California 540nr Transcript Form 2017

What is the California 540nr Transcript Form

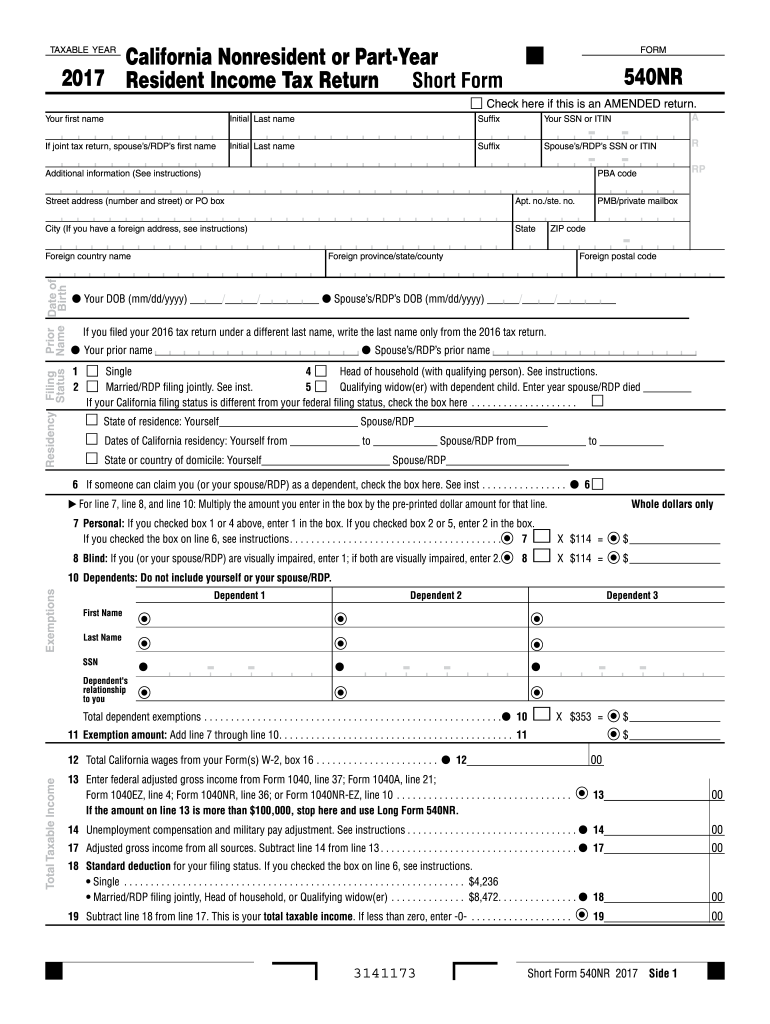

The California 540nr Transcript Form is a tax document specifically designed for non-residents of California who need to report income earned within the state. This form allows individuals to provide necessary financial information to the California Franchise Tax Board (FTB) for accurate tax assessment. It is essential for non-residents to complete this form to comply with state tax laws and ensure proper tax calculations based on their income sourced from California.

How to use the California 540nr Transcript Form

Using the California 540nr Transcript Form involves several key steps. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form accurately, ensuring that all income earned in California is reported. After completing the form, review it for any errors or omissions before submitting it to the California FTB. Utilizing an electronic signature solution can streamline this process, allowing for secure and efficient submission.

Steps to complete the California 540nr Transcript Form

Completing the California 540nr Transcript Form requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, report your income, detailing the amounts earned from California sources. Make sure to include any deductions or credits you may qualify for. After filling out all sections, double-check your entries for accuracy. Finally, sign the form electronically or by hand before submitting it to the appropriate tax authority.

Legal use of the California 540nr Transcript Form

The California 540nr Transcript Form is legally recognized as a valid document for reporting income by non-residents. It must be completed in accordance with California tax laws to ensure compliance. The form allows taxpayers to declare their financial responsibilities accurately and is essential for avoiding potential penalties. Using an eSignature solution enhances the legal validity of the submission, aligning with the requirements set forth by the IRS and state authorities.

