Arizona Foster Care Tax Credit Donate & Reduce Your 2023

Understanding the Arizona Foster Care Tax Credit

The Arizona Foster Care Tax Credit is a program designed to encourage donations to qualified foster care organizations. This tax credit allows individuals to receive a dollar-for-dollar reduction in their state tax liability, making it a financially beneficial way to support children in foster care. The credit is available to both individuals and couples filing jointly, providing an opportunity to make a significant impact on the lives of foster children while also benefiting from tax savings.

Eligibility Criteria for the Arizona Foster Care Tax Credit

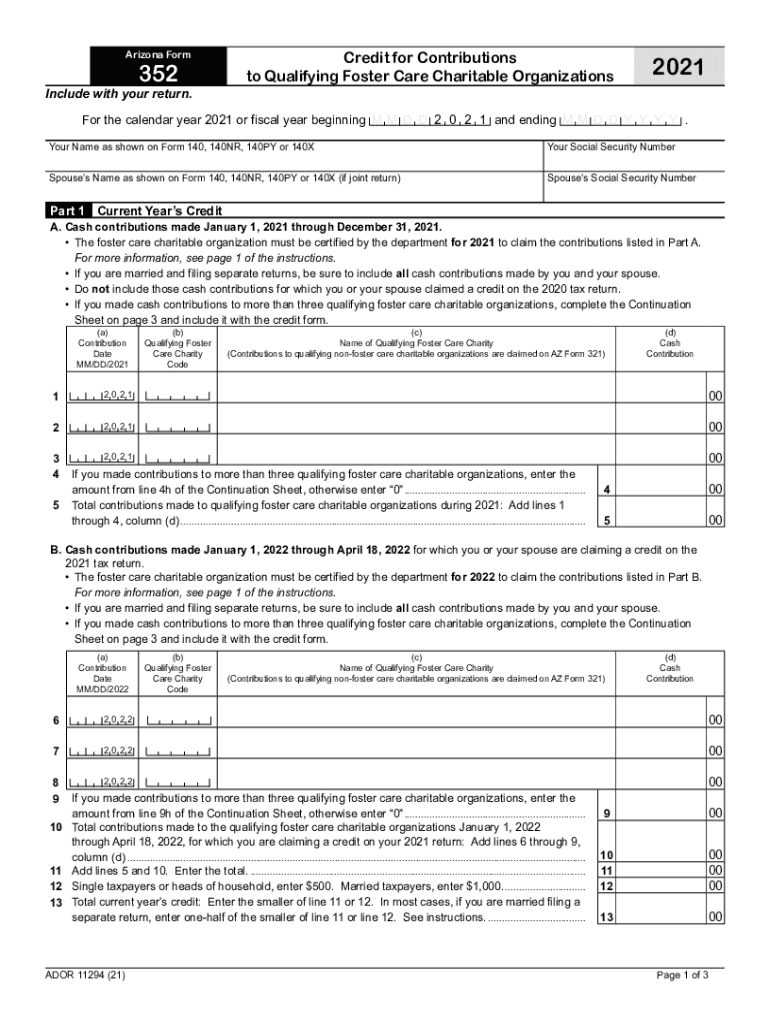

To qualify for the Arizona Foster Care Tax Credit, donors must ensure that their contributions are made to an eligible foster care organization. These organizations must be certified by the Arizona Department of Economic Security. Additionally, there are limits on the amount that can be claimed based on filing status:

- Individuals can claim up to $500.

- Married couples filing jointly can claim up to $1,000.

It is essential for donors to retain receipts and documentation of their contributions, as these will be required when filing state taxes.

Steps to Claim the Arizona Foster Care Tax Credit

Claiming the Arizona Foster Care Tax Credit involves a straightforward process. First, donors should ensure their contributions are made to a qualifying organization. Following the donation, donors must complete the appropriate forms when filing their state taxes. The key steps include:

- Gathering documentation of the donation.

- Completing Arizona Form 321, which is specifically for claiming the foster care tax credit.

- Submitting the form along with your state tax return.

It is advisable to consult a tax professional if there are any uncertainties regarding the process or eligibility.

Required Documents for the Arizona Foster Care Tax Credit

When claiming the Arizona Foster Care Tax Credit, specific documents are necessary to substantiate the donation. Donors should keep the following on hand:

- Receipts or acknowledgment letters from the foster care organization.

- A completed Arizona Form 321.

- Any additional documentation required by the Arizona Department of Revenue.

Having these documents organized will facilitate a smoother tax filing process and ensure compliance with state regulations.

Examples of Using the Arizona Foster Care Tax Credit

Utilizing the Arizona Foster Care Tax Credit can take various forms, depending on the donor's financial situation. For instance:

- A single taxpayer who donates $500 to a qualified organization can reduce their state tax liability by the same amount.

- A married couple donating $1,000 can similarly reduce their tax liability, providing significant savings while supporting a worthy cause.

These examples illustrate how the tax credit not only aids foster care organizations but also provides tangible financial benefits to donors.

Filing Deadlines for the Arizona Foster Care Tax Credit

It is crucial to be aware of the filing deadlines associated with the Arizona Foster Care Tax Credit. Generally, the tax return must be filed by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may extend to the next business day. Donors should ensure that their contributions are made before this deadline to qualify for the credit on their upcoming tax return.

Quick guide on how to complete arizona foster care tax credit donate ampamp reduce your

Effortlessly Prepare Arizona Foster Care Tax Credit Donate & Reduce Your on Any Device

Digital document management has gained signNow popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary format and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Manage Arizona Foster Care Tax Credit Donate & Reduce Your on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and eSign Arizona Foster Care Tax Credit Donate & Reduce Your with Ease

- Obtain Arizona Foster Care Tax Credit Donate & Reduce Your and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark essential sections of your documents or obscure confidential information with the tools that airSlate SignNow provides specifically for that reason.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Arizona Foster Care Tax Credit Donate & Reduce Your and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona foster care tax credit donate ampamp reduce your

Create this form in 5 minutes!

How to create an eSignature for the arizona foster care tax credit donate ampamp reduce your

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Foster Care Tax Credit?

The Arizona Foster Care Tax Credit allows taxpayers to make donations to qualified foster care organizations and receive a dollar-for-dollar tax credit. This means that you can donate and reduce your tax liability while supporting children in need. By participating, you can make a signNow impact on the lives of foster children in Arizona.

-

How can I donate to qualify for the Arizona Foster Care Tax Credit?

To qualify for the Arizona Foster Care Tax Credit, you need to donate to a qualified foster care organization. Ensure that the organization is recognized by the Arizona Department of Revenue. Once you make your donation, you can claim the credit on your state tax return, allowing you to donate and reduce your tax burden effectively.

-

What are the benefits of the Arizona Foster Care Tax Credit?

The primary benefit of the Arizona Foster Care Tax Credit is the ability to reduce your state tax liability while supporting a worthy cause. Additionally, your contributions help provide essential services and support to foster children in Arizona. This tax credit not only benefits you financially but also positively impacts the community.

-

Is there a limit to how much I can donate for the Arizona Foster Care Tax Credit?

Yes, there are limits to the amount you can donate for the Arizona Foster Care Tax Credit. For individuals, the maximum credit is typically $500, while married couples filing jointly can claim up to $1,000. It's important to check the latest guidelines from the Arizona Department of Revenue to ensure you maximize your donation and tax benefits.

-

How does airSlate SignNow facilitate donations for the Arizona Foster Care Tax Credit?

airSlate SignNow provides an easy-to-use platform for organizations to manage donations efficiently. With our eSigning capabilities, donors can quickly complete necessary documentation for the Arizona Foster Care Tax Credit. This streamlines the donation process, making it simpler for you to donate and reduce your tax liability.

-

Can I use the Arizona Foster Care Tax Credit if I live outside of Arizona?

Unfortunately, the Arizona Foster Care Tax Credit is only available to residents of Arizona. However, if you have ties to the state or support foster care initiatives elsewhere, you can still contribute to those causes. Always consult with a tax professional to understand your eligibility for various tax credits.

-

What types of organizations qualify for the Arizona Foster Care Tax Credit?

Qualified organizations for the Arizona Foster Care Tax Credit include those that provide care and services to children in foster care. These organizations must be certified by the Arizona Department of Revenue. Donating to these organizations allows you to support foster children while benefiting from the tax credit.

Get more for Arizona Foster Care Tax Credit Donate & Reduce Your

- Letter tenant about sample 497310825 form

- 30 day notice to terminate tenancy at will for residential from landlord to tenant maine form

- Maine lease form

- Maine 30 form

- 7 day to pay rent or lease terminates nonresidential or commercial maine form

- Maine 7 day notice form

- Assignment of mortgage by individual mortgage holder maine form

- Assignment of mortgage by corporate mortgage holder maine form

Find out other Arizona Foster Care Tax Credit Donate & Reduce Your

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast