Notification by an Employer of an Employee Who Commences to Be Employed IR56E Notification by an Employer of an Employee Who Com 2014

What is the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com

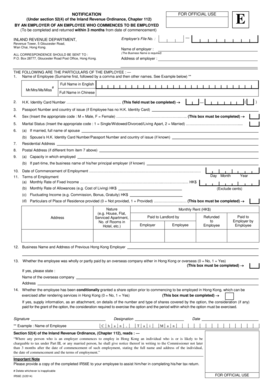

The Notification By An Employer Of An Employee Who Commences To Be Employed IR56E is a formal document used by employers to report the commencement of employment for new employees. This notification is essential for compliance with tax regulations and ensures that the employee's tax obligations are accurately recorded. It typically includes details such as the employee's name, Social Security number, start date, and job title. Properly completing this form is crucial for both the employer and employee to avoid potential legal issues.

Steps to Complete the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com

Completing the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E involves several key steps:

- Gather necessary information: Collect the employee's personal details, including their full name, Social Security number, and contact information.

- Fill out the form: Accurately input all required information into the form, ensuring that there are no errors or omissions.

- Review the form: Double-check all entries for accuracy. Incomplete or incorrect forms may lead to penalties or delays.

- Submit the form: Follow the appropriate submission method, which may include online submission or mailing the completed form to the relevant tax authority.

Legal Use of the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com

The legal use of the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E is essential for maintaining compliance with tax laws. Employers are required to submit this notification to report new hires, which helps in tracking employment and tax responsibilities. Failure to submit this form can result in penalties, including fines or legal action. Employers must ensure that the information provided is accurate and submitted within the designated time frame to avoid complications.

Key Elements of the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com

Key elements of the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E include:

- Employee Information: Full name, Social Security number, and address.

- Employment Details: Job title, start date, and employment type (full-time or part-time).

- Employer Information: Company name, address, and employer identification number (EIN).

- Signature: The form must be signed by an authorized representative of the employer to validate the information provided.

Form Submission Methods

There are several methods available for submitting the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E. Employers can choose to:

- Submit Online: Many states and tax authorities offer online submission options, which can be more efficient and faster.

- Mail the Form: Employers can complete the form and send it via postal service to the appropriate tax authority.

- In-Person Submission: Some employers may prefer to deliver the form in person at local tax offices, ensuring immediate receipt.

Penalties for Non-Compliance

Non-compliance with the Notification By An Employer Of An Employee Who Commences To Be Employed IR56E can lead to significant penalties. These may include:

- Fines: Employers may incur monetary fines for failing to submit the notification on time or for providing inaccurate information.

- Legal Action: Persistent non-compliance can result in legal consequences, including audits or investigations by tax authorities.

- Increased Scrutiny: Employers may face increased scrutiny from tax authorities, leading to more frequent audits and reviews.

Quick guide on how to complete notification by an employer of an employee who commences to be employed ir56e notification by an employer of an employee who

A concise guide on how to create your Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com

Locating the appropriate template can be daunting when you are required to provide official international paperwork. Even when you possess the necessary form, it might be challenging to swiftly fill it out according to all the specifications if you are using paper forms instead of handling everything digitally. airSlate SignNow is the digital signature platform that assists you in overcoming those hurdles. It allows you to obtain your Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com and promptly complete and endorse it on-site without the need to reprint documents when you make an error.

Here are the procedures you must follow to prepare your Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com with airSlate SignNow:

- Press the Get Form button to quickly add your document to our editor.

- Begin with the first unfilled field, enter your information, and continue with the Next tool.

- Complete the empty sections using the Cross and Check options from the toolbar above.

- Select the Highlight or Line tools to mark the most crucial details.

- Click on Image to upload one if your Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com requires it.

- Utilize the right-hand pane to add more fields for you or others to complete if needed.

- Review your responses and confirm the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing the form by clicking the Done button and selecting your file-sharing preferences.

Once your Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com is completed, you can distribute it as you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed paperwork in your account, organized in folders according to your preferences. Don’t waste time on manual document completion; experience airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct notification by an employer of an employee who commences to be employed ir56e notification by an employer of an employee who

FAQs

-

Is an employer obligated to provide paid maternity leave for a full-time employee who is pregnant by way of being a paid surrogate mother?

Your Quora bio indicates that you live in the United States. The laws on paid maternity leave vary signNowly, depending on what country you’re located in. Here is the legal rule for your jurisdiction:Employers in the United States are not legally obligated to provide paid maternity leave for any of their employees. It does not matter if the employee is full-time or part-time. It does not matter whether she is a surrogate mother or not. It does not matter if the employee develops a pregnancy-related medical condition that renders her unable to perform the essential functions of her position. If she is not working, the employer is not required to pay her.An employee who develops a pregnancy-related medical condition that requires her to go on leave may be covered by the employer’s ordinary sick-leave policy. (The state of California, where you live, requires all employers to offer their employees a certain amount of paid sick leave.) But once the employee’s paid sick leave is used up, it’s gone. If the employee has two weeks of paid sick leave available, and the employee needs six weeks of maternity leave, she will be on unpaid leave for four of those six weeks.The Family and Medical Leave Act (FMLA) gives most full-time employees the legal right to take up to twelve weeks of unpaid leave per year for pregnancy and childbirth. But the FMLA does not provide paid leave. It means only that the employee’s job will still be waiting for her when she’s ready to return to work.California has a pair of statutes that operate as a state-law analog to the FMLA. Like the FMLA, these statutes require the employer to give the employee only unpaid leave.

-

What is the minimum salary of a junior employee who is sent by an employer in Singapore overseas to work?

There is no stipulated minimum, I have seen incredibly terrible compensation of people posted overseas. Generally speaking, you can be bullied into such a position that working abroad cost more than what you are paid. Some employers will try to get away with this, and I feel it's the employee's fault if they allow this.Research the cost, ask for a better payout, or reject the assignment, if you don't get covered sufficiently. Noone will look after your interests in life, except your parents.

-

As an employer, how do you feel about employees who take their lunch breaks later in the day to “make the rest of the day go by faster”?

Hmmmm. This is a little circular for me: I’m an employer, and I take my lunch later in the day for that exact reason…. How to answer!?I never really paid much attention to when the people I managed took their lunch breaks—and I’ve never bumped into a situation where people drew attention to my schedule, either.I suppose a disadvantage to both early- and late-lunch-takers is that there is a longer span of the day when not everyone is working together. People who come back from lunch at noon, with others who come back at 2:00 leave about three hours of the work day less than 100% covered…. But even if everyone took their lunch at the same time, there would be zero percent coverage during that time, so….Different lunch breaks can make scheduling meetings around the lunch hour more difficult—but it’s never risen to the point of a problem for me.

-

Do companies who offer IVF as part of their health insurance require an employee to have been employed by them for a certain amount of time before being able to use this benefit?

As a practical matter, the IVF benefit would be available to everyone enrolled in the plan. The only way to withhold the benefit based upon length of service would be to have a long waiting period before allowing new employees to enroll. Under the Affordable Care Act, employers cannot have a waiting period longer than 90 days.

-

As an H-1B employee, how do I make sure not to be exploited by the employer?

There is not much you can do about this if the employer’s intention is to keep more than their fair share of the total money the end client is paying for you. Your only course of action is to find a new employer, who will act better and willing to take over your H-1B visa and do all the right things for you. Unfortunately, if you are working for any sweatshop, your more than 99% likely that you are being exploited.

-

As a successful self employed person who started out as an employee, how much do you value the contribution of your employment experience to your success?

Sorry, never faced this. I have always been employed and have been attached to various organizations. So I am not fit to share my experience. But from what I have heard from others: Each workplace contributes to a person's growth, with respect to skillset, professional skills and even attitude. A workplace environment grooms a person, and soon s/he picks up habits which will last for life.

-

Do perspective employers have access to some sort of database if an employee was fired or is the only way they could find out by contacting the perspective employee’s last employer?

There is no database (in the US), and most companies will not provide that information (liability issues).But ….There are still tons of ways for an employer find out. Outside of the information being given from the employer (even if they are not supposed too), they can find out from your references, signNow out to others via LinkedIn, etc. Just because they can’t come out and ask directly, don’t assume they can’t find out.My recommendation is always deal forthright with issues like this, and be prepared to speak to it. Even if you were fired for cause, you can explain the situation, what you learned from it, and how you have handled it so it will not happen again. Obviously this will not work if you were stealing from the company, or doing something illegal or dangerous, but in the case of performance problems and normal situations you can turn the negative around fairly simply.This strategy has the added benefit that you don’t have to worry about anyone found out :)Good Luck!

Create this form in 5 minutes!

How to create an eSignature for the notification by an employer of an employee who commences to be employed ir56e notification by an employer of an employee who

How to generate an eSignature for your Notification By An Employer Of An Employee Who Commences To Be Employed Ir56e Notification By An Employer Of An Employee Who in the online mode

How to make an eSignature for your Notification By An Employer Of An Employee Who Commences To Be Employed Ir56e Notification By An Employer Of An Employee Who in Chrome

How to make an electronic signature for signing the Notification By An Employer Of An Employee Who Commences To Be Employed Ir56e Notification By An Employer Of An Employee Who in Gmail

How to make an eSignature for the Notification By An Employer Of An Employee Who Commences To Be Employed Ir56e Notification By An Employer Of An Employee Who right from your mobile device

How to generate an eSignature for the Notification By An Employer Of An Employee Who Commences To Be Employed Ir56e Notification By An Employer Of An Employee Who on iOS

How to make an electronic signature for the Notification By An Employer Of An Employee Who Commences To Be Employed Ir56e Notification By An Employer Of An Employee Who on Android

People also ask

-

What is a Notification By An Employer Of An Employee Who Commences To Be Employed IR56E?

A Notification By An Employer Of An Employee Who Commences To Be Employed IR56E is a formal document required by the tax authorities in certain regions. This notification indicates that an employee has started working, enabling proper tax and contribution assessments. It is essential for compliance and helps avoid any legal repercussions.

-

How does airSlate SignNow simplify the process of sending IR56E notifications?

airSlate SignNow streamlines the process of sending Notifications By An Employer Of An Employee Who Commences To Be Employed IR56E by providing a user-friendly platform for eSigning and document management. The software allows employers to quickly prepare, send, and track these notifications, ensuring timely submissions. This enhances efficiency and ensures compliance with regulatory requirements.

-

What are the key features of airSlate SignNow for managing employee notifications?

Key features of airSlate SignNow include document templates, real-time tracking of signatures, and easy integration with various business systems. These features enable effective management of Notifications By An Employer Of An Employee Who Commences To Be Employed IR56E. Additionally, the platform supports bulk sending, which can save employers signNow time during onboarding.

-

Is airSlate SignNow cost-effective for small businesses needing IR56E notifications?

Yes, airSlate SignNow offers scalable pricing plans suitable for small businesses requiring Notifications By An Employer Of An Employee Who Commences To Be Employed IR56E. The pricing structure is flexible, making it affordable for businesses of all sizes. Investing in this platform can save time and reduce costs associated with manual documentation.

-

Can airSlate SignNow integrate with other HR software for processing notifications?

Absolutely, airSlate SignNow can integrate seamlessly with various HR software systems. This integration enables the automatic creation and sending of Notifications By An Employer Of An Employee Who Commences To Be Employed IR56E. It fosters better workflow between HR and compliance teams, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for IR56E notifications?

Using airSlate SignNow for Notifications By An Employer Of An Employee Who Commences To Be Employed IR56E offers numerous benefits, including increased speed, accuracy, and compliance. The platform reduces paper usage and errors associated with manual processing. Additionally, features like automatic reminders ensure that deadlines are met.

-

How secure is airSlate SignNow for handling sensitive employee documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This security ensures that Notifications By An Employer Of An Employee Who Commences To Be Employed IR56E and other sensitive documents are safely handled. Users can have confidence that their data is protected throughout the signing process.

Get more for Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com

- Rattlesnakes and men michael bishop correctedqxd form

- Security guard unarmed training verification arizona department of licensing azdps form

- Exhibit b job placement agreement form doc

- Affidavit of authorization form

- Skin surgery consent form docx

- Paid parental leave application 6 09doc bmcc cuny form

- Haccp plan for soup form

- Drama camp registration form jacksonville state university jsu

Find out other Notification By An Employer Of An Employee Who Commences To Be Employed IR56E Notification By An Employer Of An Employee Who Com

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy