Form CT 3 ABC 2023

What is the Form CT 3 ABC

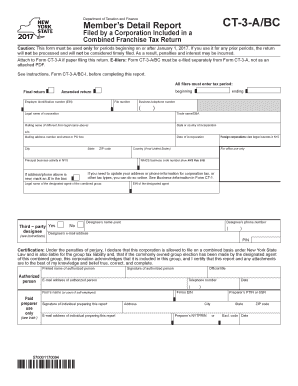

The Form CT 3 ABC is a tax form used in the United States, specifically for corporate tax reporting. It is essential for corporations to report their income, deductions, and credits to the appropriate tax authorities. This form is part of the Connecticut corporate tax filing requirements and is used to calculate the corporation's tax liability based on its net income. Understanding the purpose and requirements of Form CT 3 ABC is crucial for compliance and accurate tax reporting.

How to use the Form CT 3 ABC

Using the Form CT 3 ABC involves several steps to ensure accurate completion and submission. Initially, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with the required financial details, ensuring that all figures are accurate and reflect the corporation's financial activities for the tax year. After completing the form, review it for any errors or omissions before submitting it to the state tax authority. This careful process helps avoid potential penalties and ensures compliance with state tax regulations.

Steps to complete the Form CT 3 ABC

Completing the Form CT 3 ABC requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, including profit and loss statements.

- Fill in the corporation's identifying information at the top of the form.

- Report total income, including gross receipts and other income sources.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the net income by subtracting deductions from total income.

- Determine the tax liability based on the net income and applicable tax rates.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 3 ABC are critical for compliance. Corporations typically must submit this form by the fifteenth day of the fourth month following the end of their fiscal year. For those operating on a calendar year, this means the deadline is April 15. It is essential to be aware of these deadlines to avoid late fees and penalties. Additionally, if a corporation requires an extension, it must file the appropriate extension request before the original deadline.

Required Documents

When preparing to file the Form CT 3 ABC, certain documents are necessary to ensure accurate reporting. These documents typically include:

- Financial statements, including balance sheets and income statements.

- Records of all income sources, including sales and investments.

- Documentation for all deductions claimed, such as receipts for business expenses.

- Previous year’s tax returns for reference and consistency.

Having these documents ready can streamline the filing process and enhance accuracy.

Penalties for Non-Compliance

Failure to comply with the filing requirements for Form CT 3 ABC can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal repercussions for the corporation. It is crucial for businesses to file their forms accurately and on time to avoid these consequences. Understanding the implications of non-compliance can motivate timely and correct submissions, safeguarding the corporation's financial health.

Quick guide on how to complete form ct 3 abc

Complete Form CT 3 ABC seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Form CT 3 ABC on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form CT 3 ABC effortlessly

- Obtain Form CT 3 ABC and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the document or redact sensitive details using tools that airSlate SignNow has developed specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal weight as a traditional hand-signed signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form CT 3 ABC to ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 abc

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 abc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 3 ABC?

Form CT 3 ABC is a tax form used by corporations in Connecticut to report their income and calculate their tax liability. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with Form CT 3 ABC?

airSlate SignNow simplifies the process of completing and eSigning Form CT 3 ABC by providing an intuitive platform for document management. Users can easily fill out the form, add electronic signatures, and securely send it to relevant parties.

-

Is there a cost associated with using airSlate SignNow for Form CT 3 ABC?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that streamline the completion and submission of Form CT 3 ABC, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for Form CT 3 ABC?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure cloud storage, all of which enhance the experience of working with Form CT 3 ABC. These tools help ensure that your documents are accurate and compliant.

-

Can I integrate airSlate SignNow with other software for Form CT 3 ABC?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling Form CT 3 ABC. This ensures that your data is synchronized across platforms, enhancing efficiency.

-

What are the benefits of using airSlate SignNow for Form CT 3 ABC?

Using airSlate SignNow for Form CT 3 ABC provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows businesses to manage their documents digitally, saving time and resources.

-

Is airSlate SignNow secure for handling Form CT 3 ABC?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form CT 3 ABC and other documents are protected. The platform employs advanced encryption and security measures to safeguard sensitive information.

Get more for Form CT 3 ABC

- Fastpitch roster sanction form usfatncom

- Esic form 25 download

- Haushaltsbescheinigung form

- Soccer referee evaluation form

- In each of the following pairs circle the form of radiation with the longer wavelength

- Guest parking pass guest parking pass reflections at hidden lake form

- Apply for an ardf grantthe anglican relief and form

Find out other Form CT 3 ABC

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors