California 540nr Transcript Form 2016

What is the California 540nr Transcript Form

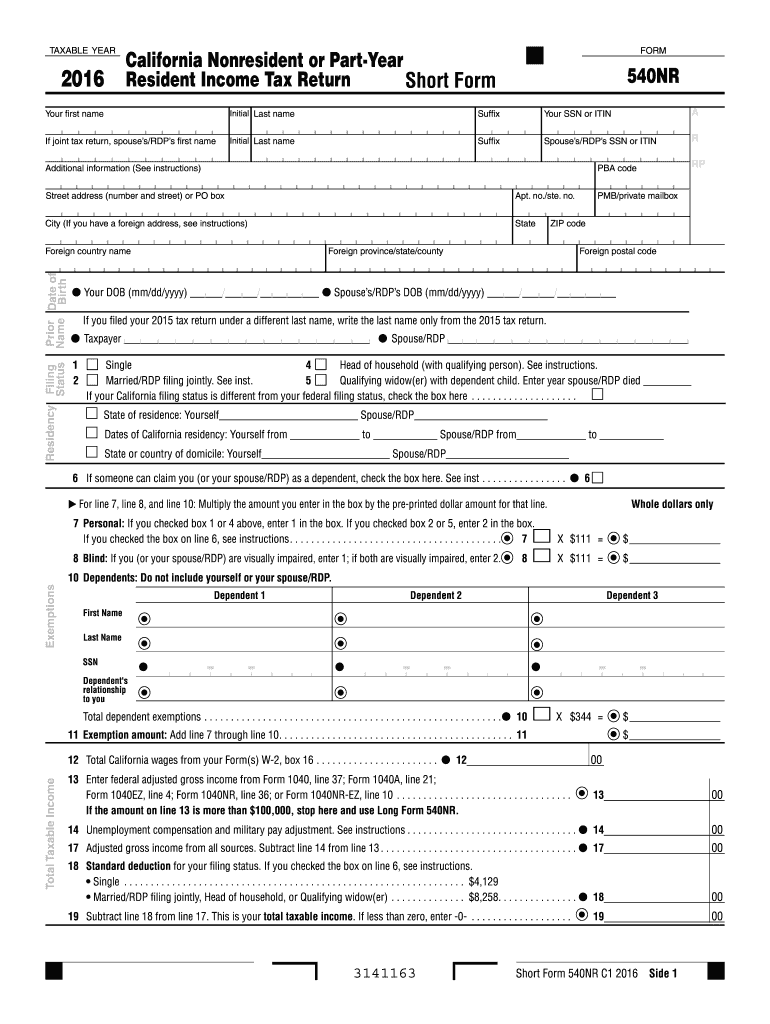

The California 540nr Transcript Form is a tax document designed for non-resident individuals who earn income in California. This form allows taxpayers to report their income and calculate their tax liability according to California state tax laws. The form is essential for those who do not reside in California but have financial ties to the state, ensuring compliance with local tax regulations. Proper completion of this form is crucial for accurate tax reporting and potential refunds.

How to use the California 540nr Transcript Form

Using the California 540nr Transcript Form involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your income and deductions as specified in the instructions. Finally, review the completed form for accuracy before submitting it to the California Franchise Tax Board.

Steps to complete the California 540nr Transcript Form

Completing the California 540nr Transcript Form requires careful attention to detail. Follow these steps:

- Collect all relevant income documents.

- Begin filling out the form with your personal details.

- Report your total income from all sources.

- Claim any deductions or credits applicable to your situation.

- Double-check your entries for accuracy.

- Sign and date the form before submission.

Legal use of the California 540nr Transcript Form

The California 540nr Transcript Form is legally recognized by the California Franchise Tax Board as a valid means for non-residents to report income. Proper use of this form ensures compliance with state tax laws and helps avoid potential penalties. It is essential to adhere to the guidelines provided by the California Franchise Tax Board to maintain the legality of your tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the California 540nr Transcript Form typically align with federal tax deadlines. Generally, the due date for submitting this form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines, especially in light of special circumstances such as natural disasters or federal extensions.

Required Documents

To accurately complete the California 540nr Transcript Form, several documents are required. These include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits you intend to claim.

- Previous year’s tax return for reference.

Form Submission Methods

The California 540nr Transcript Form can be submitted through various methods. Taxpayers have the option to file online through the California Franchise Tax Board's website, which provides a secure platform for electronic submissions. Alternatively, forms can be mailed to the appropriate address listed on the form instructions. In-person submissions may also be available at designated tax offices, ensuring flexibility for taxpayers.

Quick guide on how to complete california 540nr transcript 2016 form

Your assistance manual on how to prepare your California 540nr Transcript Form

If you’re wondering how to fill out and file your California 540nr Transcript Form, here are a few straightforward guidelines to help make tax filing easier.

To begin, you just need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and digital signatures and revert to modify responses as necessary. Streamline your tax organization with enhanced PDF editing, eSigning, and simple sharing.

Adhere to the steps below to finish your California 540nr Transcript Form in no time:

- Create your profile and start working on PDFs almost instantly.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your California 540nr Transcript Form in our editor.

- Enter the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to apply your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting in paper form can lead to increased return errors and delays in refunds. It’s advisable to check the IRS website for filing regulations applicable in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct california 540nr transcript 2016 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

What can happen to me if I mistakenly file a resident state tax return form 540 in California instead of a non-resident form 540NR?

California will tax you on you worldwide income, this may be a higher tax rate that you could have in the other state. Your withholding from the other state won't be counted against those CA taxes, resulting in a higher CA balance due. The other state will take exception to you not paying taxes on the income earned in that state, and you'll eventually end up paying that state's tax, plus penalty and interest. Then you'll have to do amendments to the CA returns you filed, to avoid now being taxed in both states.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

Create this form in 5 minutes!

How to create an eSignature for the california 540nr transcript 2016 form

How to make an eSignature for your California 540nr Transcript 2016 Form in the online mode

How to make an electronic signature for your California 540nr Transcript 2016 Form in Google Chrome

How to create an eSignature for signing the California 540nr Transcript 2016 Form in Gmail

How to create an electronic signature for the California 540nr Transcript 2016 Form straight from your smartphone

How to make an electronic signature for the California 540nr Transcript 2016 Form on iOS devices

How to generate an electronic signature for the California 540nr Transcript 2016 Form on Android OS

People also ask

-

What is the California 540nr Transcript Form and why do I need it?

The California 540nr Transcript Form is a tax document used by non-residents to report income earned in California. Completing this form accurately ensures compliance with state tax regulations, potentially leading to refunds or minimizing taxes owed. Understanding its purpose is essential for anyone conducting business or earning income in California.

-

How can airSlate SignNow help me in completing the California 540nr Transcript Form?

airSlate SignNow provides an easy-to-use platform for signing and completing the California 540nr Transcript Form electronically. With its intuitive interface, you can fill out the form quickly, affix your digital signature, and securely send it to the necessary parties. This streamlines the process and saves you valuable time.

-

Is there a cost associated with using airSlate SignNow for the California 540nr Transcript Form?

Yes, airSlate SignNow operates on a subscription basis, offering various pricing plans tailored to your needs. The cost is competitive, especially when considering the benefits of efficient document management and eSigning capabilities for the California 540nr Transcript Form. You’ll find that the service pays for itself by enhancing productivity.

-

What features does airSlate SignNow offer for processing the California 540nr Transcript Form?

airSlate SignNow provides several features for processing the California 540nr Transcript Form, including customizable templates, real-time tracking, and collaborative tools. You can invite others to review and sign the form easily, ensuring a smooth workflow. These features signNowly enhance the efficiency of your document processes.

-

Can I integrate airSlate SignNow with other software for the California 540nr Transcript Form?

Absolutely! airSlate SignNow supports numerous integrations with popular software, which can be beneficial for handling the California 540nr Transcript Form. Whether you use CRM systems, cloud storage, or accounting software, these integrations allow you to manage your documents seamlessly across platforms.

-

What are the benefits of using airSlate SignNow for eSigning the California 540nr Transcript Form?

The primary benefits of using airSlate SignNow for eSigning the California 540nr Transcript Form include enhanced security, faster processing times, and reduced paper usage. You can sign documents from any location at any time, making it convenient for busy professionals. Additionally, the platform’s compliance with electronic signature laws ensures validity.

-

How secure is my information when using airSlate SignNow for the California 540nr Transcript Form?

airSlate SignNow prioritizes the security of your information by implementing advanced encryption protocols and complying with industry standards. When you use the platform for the California 540nr Transcript Form, your data remains confidential and secure. You can confidently send and receive documents knowing your information is protected.

Get more for California 540nr Transcript Form

- Emergency detention certificate form

- Certification statement community health care association of new chcanys form

- Examples of completed dols form 3 357868137

- Levnadsintyg life certificate lebensbescheinigung certificado form

- Staff name signature date livingresourcesorg form

- Indie label contract template form

- Infernal contract template form

- Infidelity contract template form

Find out other California 540nr Transcript Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document