Key elements of the California 540nr Transcript Form

Key elements of the California 540nr Transcript Form include personal identification information, income reporting sections, deductions, and credits. The form requires taxpayers to disclose all income earned from California sources, which may include wages, rental income, or business profits. Additionally, it outlines available deductions that can reduce taxable income, such as state taxes paid or certain business expenses. Understanding these elements is crucial for accurate tax reporting and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the California 540nr Transcript Form typically align with federal tax deadlines. Generally, non-residents must submit their forms by April 15 of the following tax year. However, if additional time is needed, taxpayers can request an extension, allowing for an extended deadline. It is important to stay informed about any changes to these dates, as they can vary based on state regulations or specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

The California 540nr Transcript Form can be submitted through various methods. Taxpayers have the option to file online using secure e-filing platforms, which often provide a streamlined process and quicker processing times. Alternatively, forms can be mailed to the California Franchise Tax Board or submitted in person at designated locations. Each method has its advantages, and choosing the right one depends on individual preferences and circumstances.

Quick guide on how to complete california 540nr transcript 2017 form

Your assistance manual on preparing your California 540nr Transcript Form

If you’re unsure about how to finalize and submit your California 540nr Transcript Form, here are some brief guidelines to make tax filing simpler.

To start, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to edit, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures and return to modify details as necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to complete your California 540nr Transcript Form in minutes:

- Sign up for your account and start working on PDFs in no time.

- Utilize our catalog to obtain any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your California 540nr Transcript Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if needed).

- Examine your document and rectify any errors.

- Save modifications, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting on paper can increase return errors and postpone reimbursements. Additionally, before e-filing your taxes, visit the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct california 540nr transcript 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

What can happen to me if I mistakenly file a resident state tax return form 540 in California instead of a non-resident form 540NR?

California will tax you on you worldwide income, this may be a higher tax rate that you could have in the other state. Your withholding from the other state won't be counted against those CA taxes, resulting in a higher CA balance due. The other state will take exception to you not paying taxes on the income earned in that state, and you'll eventually end up paying that state's tax, plus penalty and interest. Then you'll have to do amendments to the CA returns you filed, to avoid now being taxed in both states.

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

Create this form in 5 minutes!

How to create an eSignature for the california 540nr transcript 2017 form

How to generate an electronic signature for your California 540nr Transcript 2017 Form in the online mode

How to generate an eSignature for your California 540nr Transcript 2017 Form in Chrome

How to make an electronic signature for putting it on the California 540nr Transcript 2017 Form in Gmail

How to create an electronic signature for the California 540nr Transcript 2017 Form straight from your smart phone

How to make an electronic signature for the California 540nr Transcript 2017 Form on iOS devices

How to create an eSignature for the California 540nr Transcript 2017 Form on Android OS

People also ask

-

What is the California 540nr Transcript Form?

The California 540nr Transcript Form is a tax document used by non-residents to report income earned in California. This form helps ensure compliance with California tax laws and can be crucial for anyone who has earned income while living outside the state.

-

How can airSlate SignNow simplify the process of completing the California 540nr Transcript Form?

airSlate SignNow streamlines the process of completing the California 540nr Transcript Form by providing user-friendly templates and electronic signatures. This makes it easy to fill out, sign, and send your forms without the hassle of printing and mailing physical documents.

-

Is there a cost associated with using airSlate SignNow for the California 540nr Transcript Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. With competitive pricing, you can access the features necessary to efficiently manage the California 540nr Transcript Form and other documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers seamless integrations with various tax preparation software. This allows you to easily manage and submit the California 540nr Transcript Form alongside your other tax documents, enhancing your overall efficiency.

-

What are the benefits of using airSlate SignNow for the California 540nr Transcript Form?

Using airSlate SignNow for the California 540nr Transcript Form ensures that your documents are securely signed and stored. Additionally, it speeds up the process of getting necessary approvals and keeps you organized, making tax season much easier to navigate.

-

Can I track the status of my California 540nr Transcript Form through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your California 540nr Transcript Form. You'll receive notifications when your document is viewed, signed, or completed, giving you peace of mind throughout the process.

-

Is it easy to share the California 540nr Transcript Form with others using airSlate SignNow?

Definitely! airSlate SignNow makes it simple to share your California 540nr Transcript Form with colleagues or tax professionals via secure links or email invitations. This facilitates collaboration and ensures everyone involved has the necessary access to the document.

Get more for California 540nr Transcript Form

- Holding deposit 238493839 form

- Stampscom insurance claim form

- Application form example

- Form g see rule 10 form of consent for invasive techniques i wifedaughter of

- Of form 612 usaid

- Getting paid reinforcement worksheet answers form

- Netherlands visa information thailand home vfs global

- Missouri 4h university of missouri 4h center for y form

Find out other California 540nr Transcript Form

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document