California 540nr Transcript Form 2013

What is the California 540nr Transcript Form

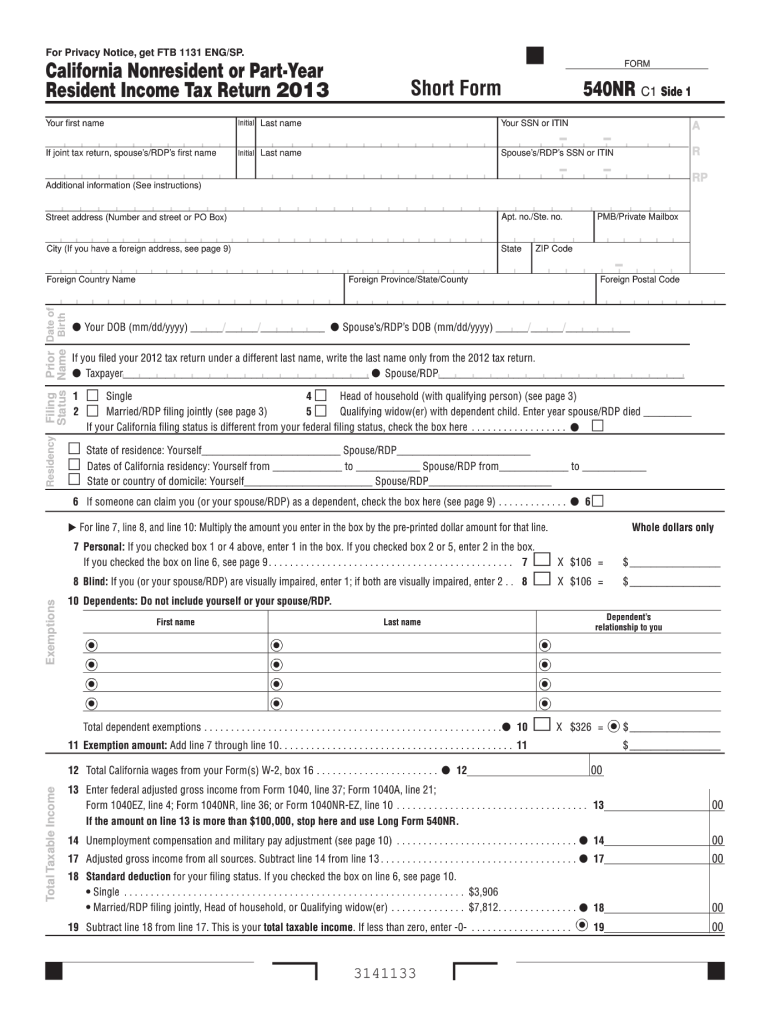

The California 540nr Transcript Form is a tax document used by non-resident individuals to report income earned in California. This form is essential for those who do not reside in California but have income sourced from the state, such as wages, business income, or rental income. The form helps ensure compliance with California tax laws and allows the state to assess the appropriate tax liability based on the income reported. It is crucial for non-residents to accurately complete this form to avoid penalties and ensure proper tax processing.

How to use the California 540nr Transcript Form

Using the California 540nr Transcript Form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements relevant to your California earnings. Next, fill out the form accurately, ensuring that all income sources and deductions are reported. After completing the form, review it for accuracy and completeness before submitting it electronically or by mail. Utilizing eSignature solutions can streamline the signing process, making it easier to submit your tax return securely and efficiently.

Steps to complete the California 540nr Transcript Form

Completing the California 540nr Transcript Form requires careful attention to detail. Follow these steps:

- Gather all required documents, including income statements and any applicable deductions.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report all income earned in California, ensuring you include all relevant sources.

- Calculate your total tax liability based on the income reported and any deductions you qualify for.

- Review the completed form for accuracy, checking all figures and calculations.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the form either online through a secure platform or by mailing it to the appropriate tax authority.

Legal use of the California 540nr Transcript Form

The California 540nr Transcript Form is legally recognized for tax reporting purposes. It is essential for non-residents to use this form to report income derived from California to comply with state tax laws. The form must be completed accurately and submitted by the designated deadline to avoid penalties. Additionally, eSignatures are legally valid for this form, allowing for a more efficient submission process while maintaining compliance with the law.

Key elements of the California 540nr Transcript Form

Several key elements are crucial when completing the California 540nr Transcript Form. These include:

- Personal Information: Accurate details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: A comprehensive list of all income earned in California, including wages, business income, and investment income.

- Deductions: Any applicable deductions that can reduce taxable income, such as business expenses or personal exemptions.

- Tax Calculation: The total tax liability based on reported income and deductions.

- Signature: A valid signature, either electronic or handwritten, to authenticate the form.

Form Submission Methods

The California 540nr Transcript Form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online Submission: Utilizing secure eSignature solutions to complete and submit the form electronically.

- Mail: Printing the completed form and sending it to the appropriate tax authority via postal service.

- In-Person: Visiting a local tax office to submit the form directly, if preferred.

Quick guide on how to complete california 540nr transcript 2013 form

Your assistance manual on preparing your California 540nr Transcript Form

If you are curious about how to generate and present your California 540nr Transcript Form, here are some brief instructions on simplifying tax processing signNowly.

To begin, you simply need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to adjust responses as needed. Optimize your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your California 540nr Transcript Form in just a few minutes:

- Create your profile and start working on PDFs in moments.

- Utilize our catalog to find any IRS tax form; search through different versions and schedules.

- Click Get form to access your California 540nr Transcript Form in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your gadget.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper may increase return errors and delay refunds. Additionally, prior to e-filing your taxes, check the IRS website for submission protocols in your state.

Create this form in 5 minutes or less

Find and fill out the correct california 540nr transcript 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

What can happen to me if I mistakenly file a resident state tax return form 540 in California instead of a non-resident form 540NR?

California will tax you on you worldwide income, this may be a higher tax rate that you could have in the other state. Your withholding from the other state won't be counted against those CA taxes, resulting in a higher CA balance due. The other state will take exception to you not paying taxes on the income earned in that state, and you'll eventually end up paying that state's tax, plus penalty and interest. Then you'll have to do amendments to the CA returns you filed, to avoid now being taxed in both states.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

Create this form in 5 minutes!

How to create an eSignature for the california 540nr transcript 2013 form

How to create an electronic signature for your California 540nr Transcript 2013 Form in the online mode

How to make an electronic signature for your California 540nr Transcript 2013 Form in Chrome

How to generate an eSignature for putting it on the California 540nr Transcript 2013 Form in Gmail

How to make an electronic signature for the California 540nr Transcript 2013 Form straight from your mobile device

How to generate an eSignature for the California 540nr Transcript 2013 Form on iOS

How to generate an eSignature for the California 540nr Transcript 2013 Form on Android

People also ask

-

What is the California 540nr Transcript Form?

The California 540nr Transcript Form is a document used by non-resident taxpayers to report income earned in California. It is essential for accurately filing state taxes and ensures compliance with California tax laws. Completing this form allows you to claim deductions and credits available to non-residents.

-

How can I access the California 540nr Transcript Form using airSlate SignNow?

With airSlate SignNow, you can easily access the California 540nr Transcript Form through our platform. Simply upload the form, and our user-friendly interface allows you to fill it out and eSign it quickly. This streamlined process saves you time and ensures your documents are securely stored.

-

Is there a cost associated with using airSlate SignNow for the California 540nr Transcript Form?

Yes, there is a subscription fee for using airSlate SignNow, but it is cost-effective compared to traditional document signing services. Pricing depends on the plan you choose, which can accommodate individual users or teams. You'll find that the features provided make it a valuable investment for managing forms like the California 540nr Transcript Form.

-

What features does airSlate SignNow offer for managing the California 540nr Transcript Form?

airSlate SignNow offers a variety of features for managing the California 540nr Transcript Form, including eSignature capabilities, document templates, and cloud storage. These features allow you to edit, sign, and share your forms seamlessly. Additionally, our audit trail ensures that you can track the entire signing process for compliance.

-

Can I integrate airSlate SignNow with other applications for the California 540nr Transcript Form?

Yes, airSlate SignNow offers integration with various applications to enhance your workflow for the California 540nr Transcript Form. You can connect with tools like Google Drive, Dropbox, and more, facilitating easy access to your documents. This integration helps streamline your process and keeps your files organized.

-

What are the benefits of using airSlate SignNow for the California 540nr Transcript Form?

Using airSlate SignNow for the California 540nr Transcript Form provides several benefits, including ease of use, enhanced security, and quick turnaround times. The platform allows you to complete and send your forms electronically, reducing the need for physical paperwork. This efficiency not only saves time but also minimizes the risk of errors.

-

Is airSlate SignNow secure for handling the California 540nr Transcript Form?

Absolutely! airSlate SignNow prioritizes security when handling sensitive documents like the California 540nr Transcript Form. Our platform uses advanced encryption methods to protect your data and complies with industry standards for electronic signatures. You can trust that your information remains confidential and secure.

Get more for California 540nr Transcript Form

- Trakhees application form

- Mo ms corporation allocation and apportionment of income schedule 733567663 form

- Final fitness to return 1 20 09 doc form

- Influencer agency contract template form

- Influencer collaboration contract template form

- Influencer collaboration social media influencer influencer contract template form

- Influencer contract template form

- Influencer market contract template form

Find out other California 540nr Transcript Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation