:

- Personal Information: This includes the name, address, and Social Security number of the individual or business.

- Income Details: Accurate reporting of all income sources is necessary.

- Expense Reporting: Any deductible expenses should be clearly outlined.

- Signature: A valid signature is required to authenticate the form.

Form Submission Methods

The T3ret Fillable Form can be submitted through various methods to accommodate different preferences. Users can choose to file the form online, which is often the quickest option. Alternatively, it can be mailed to the appropriate IRS address or submitted in person at designated locations. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete 2000 t3ret fillable form 2016

A concise manual on how to create your T3ret Fillable Form

Locating the appropriate template can prove to be difficult when you need to submit official foreign paperwork. Even when you possess the necessary form, it can be tedious to swiftly prepare it in accordance with all the specifications if you utilize paper copies rather than handling everything digitally. airSlate SignNow is the online electronic signature platform that assists you in navigating through this process. It allows you to acquire your T3ret Fillable Form and promptly fill it out and sign it on-site without having to reprint documents each time you make an error.

Here are the steps you should follow to prepare your T3ret Fillable Form with airSlate SignNow:

- Click the Get Form button to instantly import your document to our editor.

- Begin with the first vacant field, enter your information, and proceed with the Next function.

- Complete the empty boxes using the Cross and Check options from the toolbar above.

- Select the Highlight or Line tools to emphasize the crucial information.

- Click on Image and upload one if your T3ret Fillable Form necessitates it.

- Utilize the right-side panel to add additional fields for yourself or others to fill out if needed.

- Review your responses and validate the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the modifications to the form by clicking the Done button and selecting your file-sharing preferences.

Once your T3ret Fillable Form is prepared, you can share it in your preferred manner - dispatch it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documentation in your account, organized into folders according to your choices. Don’t spend time on manual document completion; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct 2000 t3ret fillable form 2016

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

Create this form in 5 minutes!

How to create an eSignature for the 2000 t3ret fillable form 2016

How to make an eSignature for your 2000 T3ret Fillable Form 2016 in the online mode

How to create an eSignature for your 2000 T3ret Fillable Form 2016 in Google Chrome

How to make an eSignature for putting it on the 2000 T3ret Fillable Form 2016 in Gmail

How to create an eSignature for the 2000 T3ret Fillable Form 2016 straight from your mobile device

How to create an electronic signature for the 2000 T3ret Fillable Form 2016 on iOS devices

How to make an electronic signature for the 2000 T3ret Fillable Form 2016 on Android OS

People also ask

-

What is a T3ret Fillable Form?

A T3ret Fillable Form is a customizable document designed to streamline data collection and signatures. With airSlate SignNow, you can create and manage T3ret Fillable Forms that are easy to fill out, ensuring a smoother workflow for your business.

-

How can I create a T3ret Fillable Form using airSlate SignNow?

Creating a T3ret Fillable Form with airSlate SignNow is simple. Just log in to your account, select the 'Create Form' option, and utilize our intuitive drag-and-drop interface to add fields, such as text boxes and signature sections, to your form.

-

What are the benefits of using a T3ret Fillable Form?

Using a T3ret Fillable Form can signNowly enhance your business efficiency. It allows for automated data collection, reduces the risk of errors, and speeds up the signing process, ultimately saving time and improving customer satisfaction.

-

Is there a cost associated with using T3ret Fillable Forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can access T3ret Fillable Forms at an affordable rate, with options for both individuals and teams, ensuring you only pay for the features you need.

-

Can I integrate T3ret Fillable Forms with other applications?

Yes, airSlate SignNow allows seamless integration of T3ret Fillable Forms with various applications. You can connect with popular platforms like Google Drive, Salesforce, and more, enabling a cohesive workflow across your business tools.

-

Are T3ret Fillable Forms secure?

Absolutely! airSlate SignNow prioritizes the security of your T3ret Fillable Forms. We implement advanced encryption and comply with industry standards to ensure your data and documents remain safe and confidential.

-

What types of businesses can benefit from T3ret Fillable Forms?

T3ret Fillable Forms are versatile and can benefit a wide range of businesses, from small startups to large enterprises. Any organization that needs to collect information and signatures efficiently can take advantage of the features offered by airSlate SignNow.

Get more for T3ret Fillable Form

- Form 4561 city of chula vista chulavistaca

- Attestation d hebergement form

- Security screening certificate and briefing form

- West virginia wic program prescription formula form ons wvdhhr

- Course attendance form graduate school tu delft medewerkers

- End of year staff appraisal form government of belize

- Expanded adept 4 0 formative observation form updated

- Diploma replacement form columbia southern university columbiasouthern

Find out other T3ret Fillable Form

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer