Prepay California 540nr Taxes 2018-2026

What is the Prepay California 540nr Taxes

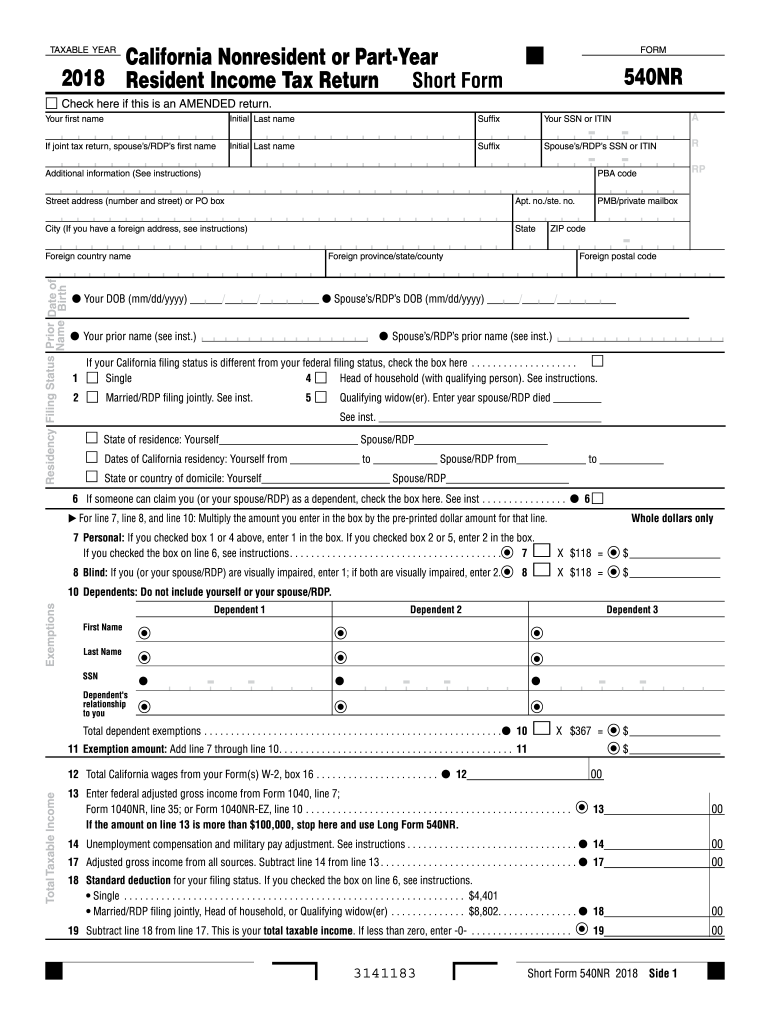

The Prepay California 540nr Taxes refers to the advance payment of state income taxes for non-residents who earn income in California. This prepayment is essential for individuals who may not meet the minimum filing thresholds but still have California-source income. By prepaying, taxpayers can avoid penalties and interest that may accrue from underpayment. Understanding this process is crucial for effective tax management and compliance with California tax laws.

Steps to complete the Prepay California 540nr Taxes

Completing the Prepay California 540nr Taxes involves several straightforward steps:

- Gather necessary financial documents, including income statements and any relevant tax forms.

- Determine your California-source income to assess your tax obligation.

- Fill out the California non-resident tax form 540NR, ensuring all fields are accurately completed.

- Calculate the estimated tax due based on your income and applicable tax rates.

- Submit your payment electronically or via mail, ensuring it is postmarked by the due date.

Required Documents

To successfully complete the Prepay California 540nr Taxes, you will need the following documents:

- Wage and income transcripts, which detail your earnings.

- Any 1099 forms that report additional income sources.

- Previous year’s tax return for reference.

- Any relevant deductions or credits that may apply to your situation.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Prepay California 540nr Taxes to avoid penalties. Typically, the prepayment is due on April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Always check the California Franchise Tax Board website for the most current dates and any changes that may occur.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Prepay California 540nr Taxes. These methods include:

- Online submission through the California Franchise Tax Board's e-file system.

