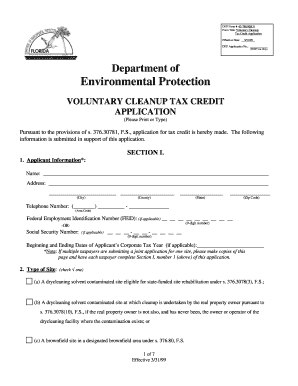

VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms Waste Management Florida DEP 788 1 PDF RULE FORM Dep State Fl

What is the Voluntary Cleanup Tax Credit Application?

The Voluntary Cleanup Tax Credit Application is a form used in Florida for taxpayers who have incurred costs related to the cleanup of contaminated sites. This application is part of the state's initiative to encourage voluntary cleanup efforts and to provide financial incentives through tax credits. The form is specifically designed for businesses and individuals involved in waste management and environmental remediation projects. By completing this application, eligible parties can seek reimbursement for certain expenses associated with the cleanup process, thereby promoting environmental responsibility and public health.

How to Use the Voluntary Cleanup Tax Credit Application

Using the Voluntary Cleanup Tax Credit Application involves several steps to ensure compliance with Florida's Department of Environmental Protection (DEP) requirements. First, applicants must gather all necessary documentation that supports their cleanup efforts, including invoices, contracts, and environmental assessments. Next, the application form must be filled out accurately, detailing the specific costs incurred during the cleanup. Once completed, the application should be submitted to the appropriate DEP office for review. It is essential to keep copies of all submitted documents for your records.

Steps to Complete the Voluntary Cleanup Tax Credit Application

Completing the Voluntary Cleanup Tax Credit Application requires careful attention to detail. Here are the steps:

- Download the application form from the Florida DEP website.

- Fill in your personal and business information, ensuring accuracy.

- Detail the cleanup activities undertaken, including dates and locations.

- Attach supporting documents that verify your expenses.

- Review the application for completeness and accuracy.

- Submit the application to the designated DEP office, either online or by mail.

Eligibility Criteria for the Voluntary Cleanup Tax Credit Application

To be eligible for the Voluntary Cleanup Tax Credit, applicants must meet specific criteria set forth by the Florida DEP. Generally, the applicant must have incurred eligible cleanup costs at a site that is classified as contaminated. The cleanup must be conducted in accordance with state regulations and guidelines. Additionally, the applicant must demonstrate that the cleanup efforts are aimed at reducing risks to human health and the environment. It is crucial to review the detailed eligibility requirements outlined by the DEP to ensure compliance.

Required Documents for Submission

When submitting the Voluntary Cleanup Tax Credit Application, it is vital to include all required documents to support your claim. The following documents are typically necessary:

- Completed application form.

- Invoices and receipts for all cleanup-related expenses.

- Contracts with cleanup contractors or consultants.

- Environmental assessment reports.

- Any correspondence with the Florida DEP regarding the cleanup.

Form Submission Methods

The Voluntary Cleanup Tax Credit Application can be submitted through various methods, providing flexibility for applicants. Submissions can be made online via the Florida DEP's electronic filing system, which allows for quick processing. Alternatively, applicants can mail the completed form along with all required documents to the designated DEP office. In-person submissions may also be possible, depending on the office's policies and hours of operation. It is advisable to check the DEP website for the most current submission guidelines.

Quick guide on how to complete voluntary cleanup tax credit application 62 788 forms waste management florida dep 788 1 pdf rule form dep state fl

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] without any hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms Waste Management Florida DEP 788 1 pdf RULE FORM Dep State Fl

Create this form in 5 minutes!

How to create an eSignature for the voluntary cleanup tax credit application 62 788 forms waste management florida dep 788 1 pdf rule form dep state fl

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms?

The VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms are essential documents required for businesses seeking tax credits related to environmental cleanup efforts in Florida. These forms are part of the Waste Management program overseen by the Florida DEP, ensuring compliance with state regulations.

-

How can I access the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms?

You can easily access the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms through the Florida DEP website or by downloading the PDF version directly. The forms are designed to be user-friendly, allowing you to fill them out efficiently for your cleanup projects.

-

What are the benefits of using the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms?

Using the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms can signNowly reduce your tax liability while promoting environmental responsibility. By completing these forms, businesses can receive financial incentives for their cleanup efforts, making it a win-win situation.

-

Are there any fees associated with the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms?

There are no direct fees for submitting the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms to the Florida DEP. However, businesses should consider potential costs related to the cleanup activities themselves, which may be eligible for tax credits.

-

How do I ensure my VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms are completed correctly?

To ensure your VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms are completed correctly, carefully follow the instructions provided by the Florida DEP. Additionally, consider consulting with an environmental compliance expert to avoid common pitfalls and ensure all necessary information is included.

-

Can I integrate the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms with other software?

Yes, the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms can be integrated with various document management and e-signature solutions like airSlate SignNow. This integration streamlines the process, allowing for efficient document handling and compliance tracking.

-

What features does airSlate SignNow offer for managing the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms?

airSlate SignNow offers features such as e-signature capabilities, document templates, and secure storage for managing the VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms. These tools enhance efficiency and ensure that your documents are processed quickly and securely.

Get more for VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms Waste Management Florida DEP 788 1 pdf RULE FORM Dep State Fl

- Osap disability verification form students attending ontario public postsecondary institutions

- Osap disability verification form 2021

- Security patrol log template form

- Form dv4

- 393815 1017 ampb1044 v3 final master limit restructure request form

- Bupa cancellation form

- Ltfrb downloadable forms 447688282

- New vehicle division of motor vehicles department of form

Find out other VOLUNTARY CLEANUP TAX CREDIT APPLICATION 62 788 Forms Waste Management Florida DEP 788 1 pdf RULE FORM Dep State Fl

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free