DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av Form

What is the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av

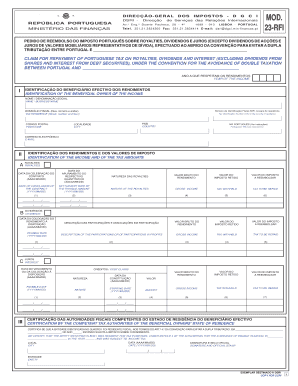

The DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av form is a crucial document related to international tax compliance for entities operating within or with connections to Portugal. This form serves to facilitate the reporting of international transactions and ensure adherence to relevant tax regulations. It is essential for businesses that engage in cross-border activities, as it helps in the accurate declaration of income and expenses associated with international services.

How to use the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av

Using the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av form involves several steps. Initially, gather all necessary information regarding your international transactions. This includes details about the parties involved, the nature of the services provided, and the corresponding financial data. Once this information is compiled, fill out the form accurately, ensuring that all sections are completed as required. After completing the form, it can be submitted electronically or via mail, depending on the specific instructions provided by the tax authority.

Steps to complete the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av

Completing the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av form involves the following steps:

- Collect all necessary documentation related to international transactions.

- Fill in the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail, following the specific guidelines provided.

Legal use of the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av

The legal use of the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av form is governed by international tax laws and regulations. It is essential to comply with these laws to avoid potential penalties or legal issues. The form must be completed accurately and submitted within the prescribed deadlines to ensure that it is recognized as valid by tax authorities. Understanding the legal implications of the information provided in the form is crucial for maintaining compliance.

Required Documents

To complete the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av form, several documents are typically required. These may include:

- Financial statements related to international transactions.

- Contracts or agreements outlining the services provided.

- Invoices or receipts for transactions conducted.

- Identification and tax information for all parties involved.

Filing Deadlines / Important Dates

Filing deadlines for the DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av form are critical to ensure compliance. It is essential to be aware of the specific dates set by the tax authority for submission. Typically, these deadlines align with the fiscal year-end or specific reporting periods for international transactions. Missing these deadlines can result in penalties or additional scrutiny from tax authorities.

Quick guide on how to complete direc o geral dsri direc o dos impostos d g c i de servi os das rela es internacionais rep blica portuguesa av

Access DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents quickly and efficiently. Manage DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and eSign DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av without hassle

- Obtain DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the direc o geral dsri direc o dos impostos d g c i de servi os das rela es internacionais rep blica portuguesa av

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av.?

The DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av. serves to facilitate the management and compliance of international services and tax obligations. This ensures that businesses have the necessary guidance to navigate complex regulations effectively.

-

How does airSlate SignNow integrate with the DIREC O GERAL DSRI services?

airSlate SignNow seamlessly integrates with the DIREC O GERAL DSRI services to streamline document sending and eSigning processes. This integration allows users to manage their international service documentation efficiently while ensuring compliance with various tax regulations.

-

What pricing options are available for airSlate SignNow with DIREC O GERAL DSRI?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including options for users who require DIREC O GERAL DSRI services. Prices vary based on features and the number of users, ensuring that you can find a cost-effective solution that meets your requirements.

-

What key features does airSlate SignNow provide for managing DIREC O GERAL DSRI related documents?

Key features of airSlate SignNow for managing DIREC O GERAL DSRI related documents include customizable templates and workflow automation. These tools enhance the user experience by simplifying the eSigning process and improving document tracking and compliance.

-

What benefits does using airSlate SignNow offer for businesses dealing with DIREC O GERAL DSRI?

Using airSlate SignNow benefits businesses dealing with DIREC O GERAL DSRI by improving efficiency and reducing administrative burdens. Companies can expedite document processing, enhance security, and ensure that all international service agreements are compliant with relevant tax laws.

-

Can airSlate SignNow adapt to changes in the DIREC O GERAL DSRI regulations?

Yes, airSlate SignNow is designed to adapt to changes in DIREC O GERAL DSRI regulations. Continuous updates and improvements ensure that businesses remain compliant and can handle new requirements without disruption to their operations.

-

How can I get support for using airSlate SignNow with DIREC O GERAL DSRI?

airSlate SignNow provides dedicated customer support through various channels, including live chat, email, and phone assistance. Users can access resources and guidance specifically related to using the system in conjunction with DIREC O GERAL DSRI for optimal results.

Get more for DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av

- File tax and wage reports and make payments form

- Oh it 1040 2020 2022 fill out tax template online us legal forms

- California state tax return amendment on form 540 or nr x

- Employer39s quarterly btaxb and bwage reportb part i bb form

- 627571040 form

- Excise tax forms and publications

- California hotel tax exempt form

- Future developments whats new irs tax formsfuture developments 21 irs tax formsfuture developments 21 irs tax forms

Find out other DIREC O GERAL DSRI Direc O DOS IMPOSTOS D G C I De Servi Os Das Rela Es Internacionais REP BLICA PORTUGUESA Av

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word