- Mailing a paper form to the appropriate address provided by the tax board.

- In-person submission at designated tax offices, though this option may vary by location.

Penalties for Non-Compliance

Failure to comply with the Prepay California 540nr Taxes can result in significant penalties. Taxpayers may face fines for underpayment, which can accumulate interest over time. Additionally, late filing can lead to further complications, including increased scrutiny from tax authorities. It is crucial to adhere to all filing requirements and deadlines to maintain compliance and avoid unnecessary financial burdens.

Quick guide on how to complete california 540nr transcript 2018 2019 form

Your assistance manual on how to prepare your Prepay California 540nr Taxes

If you’re curious about how to fill out and submit your Prepay California 540nr Taxes, below are some brief guidelines on how to make tax reporting less challenging.

To begin, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and effective document solution that enables you to modify, draft, and finalize your tax files effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to adjust answers as needed. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Complete the following steps to finish your Prepay California 540nr Taxes in no time:

- Create your account and start editing PDFs in a matter of minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Prepay California 540nr Taxes in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Examine your document and amend any inaccuracies.

- Save modifications, print your copy, send it to your addressee, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may lead to return errors and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct california 540nr transcript 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the california 540nr transcript 2018 2019 form

How to create an eSignature for your California 540nr Transcript 2018 2019 Form online

How to make an electronic signature for the California 540nr Transcript 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the California 540nr Transcript 2018 2019 Form in Gmail

How to make an eSignature for the California 540nr Transcript 2018 2019 Form right from your smartphone

How to create an electronic signature for the California 540nr Transcript 2018 2019 Form on iOS devices

How to make an electronic signature for the California 540nr Transcript 2018 2019 Form on Android OS

People also ask

-

What are the benefits of using airSlate SignNow to Prepay California 540nr Taxes?

Using airSlate SignNow to Prepay California 540nr Taxes simplifies the process of managing your tax documents. It offers an easy-to-use platform that allows you to send, sign, and store documents securely. Plus, you can save time and reduce errors by managing everything electronically.

-

How does airSlate SignNow ensure the security of my Prepay California 540nr Taxes documents?

airSlate SignNow employs advanced encryption and security protocols to protect your Prepay California 540nr Taxes documents. Our platform is compliant with industry standards, ensuring that your sensitive tax information is safe from unauthorized access.

-

Is there a trial period available for airSlate SignNow when Prepaying California 540nr Taxes?

Yes, airSlate SignNow offers a trial period that allows users to explore the platform before committing. This is a great opportunity to test the features and see how they can streamline your Prepay California 540nr Taxes process.

-

Can I integrate airSlate SignNow with my existing accounting software for Prepay California 540nr Taxes?

Absolutely! airSlate SignNow can be integrated with various accounting software solutions, making it easy to manage your Prepay California 540nr Taxes seamlessly. This integration helps you maintain organized records and ensures that your tax documents are easily accessible.

-

What features does airSlate SignNow offer for managing Prepay California 540nr Taxes?

airSlate SignNow provides features such as document templates, real-time tracking, and customizable workflows specifically for Prepay California 540nr Taxes. These tools help streamline the signing process and enhance collaboration among all parties involved.

-

How much does it cost to use airSlate SignNow for Prepay California 540nr Taxes?

The pricing for airSlate SignNow varies based on the plan you choose, but it offers competitive rates that are cost-effective for managing Prepay California 540nr Taxes. You can select a plan that fits your budget and business needs, ensuring you get the best value.

-

What types of documents can I send when Prepaying California 540nr Taxes with airSlate SignNow?

With airSlate SignNow, you can send a wide range of documents related to Prepay California 540nr Taxes, including tax forms, agreements, and receipts. Our platform supports various file formats, making it versatile for all your tax-related documentation needs.

Get more for Prepay California 540nr Taxes

Find out other Prepay California 540nr Taxes

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement