Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN

What is the Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN

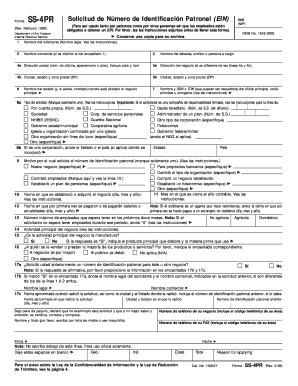

The Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN is an essential document used by businesses in the United States to apply for an Employer Identification Number (EIN). This number is crucial for tax administration and is required for various business activities, including hiring employees, opening bank accounts, and filing tax returns. The form is specifically designed for Spanish-speaking applicants, ensuring accessibility for a broader audience. Completing this form accurately is vital for compliance with IRS regulations.

Steps to complete the Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN

Completing the Form SS 4PR Rev February involves several important steps:

- Gather necessary information, including the legal name of the business, address, and the responsible party's details.

- Choose the appropriate entity type, such as a corporation, partnership, or sole proprietorship.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Review the form for any errors or omissions to prevent delays in processing.

- Submit the form electronically or via mail, depending on your preference.

How to use the Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN

Using the Form SS 4PR Rev February effectively involves understanding its purpose and the necessary steps for submission. This form is primarily used to apply for an EIN, which is essential for tax identification purposes. Once completed, the form can be submitted online through the IRS website or mailed to the appropriate address. It is important to keep a copy of the submitted form for your records, as it serves as proof of your application.

Legal use of the Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN

The Form SS 4PR Rev February is legally binding once submitted to the IRS. It must be filled out truthfully, as providing false information can lead to penalties. The form complies with IRS regulations, ensuring that businesses are properly identified for tax purposes. Understanding the legal implications of the form is crucial for business owners to avoid potential issues with the IRS.

Key elements of the Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN

Several key elements must be included when completing the Form SS 4PR Rev February:

- Legal name of the business.

- Trade name, if different from the legal name.

- Business address and contact information.

- Type of entity (e.g., LLC, corporation, partnership).

- Name and Social Security Number of the responsible party.

Filing Deadlines / Important Dates

When applying for an EIN using the Form SS 4PR Rev February, it is essential to be aware of any relevant deadlines. While there is no specific deadline for applying for an EIN, it is advisable to complete the form before starting any business activities that require the EIN, such as hiring employees or filing taxes. Timely submission ensures compliance with IRS regulations and helps avoid potential penalties.

Quick guide on how to complete form ss 4pr rev february espanol solicitud de numero de identificacion patronal ein

Effortlessly Prepare Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and efficiently. Manage Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN on any platform through the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN with Ease

- Locate Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or obscure sensitive information with tools available from airSlate SignNow designed specifically for that.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your method of sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ss 4pr rev february espanol solicitud de numero de identificacion patronal ein

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN?

Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN is an application used to obtain an Employer Identification Number (EIN) for businesses operating in Puerto Rico. This form helps streamline the process of applying for an EIN, crucial for tax purposes and hiring employees.

-

How can airSlate SignNow help with completing Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN?

airSlate SignNow provides an easy-to-use platform that allows businesses to fill out and eSign Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN digitally. This simplifies the process, ensuring accuracy and saving time while managing important documents.

-

What are the key benefits of using airSlate SignNow for Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN?

Using airSlate SignNow for Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN offers benefits such as enhanced security, easy tracking of document status, and the ability to store signed documents securely. This makes it a cost-effective solution for businesses of all sizes.

-

Is there a cost associated with using airSlate SignNow for my Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN?

Yes, airSlate SignNow offers various pricing plans designed to fit the needs of different businesses. You can choose a plan based on the volume of documents you need to manage, ensuring you only pay for what you use when handling Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN.

-

Can airSlate SignNow integrate with other software when handling Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, allowing you to manage your Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN alongside your existing tools. This enhances workflow efficiency and keeps everything organized.

-

What types of businesses can benefit from using Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN?

Any business operating in Puerto Rico that requires an Employer Identification Number can benefit from using Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN. This includes startups, LLCs, corporations, and non-profits, helping them meet federal and state tax obligations.

-

How secure is my data when using airSlate SignNow for Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN?

Data security is a priority at airSlate SignNow, as we implement advanced encryption methods and strict access controls. When using airSlate SignNow for Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN, you can be confident that your sensitive information is protected.

Get more for Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN

Find out other Form SS 4PR Rev February Espanol Solicitud De Numero De Identificacion Patronal EIN

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later